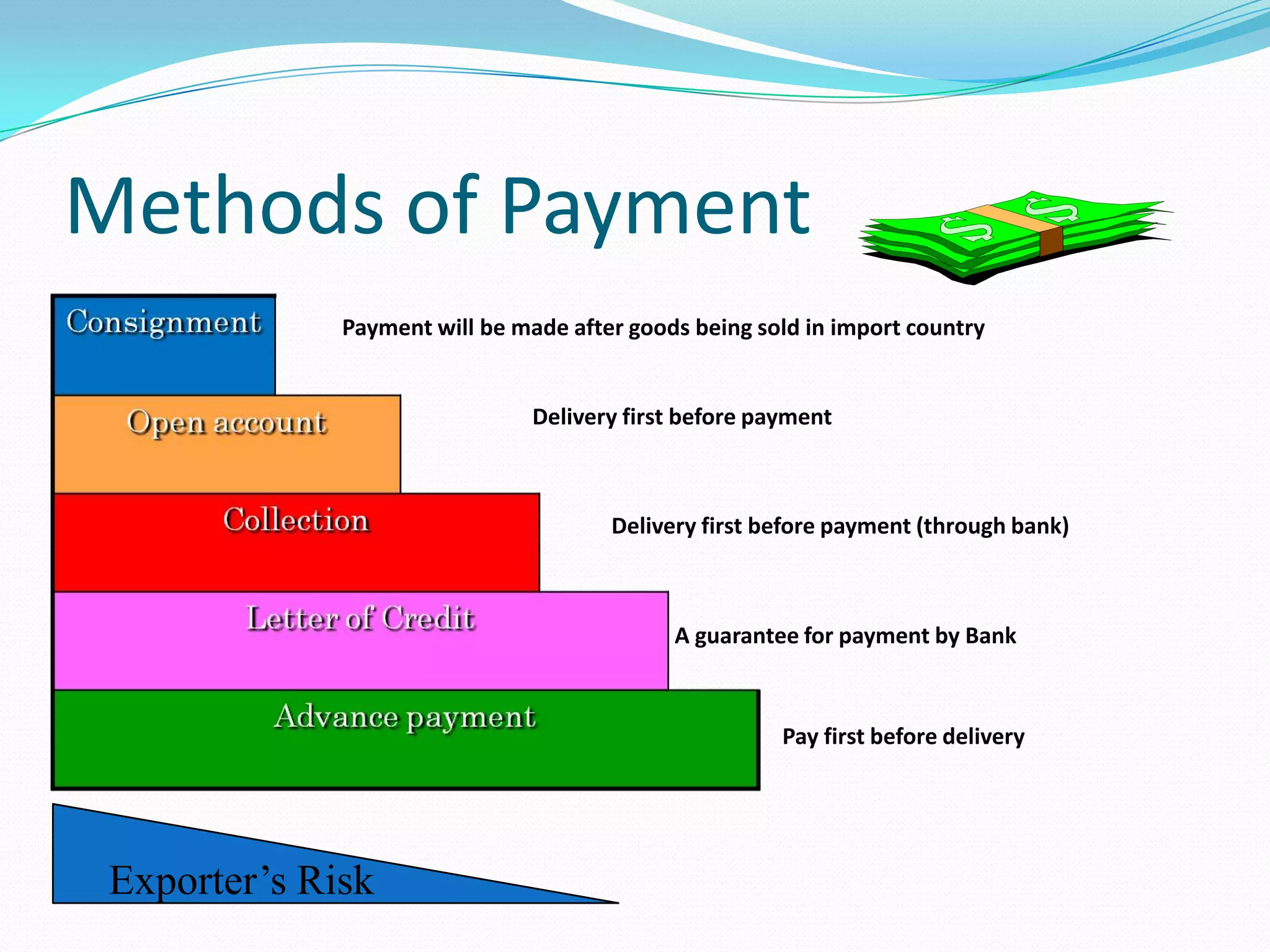

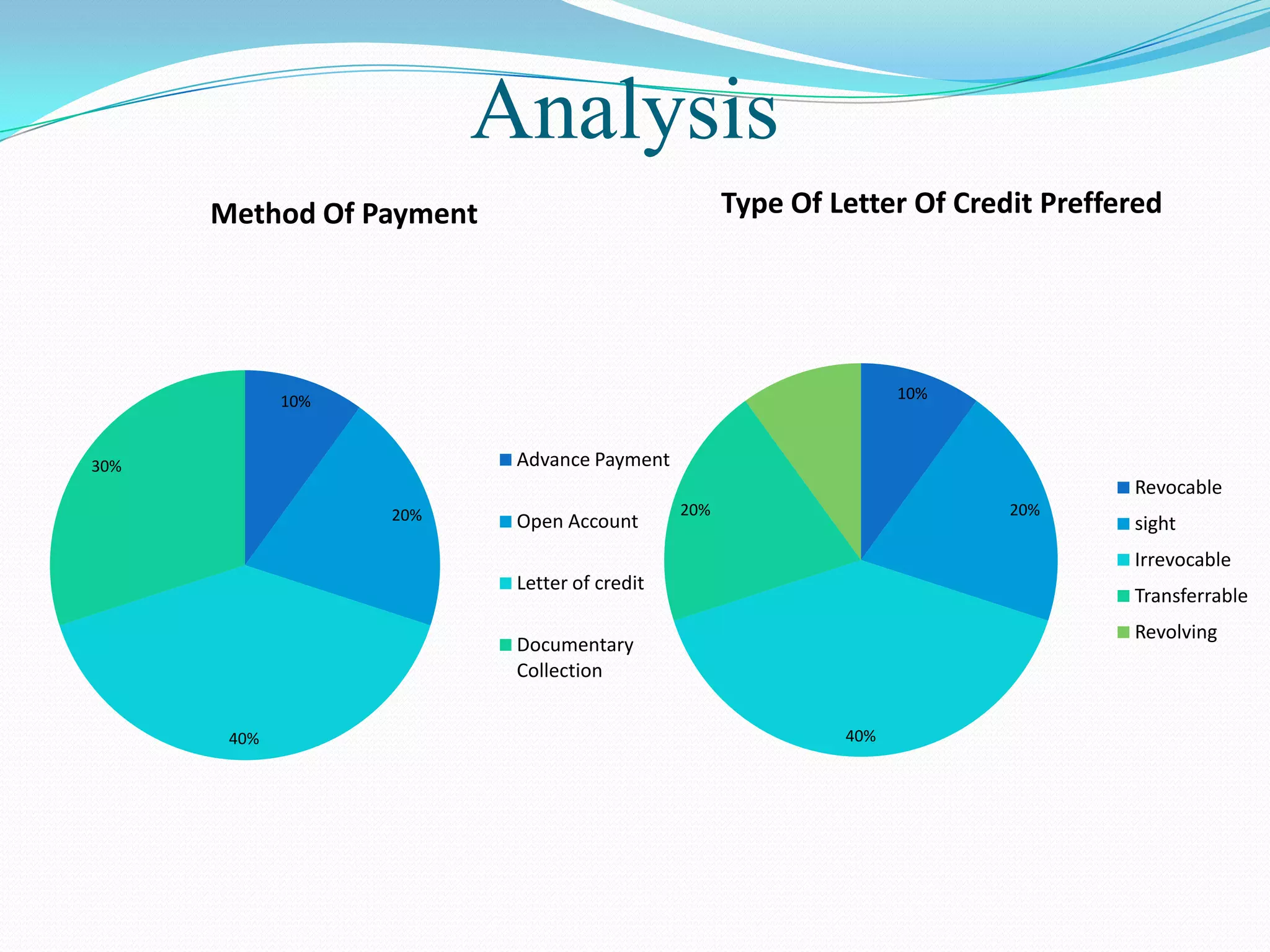

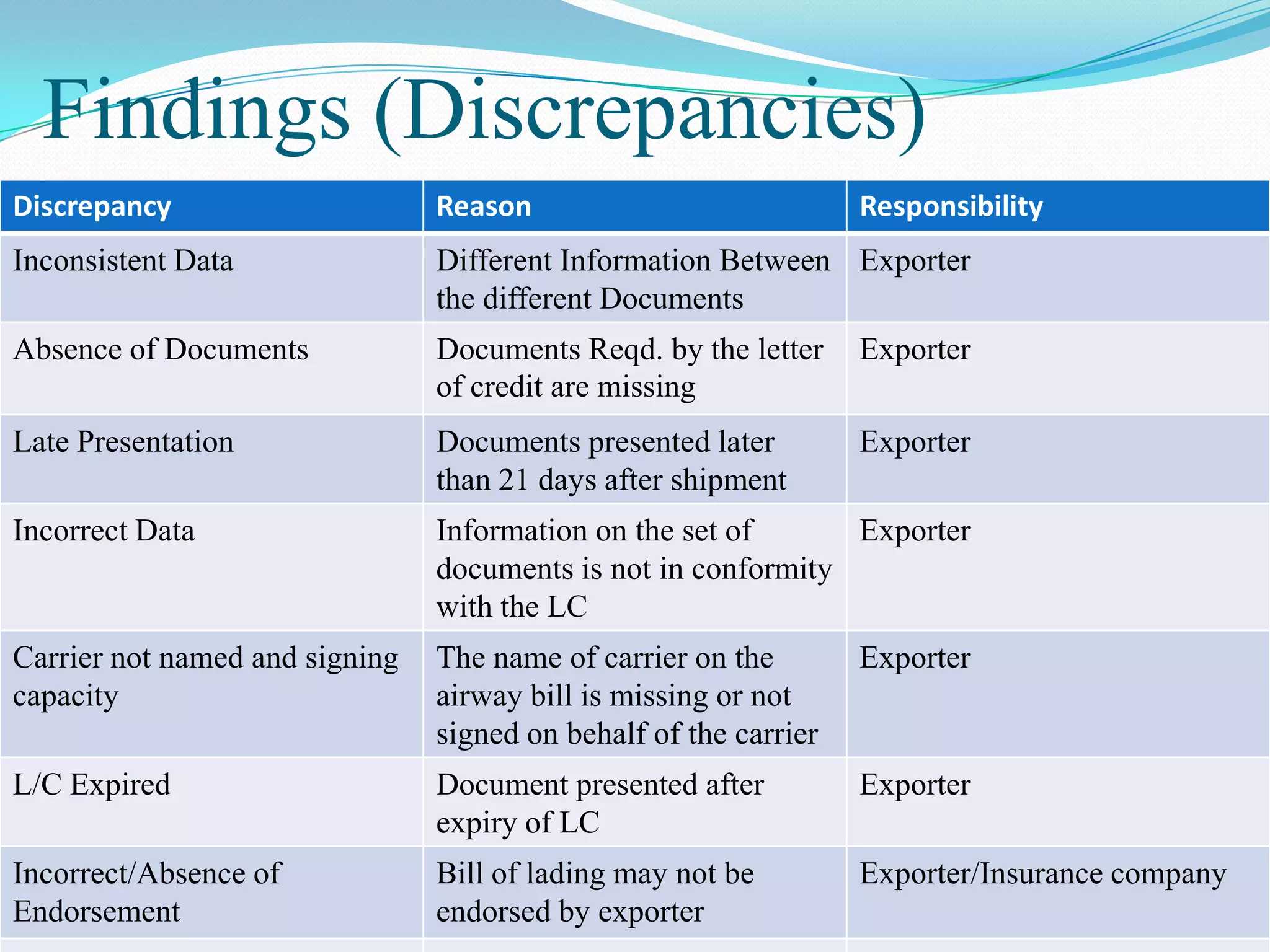

The document provides a company profile of Cobra Group, an engineering and construction firm established in 1944 in Spain and 1999 in India. It employs over 1000 people in India and 22,000 globally, with an annual turnover of over $100 million. The document then presents a SWOT analysis and discusses the objectives, scope, research methodology used in a study about letters of credit. It analyzes common discrepancies in documentary credit processes and provides recommendations to reduce issues.