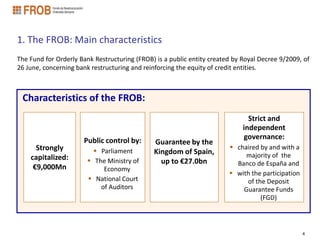

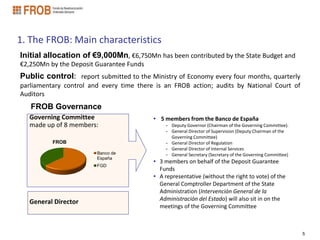

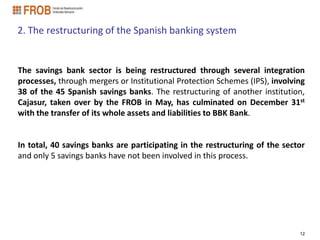

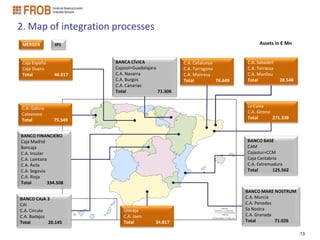

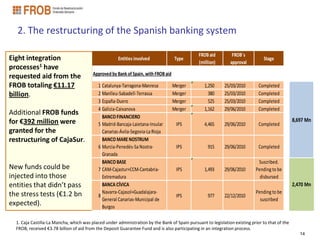

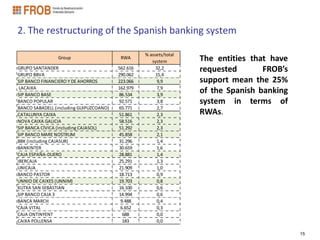

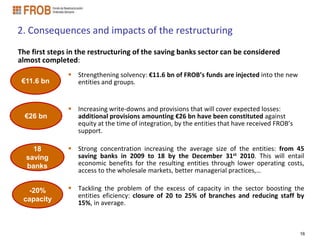

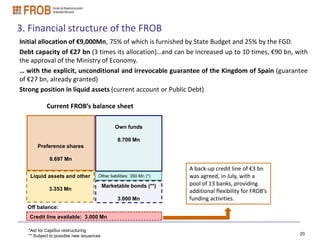

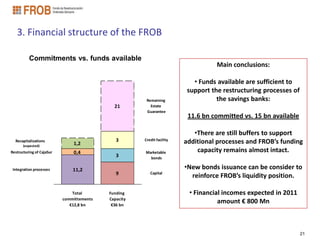

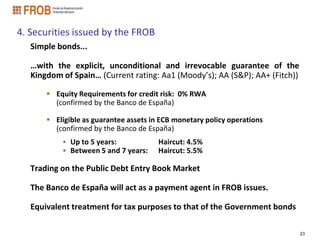

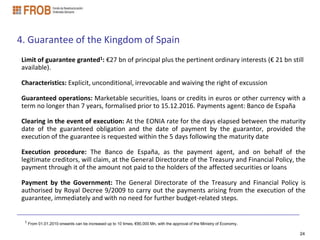

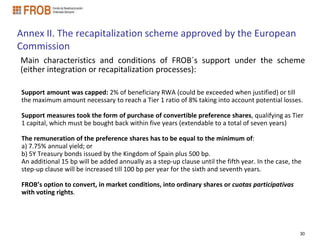

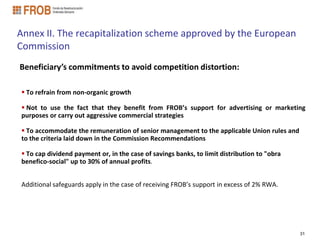

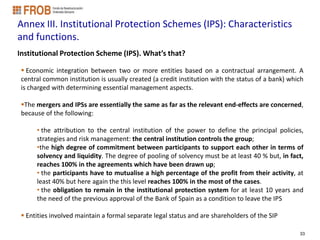

The document discusses the Fund for Orderly Bank Restructuring (FROB) in Spain. It describes the FROB's characteristics, including that it is a public entity with €9 billion in capital. The FROB aims to reinforce banks' equity and orderly restructure banks. It can provide temporary capital injections, support integration processes, and manage restructuring. The document also provides an overview of the restructuring of the Spanish banking system, noting that some smaller savings banks faced problems during the financial crisis requiring consolidation to improve efficiency and stability.