Embed presentation

Download to read offline

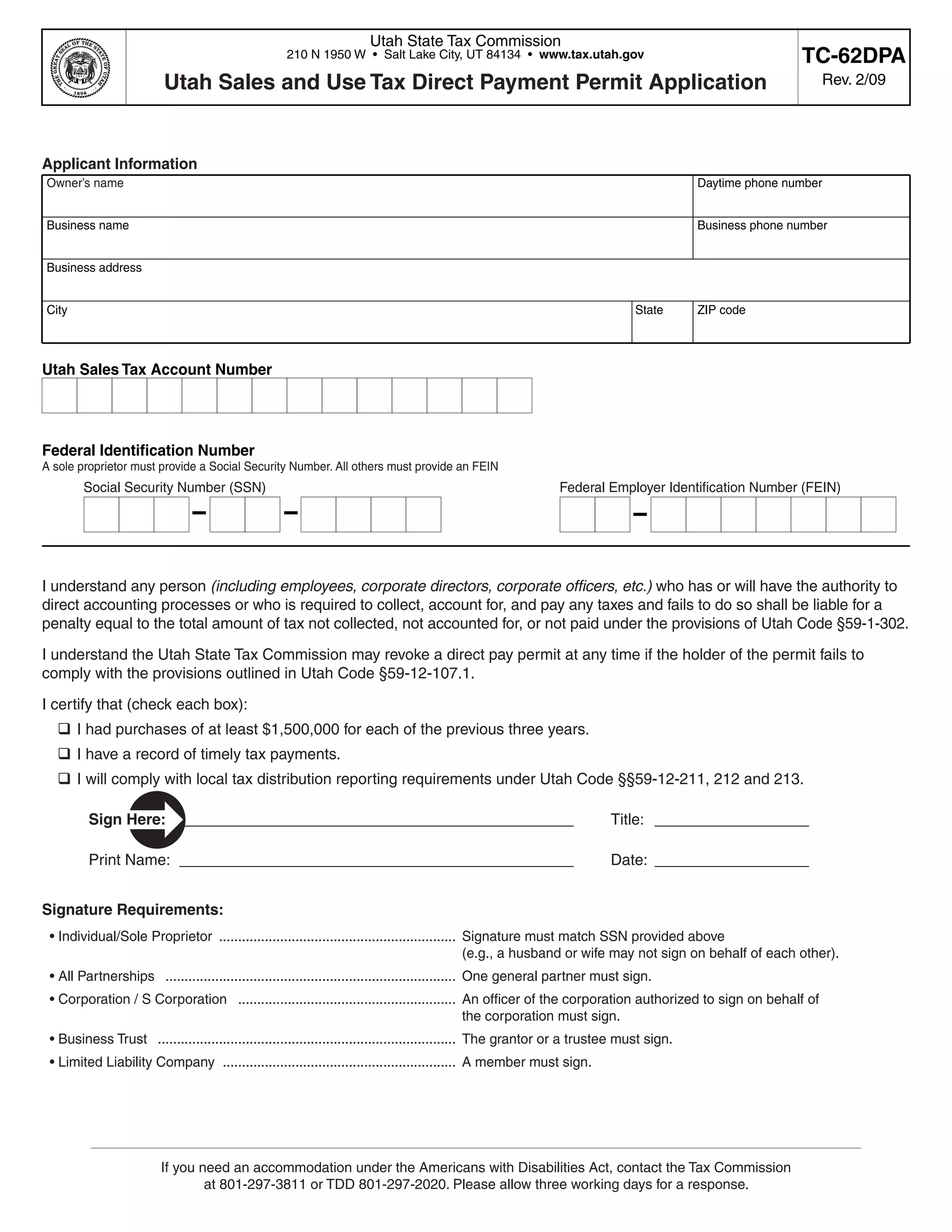

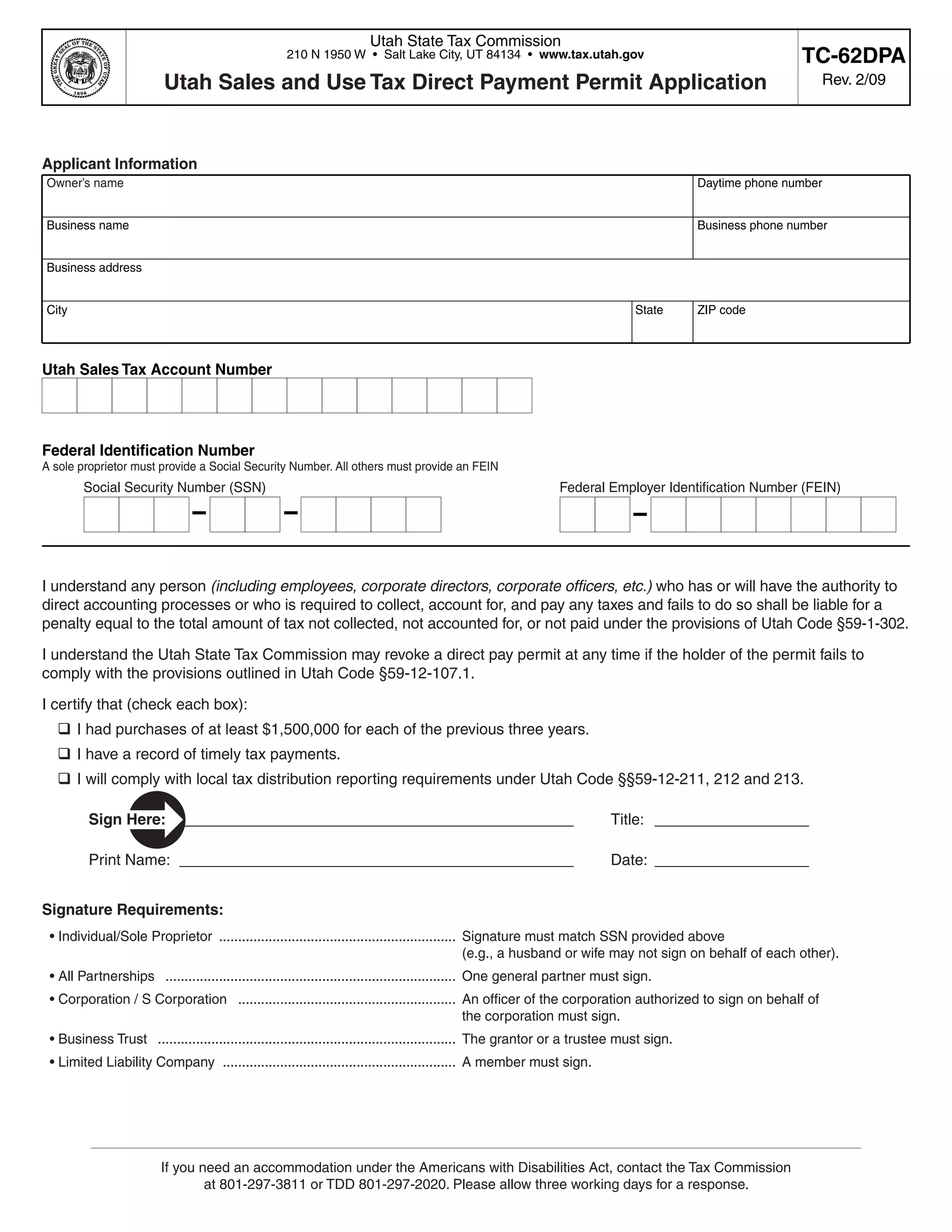

The document is an application for a Utah Sales and Use Tax Direct Payment Permit, which allows large businesses that make purchases over $1.5 million annually to pay sales tax directly to the state rather than to vendors. It provides instructions on eligibility requirements and limitations of using a direct payment permit to self-assess sales tax liability. Applicants must demonstrate a history of timely tax filings and payments and an ability to comply with local tax distribution reporting rules.