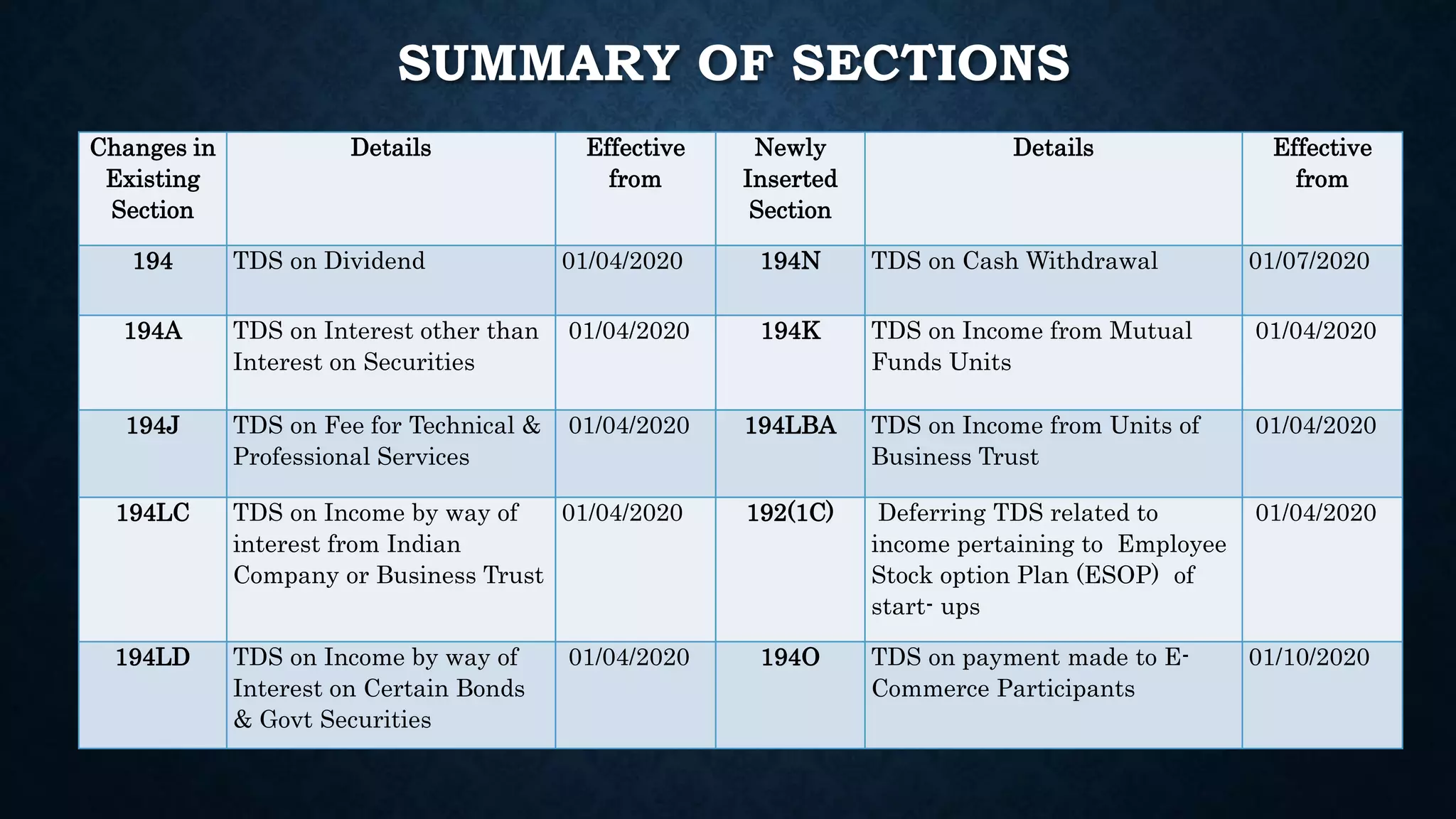

The document summarizes changes made to tax deducted at source (TDS) provisions by the Finance Act of 2020. Several existing sections related to TDS were amended and new sections for TDS on various types of payments were introduced. Key changes include amendments to TDS for dividends, interest, technical services fees, and mutual fund income. New sections introduce TDS for cash withdrawals, business trust unit income, and e-commerce participant payments. The changes are effective from financial years 2020-21 onward.