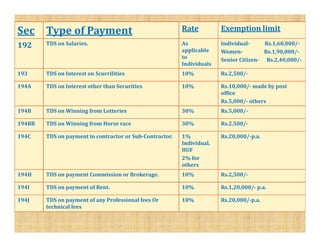

This document provides an overview of tax deducted at source (TDS) in India. It defines TDS as tax that is deducted from certain types of payments, including salaries, interest, rent, and professional fees. The objectives of TDS are to help report accurate incomes, check tax evasion, allow early collection of revenue by the government, and make tax collection cheaper and widen the tax base. The document then lists some key TDS rates and exemption limits under different sections of the Indian Income Tax Act for common types of payments.