Embed presentation

Download to read offline

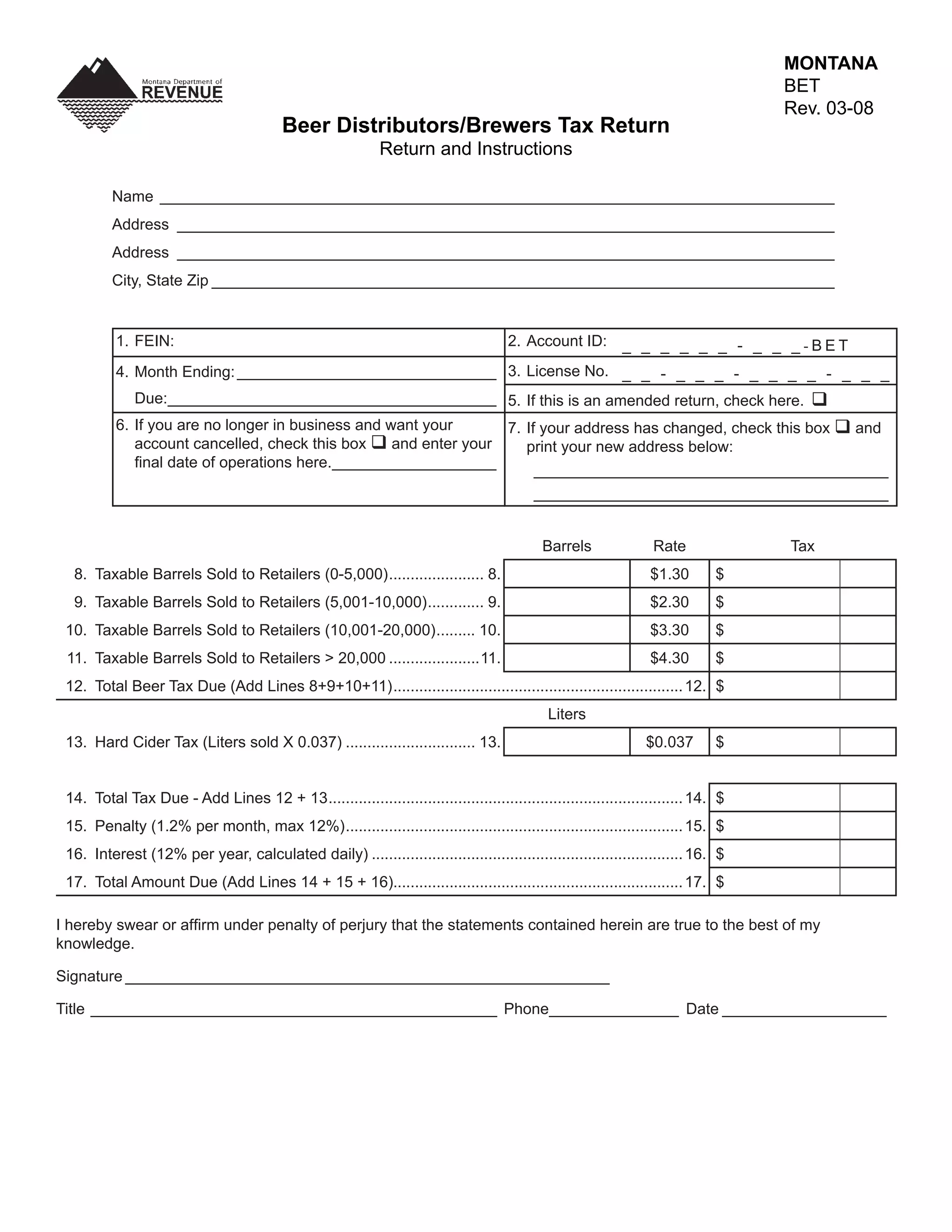

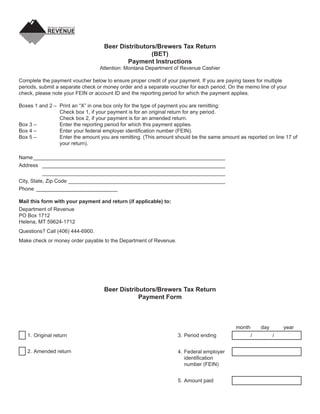

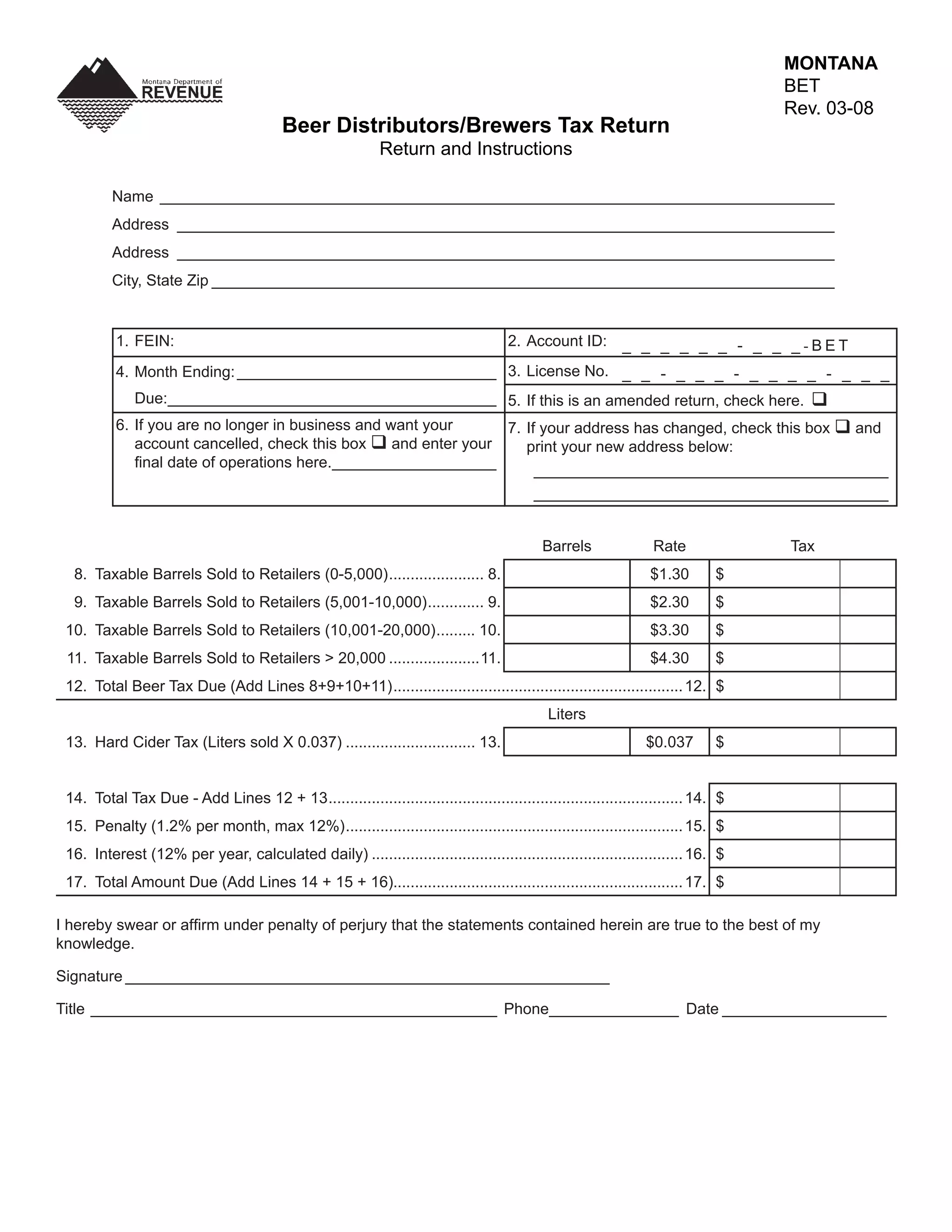

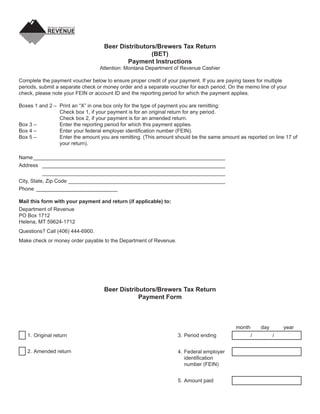

This document contains instructions for completing Montana's Beer Distributors/Brewers Tax Return (BET) form. It explains how to calculate taxes owed on beer and hard cider sales in gallons/barrels. Taxes are due on the 15th day of the month following the reporting period. Late or amended returns are subject to penalties and interest. Instructions are provided for each line item on the tax return form.