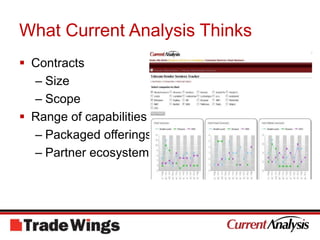

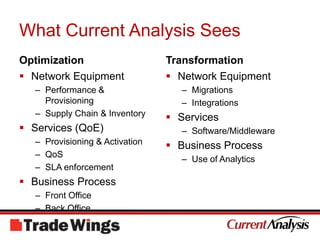

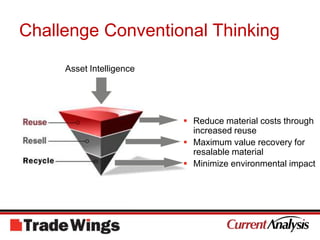

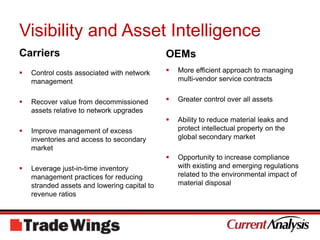

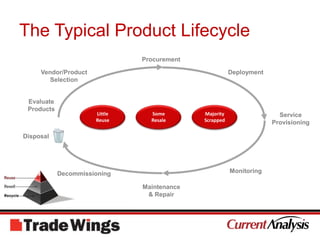

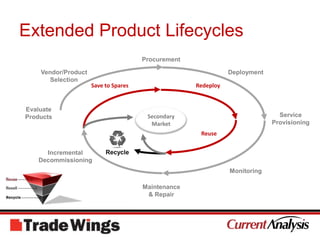

This document summarizes a presentation on gaining a competitive edge in telecom managed services. It discusses how network operators and vendors are struggling against commoditization and needing to provide more managed services. It then outlines the benefits of managed services to operators in filling knowledge gaps and increasing efficiency. It examines some of the leading managed services providers and their capabilities. The presentation emphasizes that differentiation in managed services comes from solving different types of problems for clients and having a range of capabilities. It discusses challenges around asset visibility and optimization, and how extending product lifecycles and sustainability practices can provide opportunities.