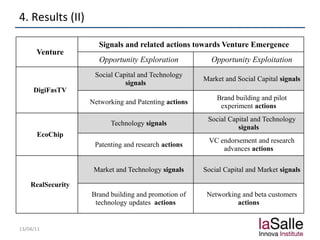

The document discusses the challenges new technology-based firms (NTBFs) face in commercializing their products and emphasizes the importance of managing technology resources and signaling quality to reduce market uncertainties. Through an exploratory case study of three NTBFs, it reveals that strategic use of signals can significantly impact venture emergence by enhancing brand awareness and networking efforts, adapting to different opportunity development stages. The findings advocate for integrating marketing and entrepreneurship literature to further comprehend the dynamics of venture emergence.