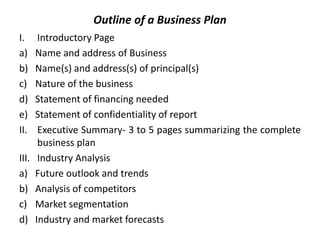

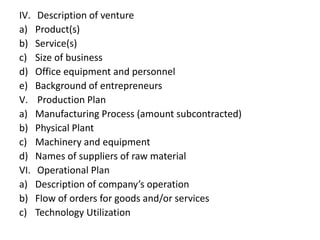

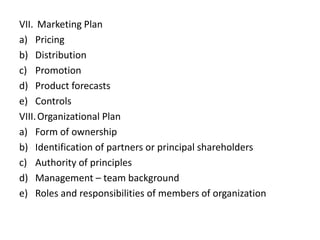

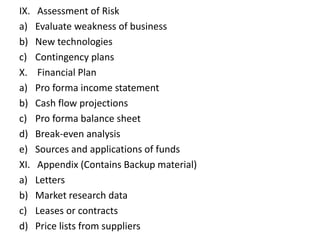

The document provides guidance on creating an effective business plan for starting a new venture. It discusses that a business plan should include an introductory section, executive summary, company description, market analysis, competitive analysis, operation plan, management team, and financial projections. The business plan is an important tool that provides structure and guidelines for the business, and helps determine viability, obtain financing, and familiarize others with the venture's goals and objectives. An effective plan requires research and clarity on all relevant internal and external elements of the business.