Embed presentation

Download to read offline

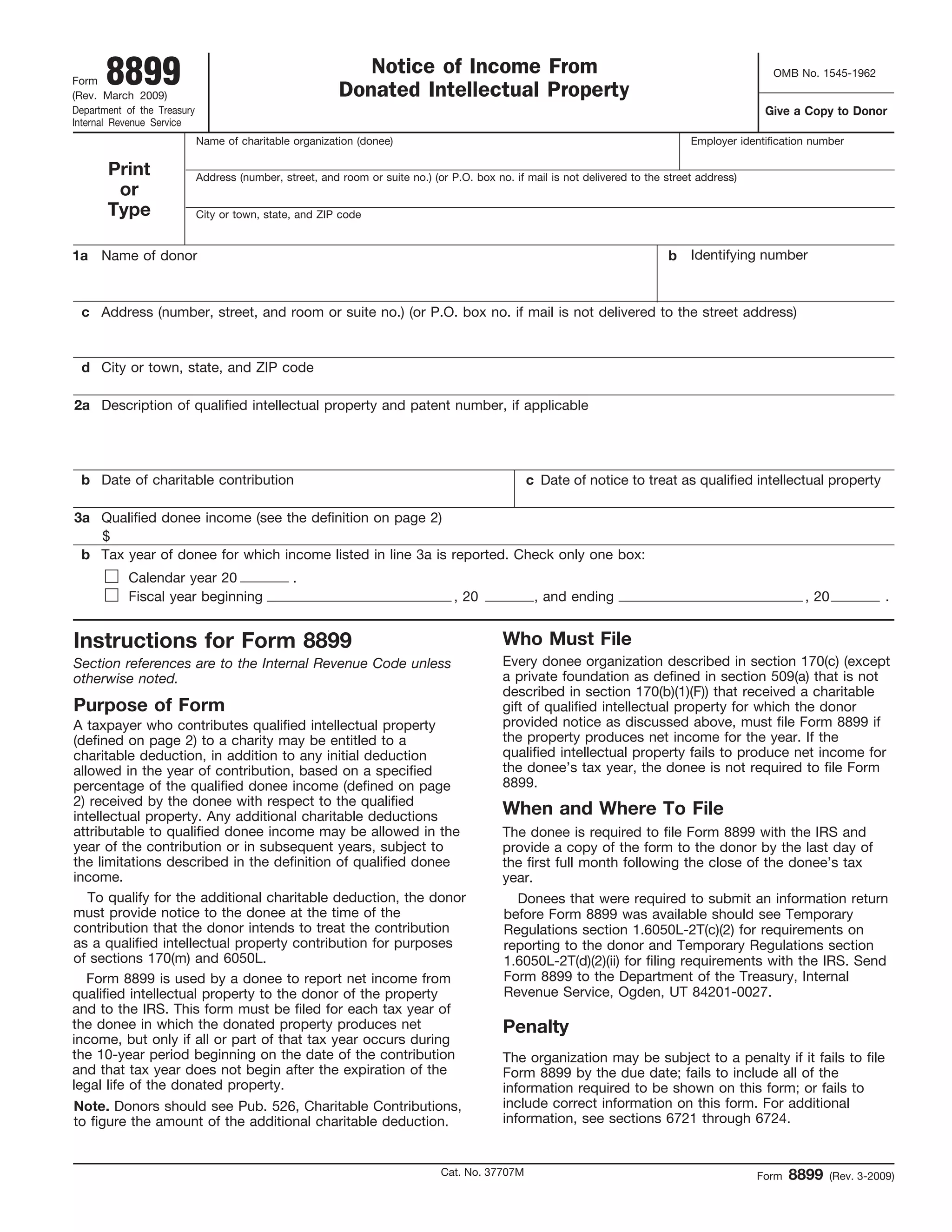

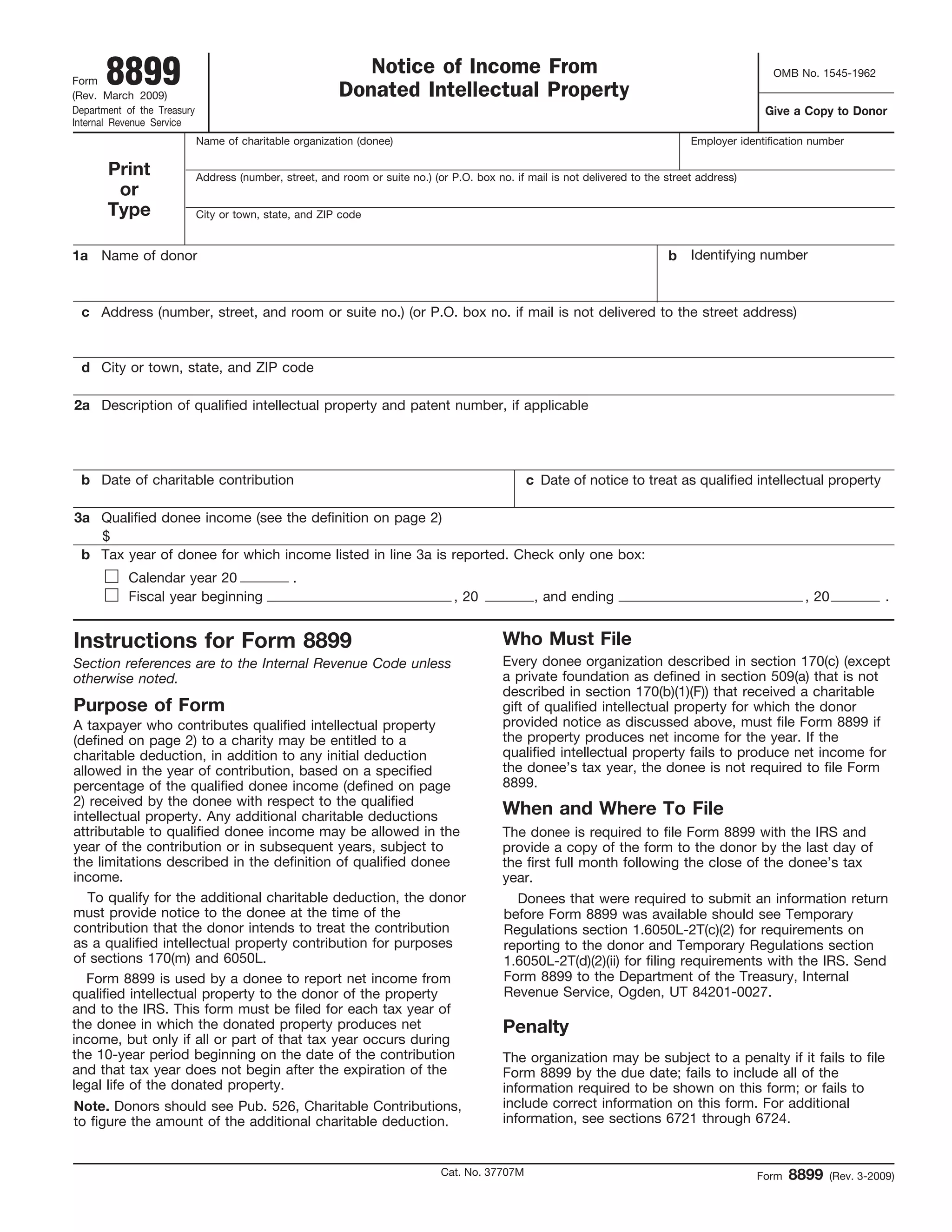

This document is an IRS Form 8899 that charitable organizations must file to report income received from donated intellectual property to donors and the IRS. It summarizes that: 1) Donee organizations that receive charitable gifts of qualified intellectual property must file this form if the property produces income for the tax year. 2) The form provides information on the qualified intellectual property donated, income received from it, and tax years involved. 3) It must be filed with the IRS and a copy provided to the donor by the last day of the first full month after the donee's tax year ends, to allow donors to claim additional charitable deductions.