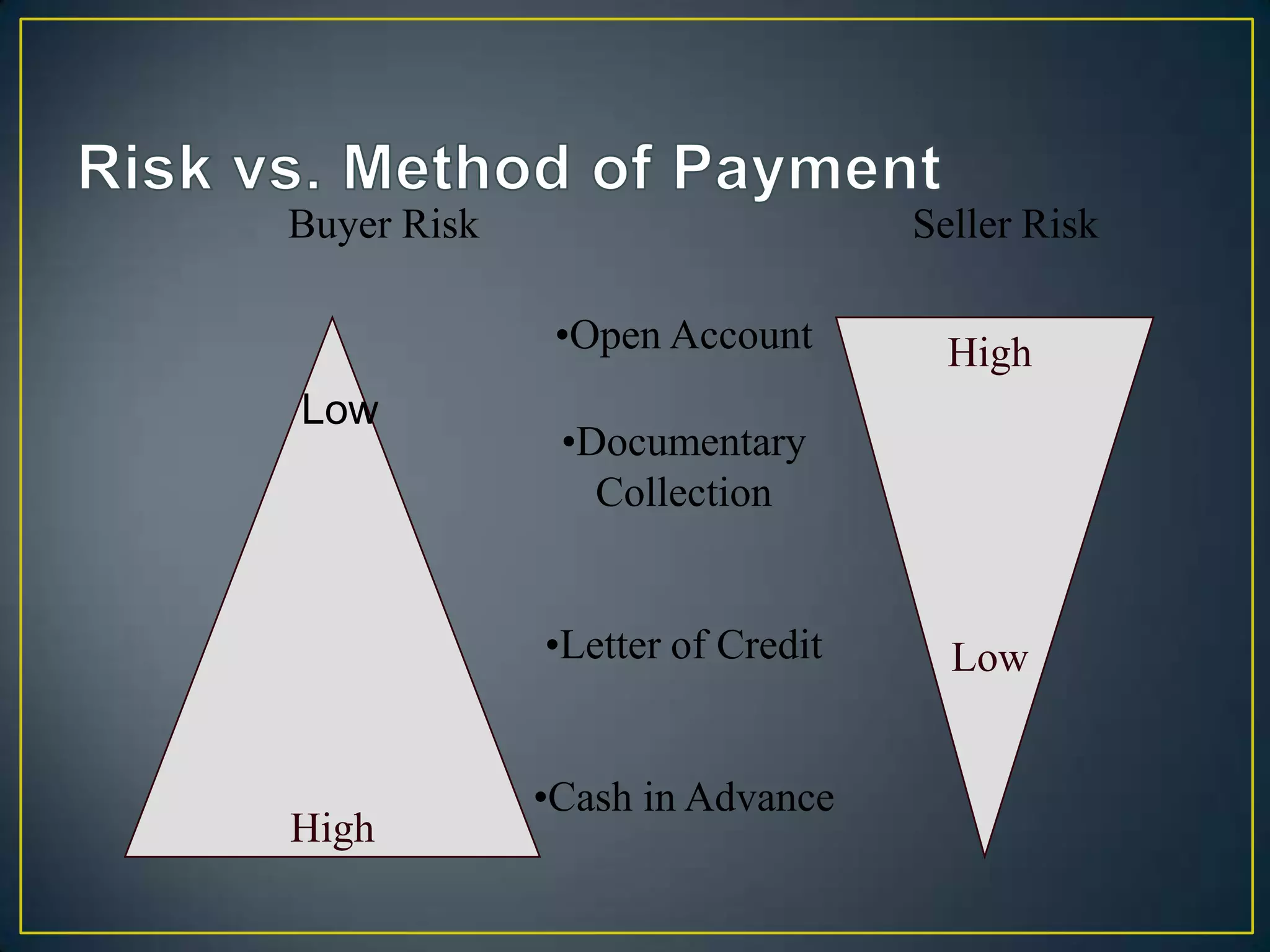

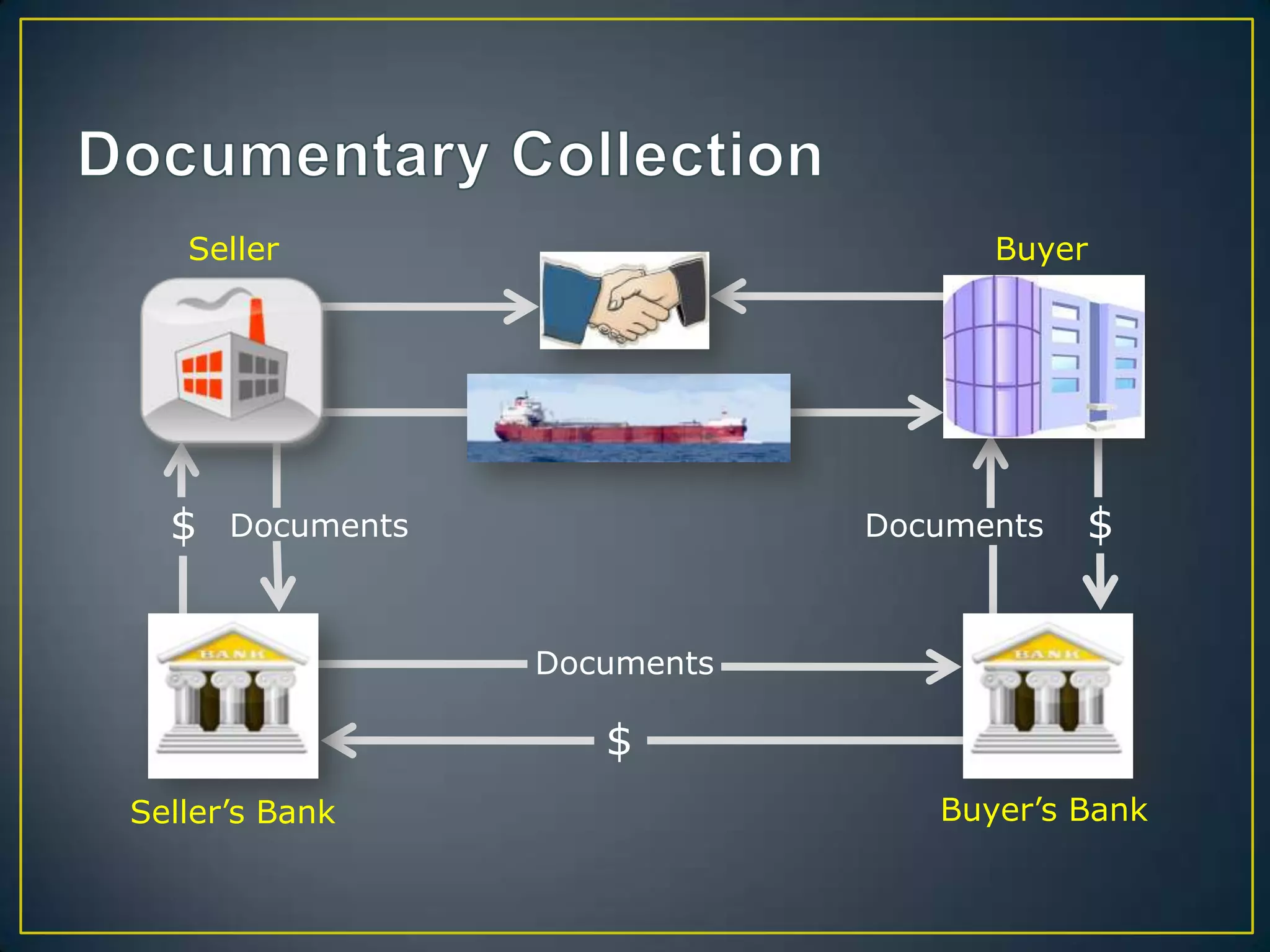

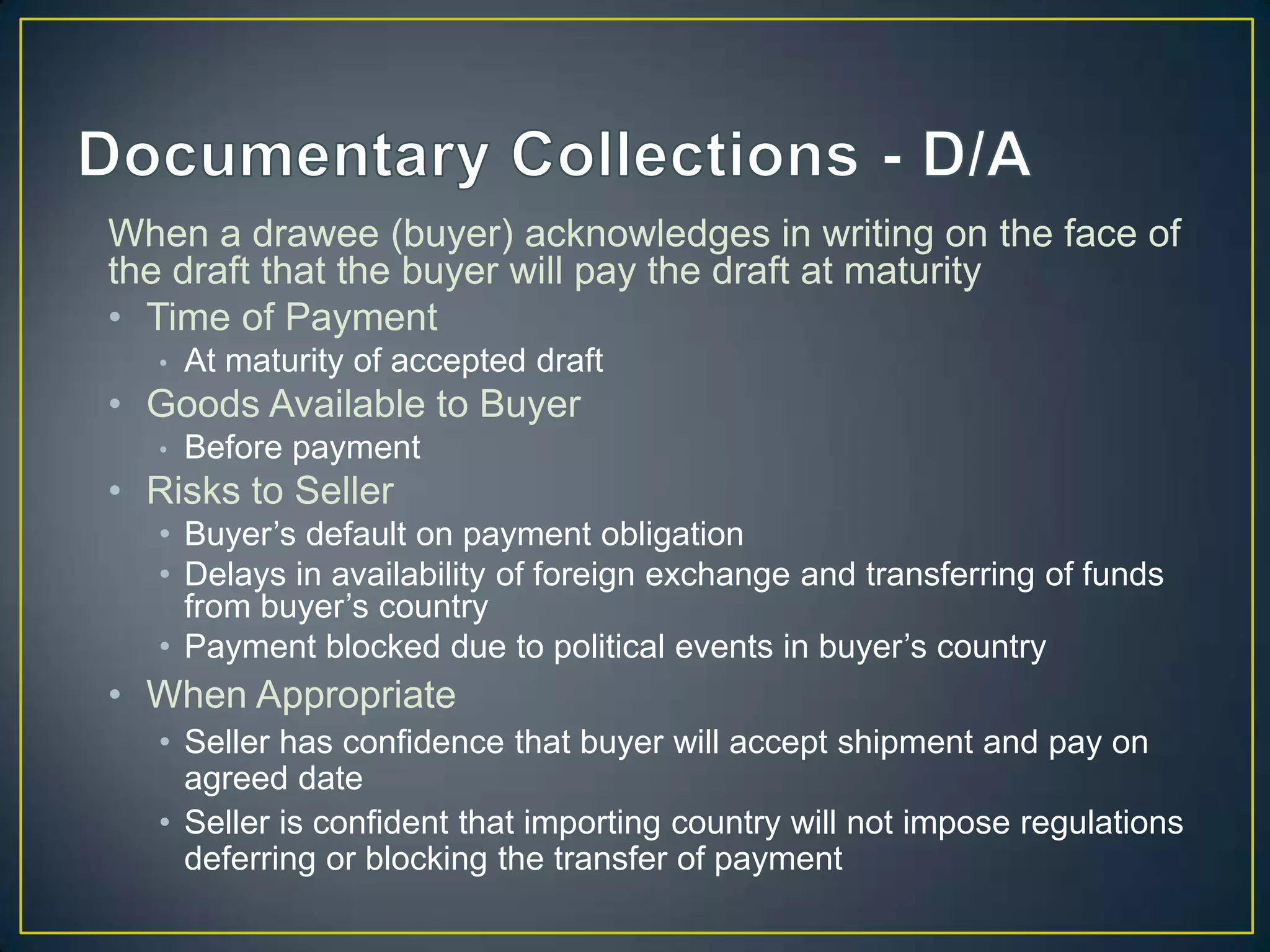

