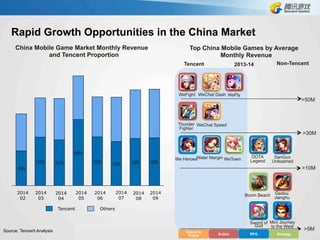

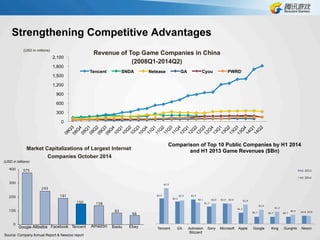

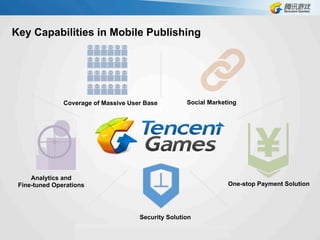

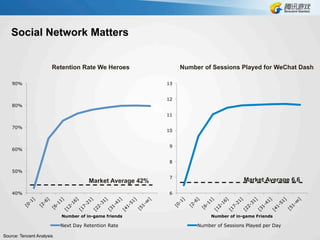

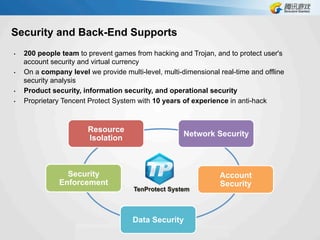

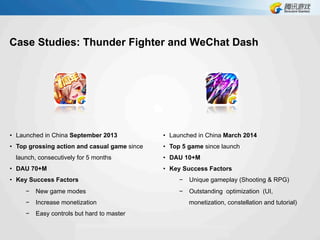

Tencent has achieved significant milestones since its founding, including launching its mobile gaming platform and various social communication services, ultimately becoming a dominant player in China's mobile gaming market. The company reported rapid growth, with over 500 million registered users on its mobile platform and a leading position in mobile game revenues. Tencent's success is attributed to its extensive user base, innovative marketing, and strong security measures.