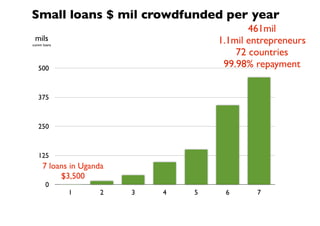

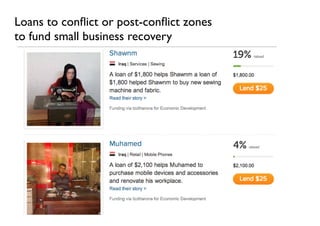

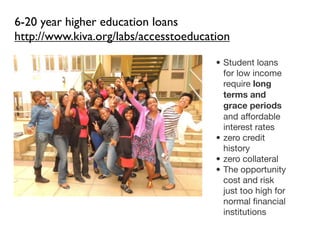

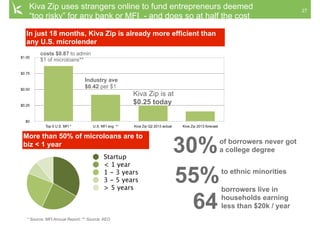

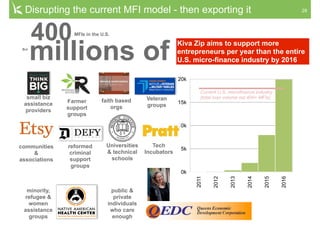

The document discusses Kiva.org's role in combating global poverty through microloans and peer-to-peer lending, emphasizing individual empowerment and social change. It outlines how Kiva's innovative approaches, such as Kiva Zip, offer funding to entrepreneurs often deemed too risky by traditional financial institutions. By supporting small businesses and micropreneurs, Kiva aims to disrupt existing lending models and broaden access to financial resources for those in need.