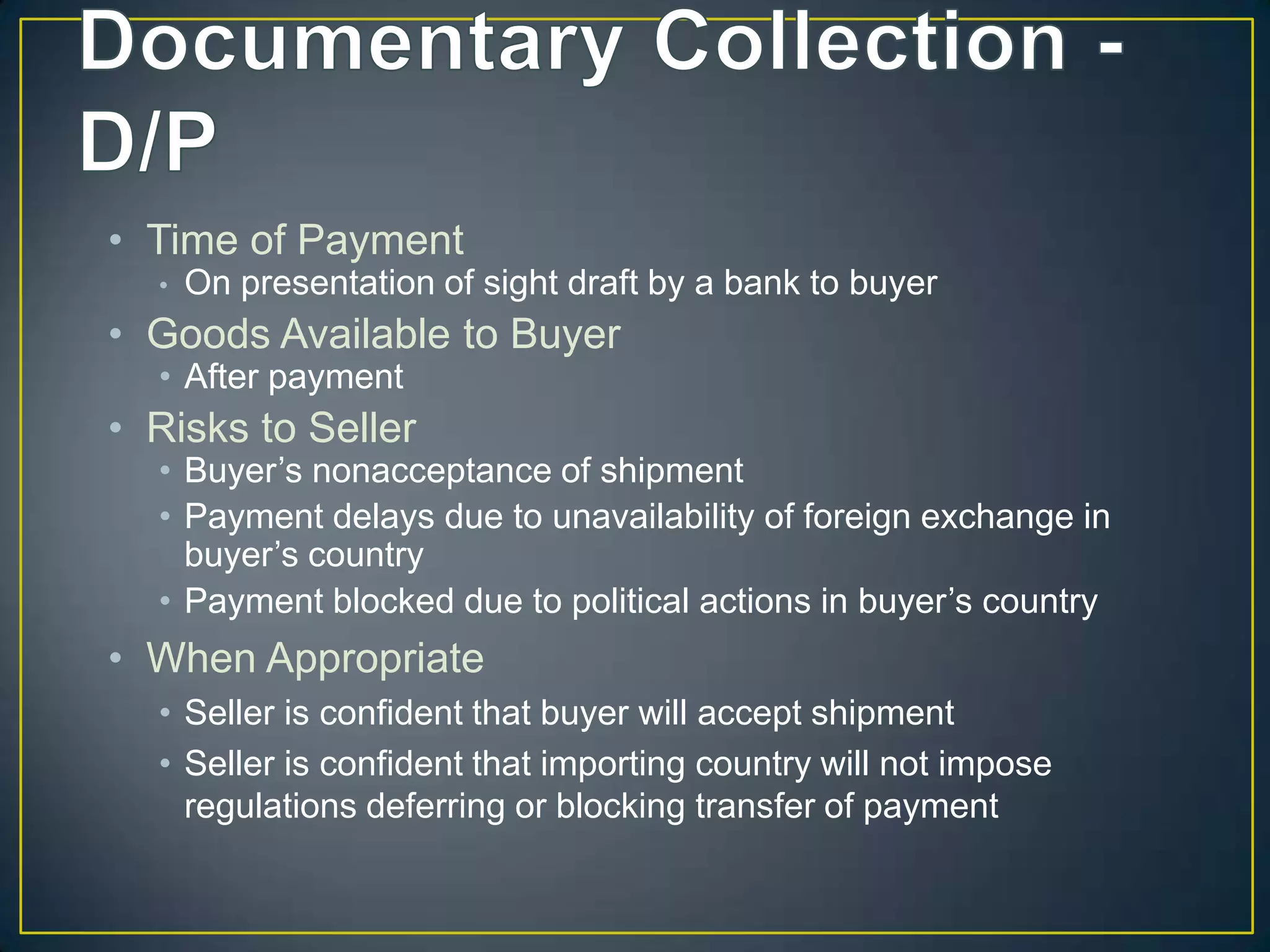

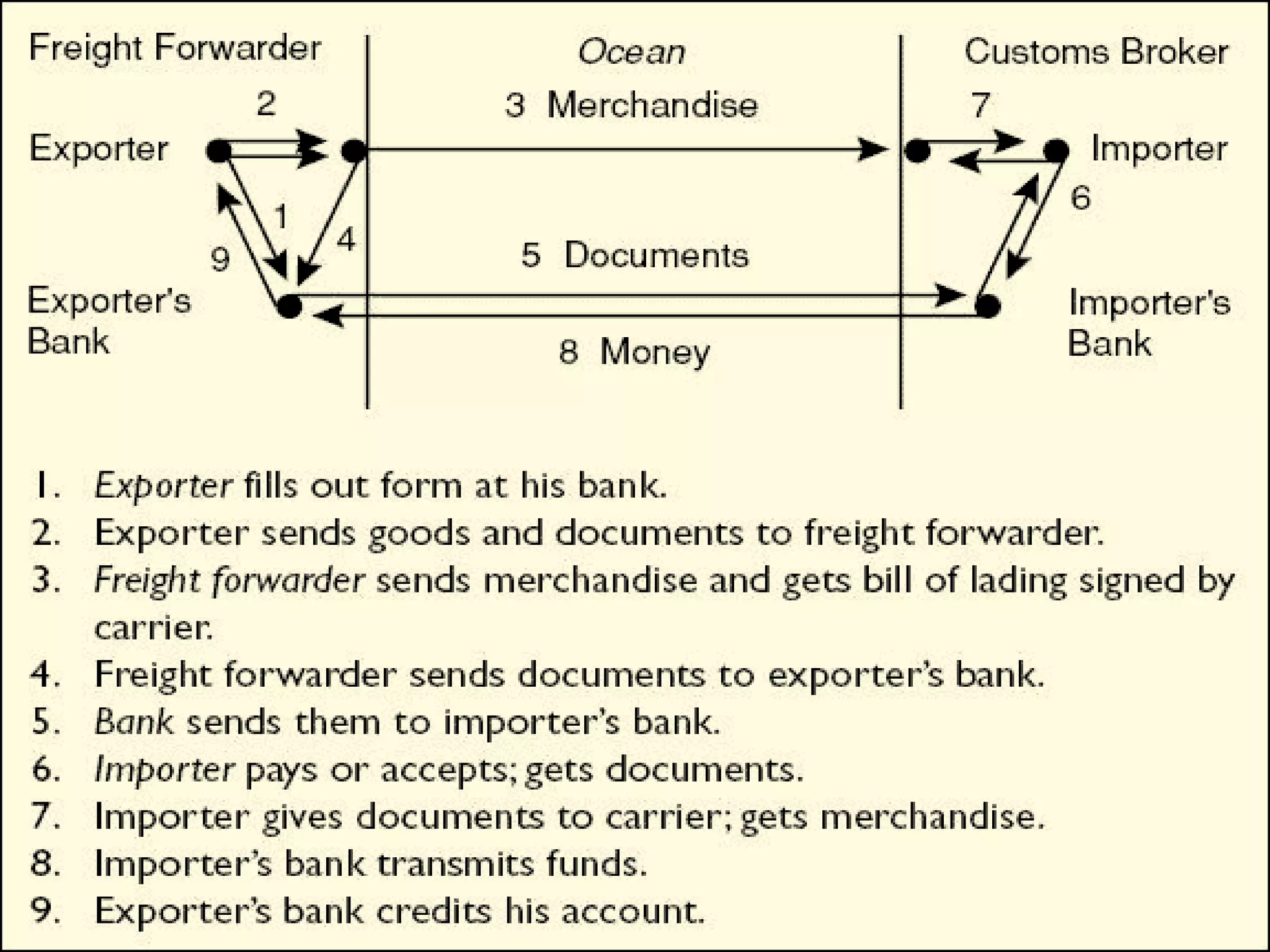

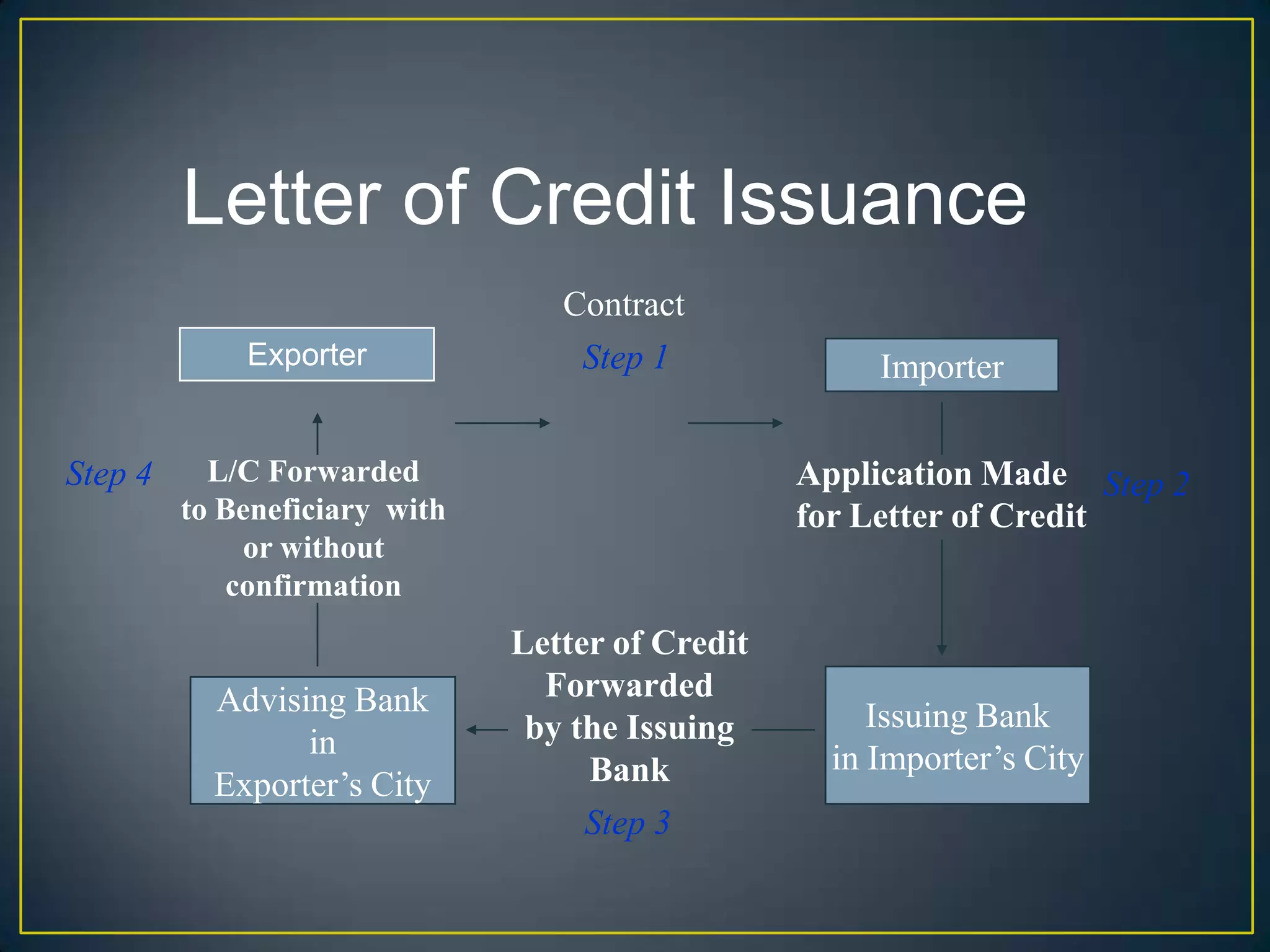

