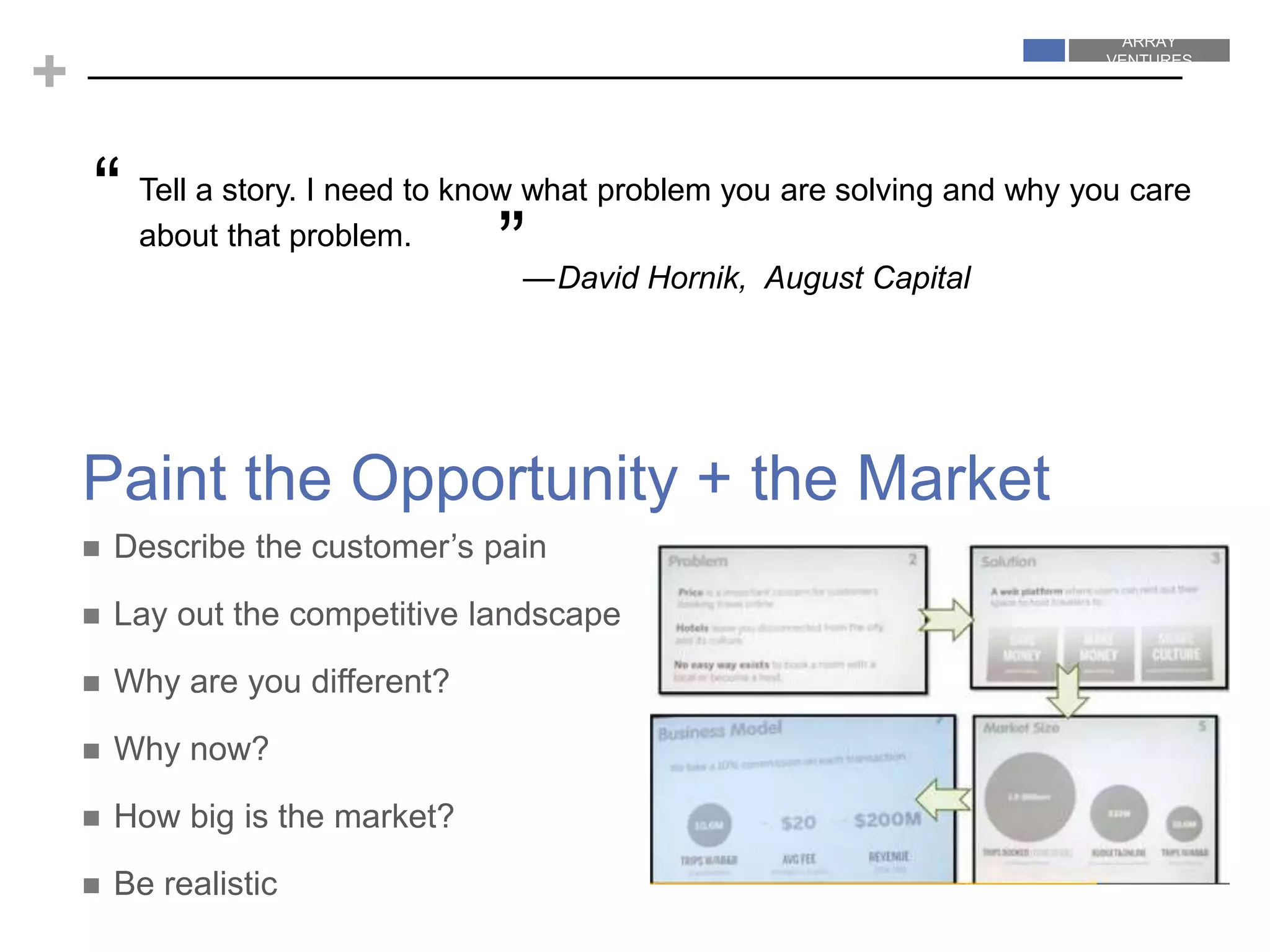

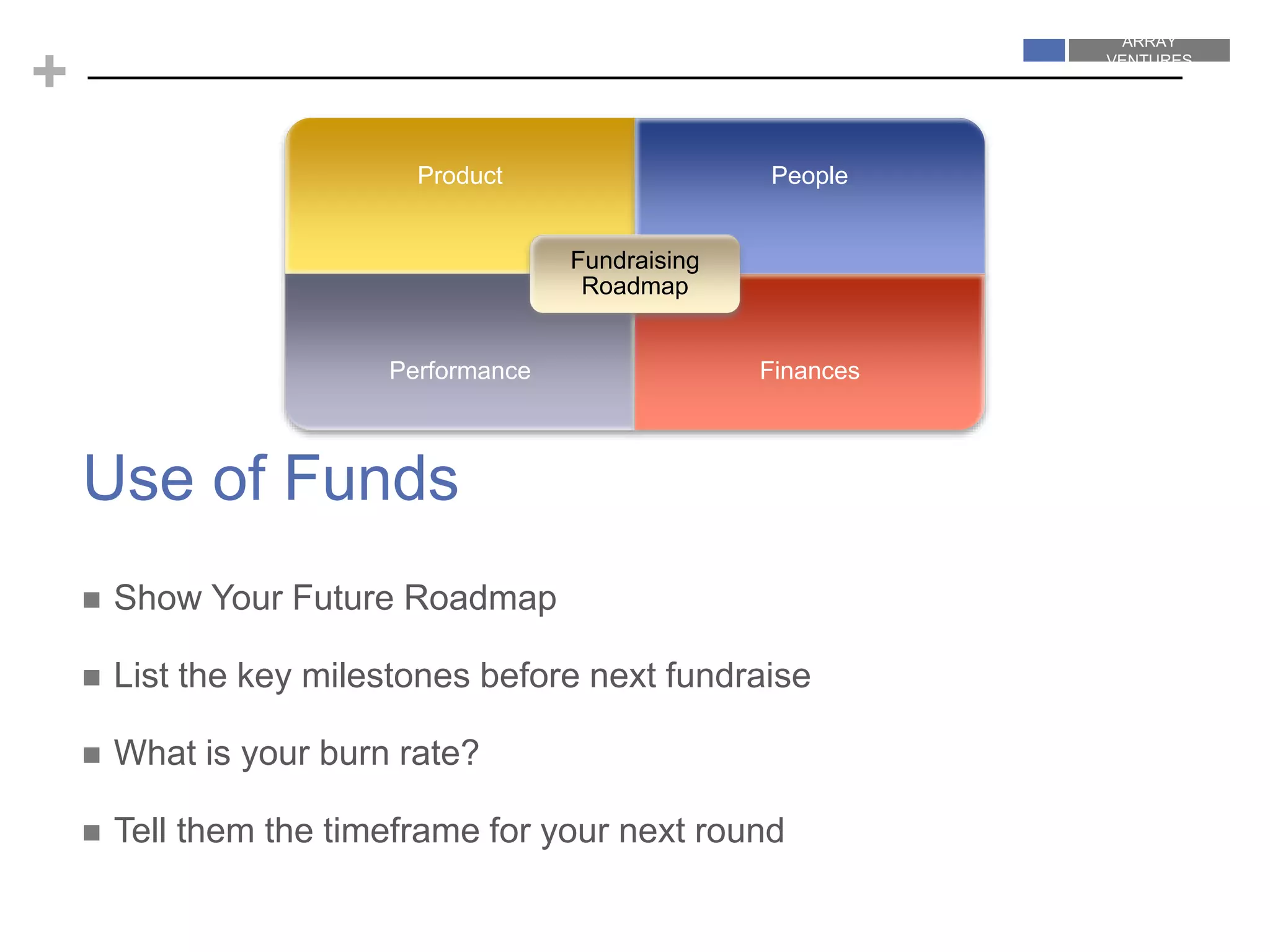

This document provides guidance on pitching to venture capitalists. It discusses key elements to include in a pitch deck such as sharing your vision, painting the opportunity and market, demonstrating third-party validation and traction, and outlining your roadmap and use of funds. It also offers tips for preparing for and conducting the meeting, including researching the investors, knowing your metrics, and avoiding missteps like bringing your whole team or getting into arguments. The goal is to help entrepreneurs effectively engage with VCs and secure funding for their startup.

![+

Getting into the Mind of a Venture Capitalist

PITCH READY

Shruti Gandhi

@atShruti [ARRAY VENTURES]](https://image.slidesharecdn.com/arrayventures500start-upspresentationv03-151014020826-lva1-app6892/75/Pitch-Ready-Get-into-the-minds-of-VCs-1-2048.jpg)