Embed presentation

Download to read offline

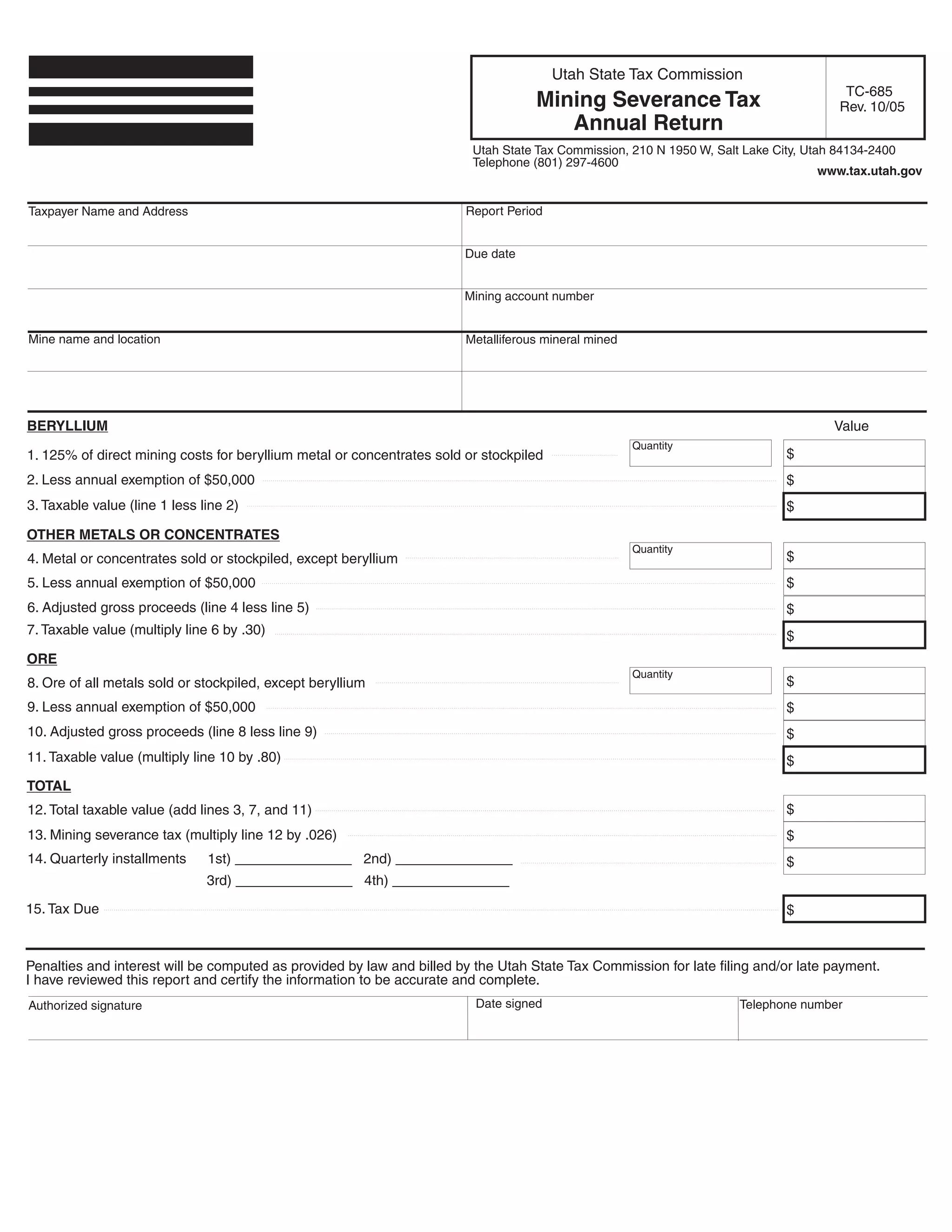

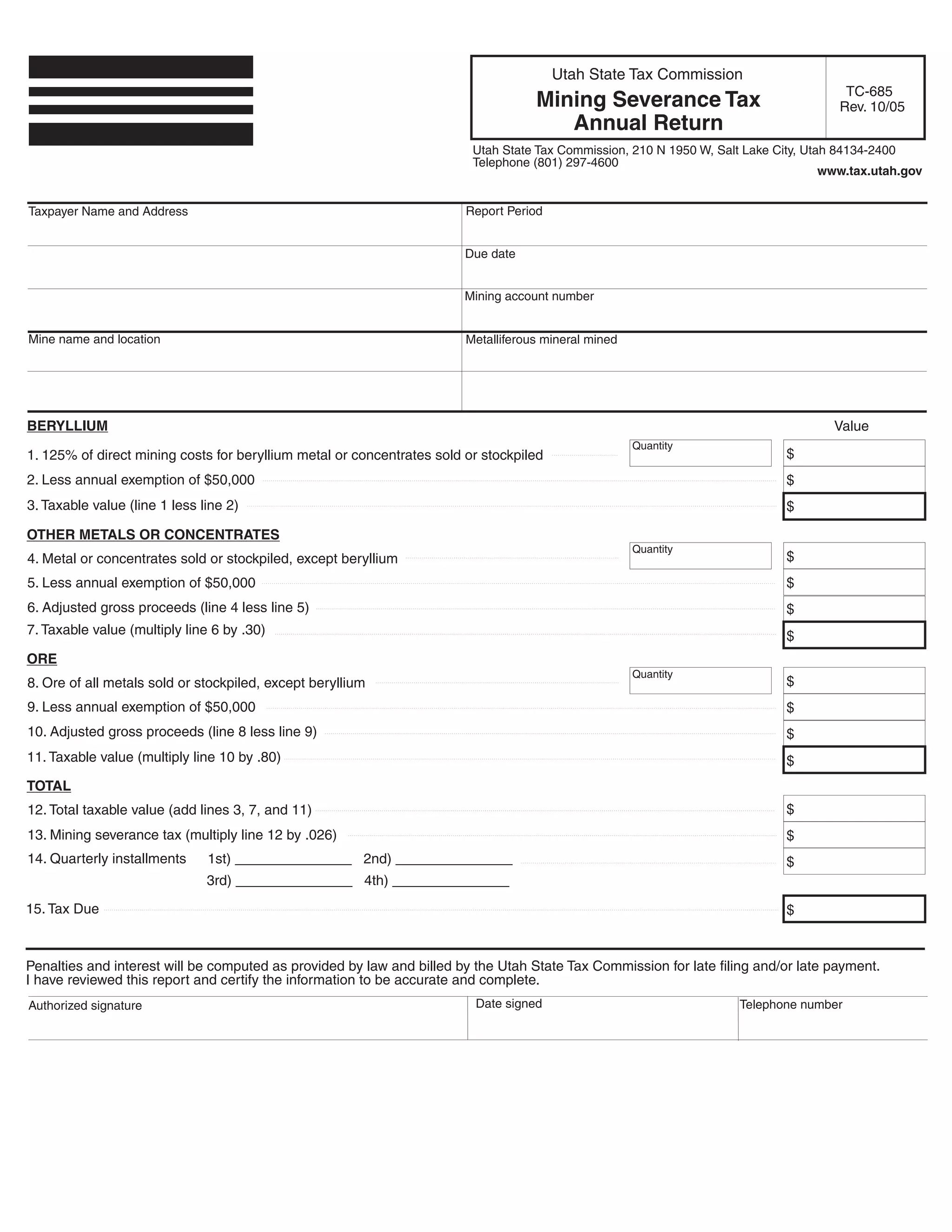

This document is an annual mining severance tax return form for a taxpayer in Utah. It requires information about the taxpayer such as their name, address, and mine location. It also requires reporting the quantity and value of various mined metals and minerals, including beryllium, other metals, and ore. Values are reported before and after applying the $50,000 annual exemption amount. The final lines calculate the total taxable value and tax due, taking into account any quarterly prepayments that were made.