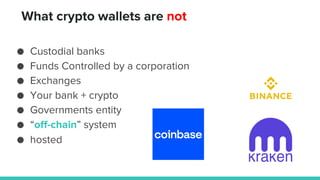

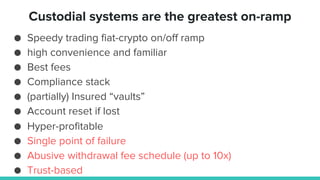

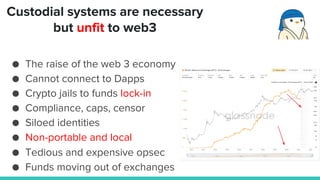

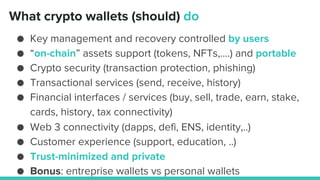

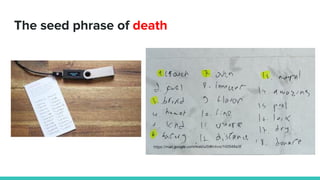

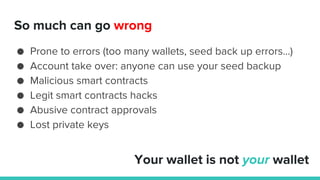

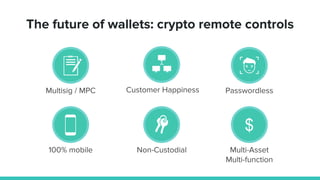

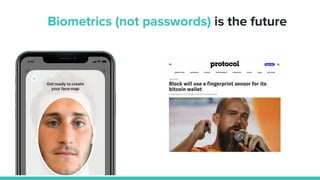

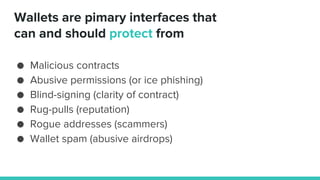

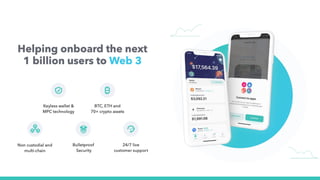

The document discusses the evolution and future of crypto wallets, highlighting their role as primary interfaces for the crypto economy and emphasizing the shift towards non-custodial wallets. It outlines the advantages and disadvantages of custodial wallets, such as convenience and compliance, while underscoring their incompatibility with web3 principles. The future of wallets is posited as being mobile, multi-functional, and focused on user security through innovations like biometrics and enhanced user experience.