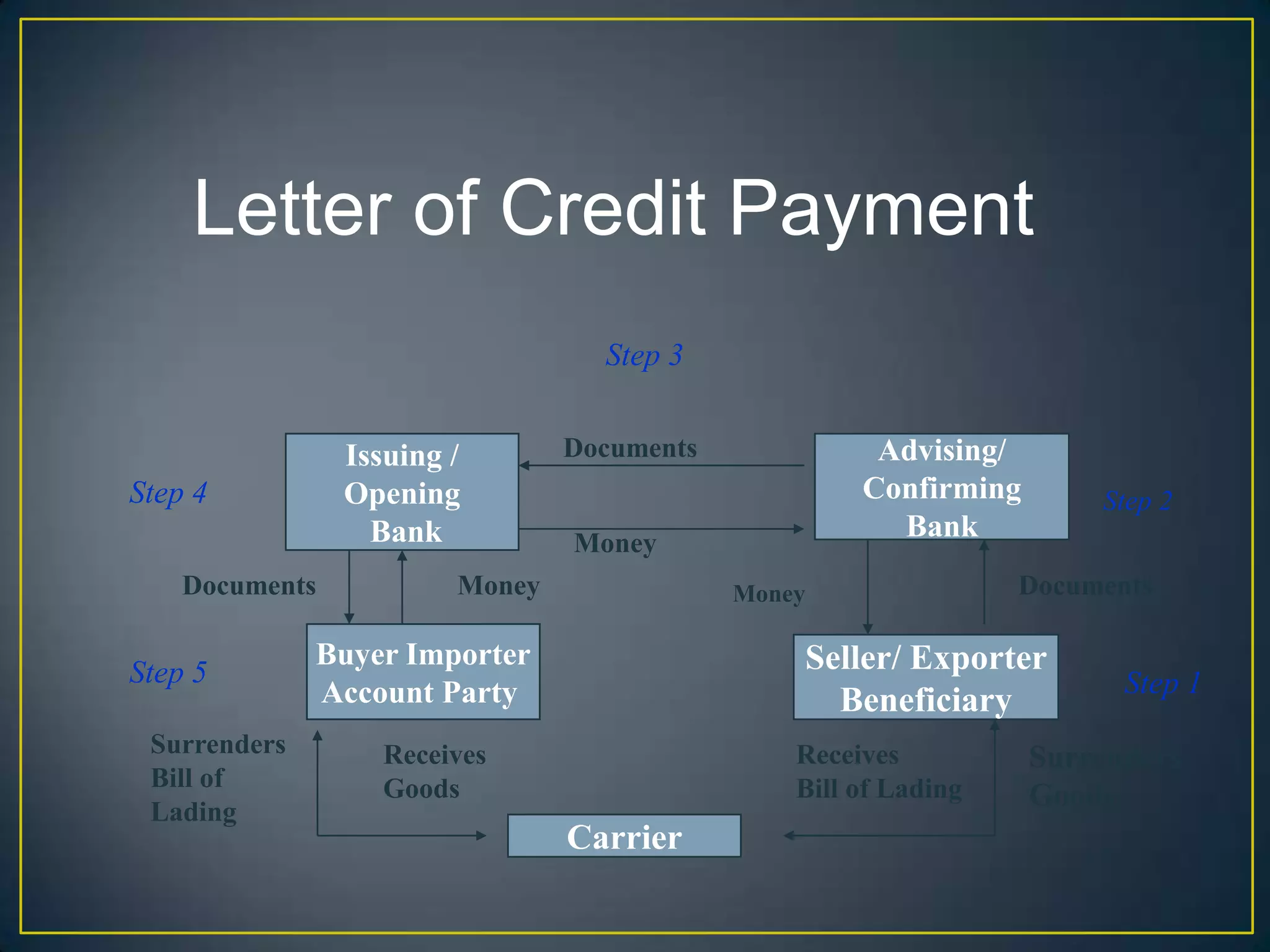

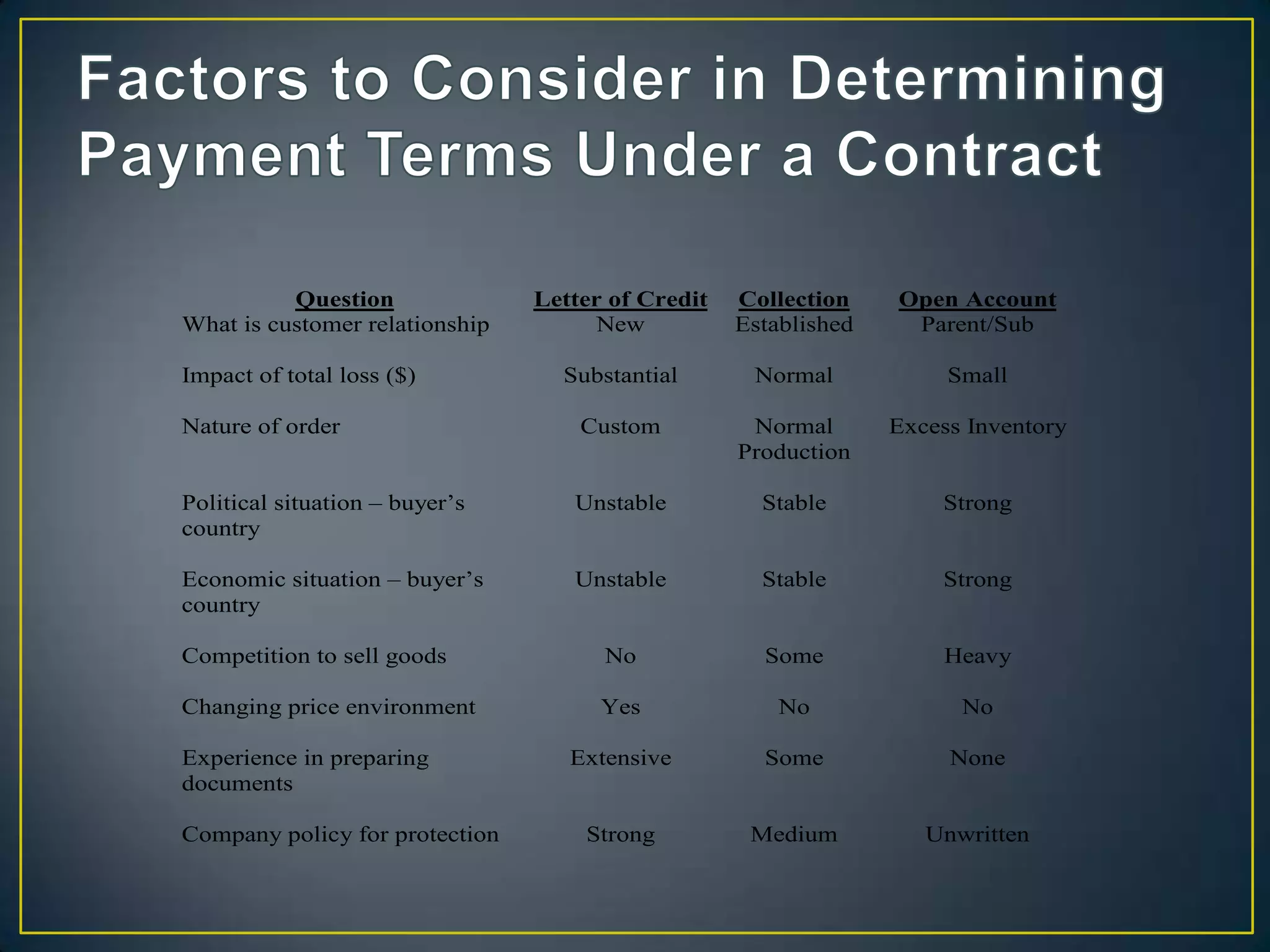

This document discusses various payment methods in international trade and their associated risks for buyers and sellers. It begins by explaining cash in advance, where payment is made before shipment. It then covers open account, where payment is due 30-90 days after shipment. This method carries risk of buyer default for the seller. The document also summarizes documentary collection and letters of credit, which shift more risk to the buyer. It provides details on the parties, documents, and processes involved in letters of credit. Overall, the summary discusses key trade payment methods and their impact on risk transfer between international buyers and sellers.