tax.state.nv.us documents 15%20Retail%20Store%20Transfer

•Download as DOC, PDF•

1 like•97 views

Report

Share

Report

Share

Recommended

More Related Content

Viewers also liked

Viewers also liked (20)

tax.state.nv.us documents 1%20Cert%20of%20comp%20appl%20letter

tax.state.nv.us documents 1%20Cert%20of%20comp%20appl%20letter

tax.state.nv.us documents Introduction%20to%20MSA%20and%20Legislation

tax.state.nv.us documents Introduction%20to%20MSA%20and%20Legislation

Qtr%20Ins%20Return%20(not%20for%20reporting%20Industrial%20Insurance)%5B1%5D

Qtr%20Ins%20Return%20(not%20for%20reporting%20Industrial%20Insurance)%5B1%5D

Similar to tax.state.nv.us documents 15%20Retail%20Store%20Transfer

Similar to tax.state.nv.us documents 15%20Retail%20Store%20Transfer (20)

tax.state.nv.us documents 5%20LTD04%20ET%20Suppliers%20Liq%20Excise%20Tax%20...

tax.state.nv.us documents 5%20LTD04%20ET%20Suppliers%20Liq%20Excise%20Tax%20...

Manufacturing - Customer KYC - ERP Master Data Form - Ver1.0

Manufacturing - Customer KYC - ERP Master Data Form - Ver1.0

Wine & Vineyard Law: Federal and New York State Licenses, Permits & Regulations

Wine & Vineyard Law: Federal and New York State Licenses, Permits & Regulations

IBC-Application for Business Form (Euro Caribbean)

IBC-Application for Business Form (Euro Caribbean)

Getting a Liquor Permit for your Restaurant in India

Getting a Liquor Permit for your Restaurant in India

tax.state.nv.us documents 10%20LTD%201%20Liquor%20Excise%20Tax%20Rtn

tax.state.nv.us documents 10%20LTD%201%20Liquor%20Excise%20Tax%20Rtn

AnnuAl RepoRt 2010ChicosFAS.comTo Our Shareholders.docx

AnnuAl RepoRt 2010ChicosFAS.comTo Our Shareholders.docx

AnnuAl RepoRt 2010ChicosFAS.comTo Our Shareholders.docx

AnnuAl RepoRt 2010ChicosFAS.comTo Our Shareholders.docx

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

""wsp;+971581248768 "/BUY%$ AbORTION PILLS ORIGNAL%In DUBAI ))%3 ((+971_58*124*8768((#Abortion Pills in Dubai#)Abu Dhabi#. #UAE# DUBAI #| SHARJAH#UAE💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation.Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

Recently uploaded (20)

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Home Furnishings Ecommerce Platform Short Pitch 2024

Home Furnishings Ecommerce Platform Short Pitch 2024

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Progress Report - Oracle's OCI Analyst Summit 2024

Progress Report - Oracle's OCI Analyst Summit 2024

Thompson_Taylor_MBBS_PB1_2024-03 (1)- Project & Portfolio 2.pptx

Thompson_Taylor_MBBS_PB1_2024-03 (1)- Project & Portfolio 2.pptx

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

Goal Presentation_NEW EMPLOYEE_NETAPS FOUNDATION.pptx

Goal Presentation_NEW EMPLOYEE_NETAPS FOUNDATION.pptx

Top Quality adbb 5cl-a-d-b Best precursor raw material

Top Quality adbb 5cl-a-d-b Best precursor raw material

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

PALWAL CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN PALWAL ESCORTS

PALWAL CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN PALWAL ESCORTS

How does a bike-share company navigate speedy success? - Cyclistic

How does a bike-share company navigate speedy success? - Cyclistic

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...

tax.state.nv.us documents 15%20Retail%20Store%20Transfer

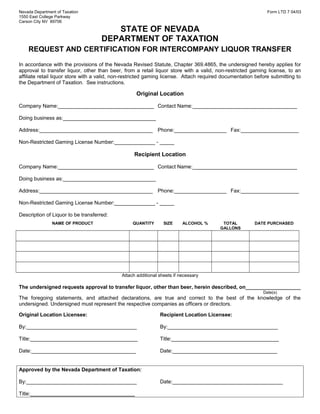

- 1. Nevada Department of Taxation Form LTD 7 04/03 1550 East College Parkway Carson City NV 89706 STATE OF NEVADA DEPARTMENT OF TAXATION REQUEST AND CERTIFICATION FOR INTERCOMPANY LIQUOR TRANSFER In accordance with the provisions of the Nevada Revised Statute, Chapter 369.4865, the undersigned hereby applies for approval to transfer liquor, other than beer, from a retail liquor store with a valid, non-restricted gaming license, to an affiliate retail liquor store with a valid, non-restricted gaming license. Attach required documentation before submitting to the Department of Taxation. See instructions. Original Location Company Name:_________________________________ Contact Name:____________________________________ Doing business as:________________________________ Address:_______________________________________ Phone:__________________ Fax:____________________ Non-Restricted Gaming License Number:______________ - _____ Recipient Location Company Name:_________________________________ Contact Name:____________________________________ Doing business as:________________________________ Address:_______________________________________ Phone:__________________ Fax:____________________ Non-Restricted Gaming License Number:______________ - _____ Description of Liquor to be transferred: NAME OF PRODUCT QUANTITY SIZE ALCOHOL % TOTAL GALLONS DATE PURCHASED Attach additional sheets if necessary The undersigned requests approval to transfer liquor, other than beer, herein described, on___________________ Date(s) The foregoing statements, and attached declarations, are true and correct to the best of the knowledge of the undersigned. Undersigned must represent the respective companies as officers or directors. Original Location Licensee: Recipient Location Licensee: By:______________________________________ By:______________________________________ Title:_____________________________________ Title:_____________________________________ Date:____________________________________ Date:____________________________________ Approved by the Nevada Department of Taxation: By:______________________________________ Date:______________________________________ Title:____________________________________

- 2. INSTRUCTIONS FOR REQUEST AND CERTIFICATION FOR INTERCOMPANY LIQUOR TRANSFER ORIGINAL LOCATION: Print the company name, doing business as name, and address of company currently in possession of the liquor to be transferred. Print a name, phone number and fax number of the contact person for the originating company. Include the non-restricted gaming license number of originating company. RECIPIENT LOCATION: Print the company name, doing business as name and address of company receiving the liquor. Print a name, phone number and fax number of the contact person for the recipient company. Include the non-restricted gaming license number of recipient company. NAME OF PRODUCT: List the brand name and type of liquor, other than beer, to be transferred. i.e.; John Doe’s Cabernet Sauvignon. QUANTITY: List the number of packages of the brand name and type of liquor to be transferred. SIZE: List the size of the package of the liquor to be transferred. i.e.: 750 ML, 1 Liter. ALCOHOL %: List the percentage of alcohol by content of the liquor to be transferred. TOTAL GALLONS: Calculate the total gallons of liquor to be transferred. Use the following formula to convert milliliters to gallons: Quantity times Size = total milliliters Divide total milliliters by 1000 = total liters Multiply total liters by .26417 for wine or .264172 for distilled spirits = total gallons Example: 12 bottles x 750 ML= 9000/1000= 9 liters x .26417= 2.37753 or 2.38 gallons. DATE PURCHASED: List the date of original purchase of liquor from Nevada licensed wholesaler. List the date(s) you are requesting to transfer liquor. Transfer must be completed on the date(s) listed on the Request and Certification for Intercompany Liquor Transfer form. If transfer cannot be completed on the date(s) approved by the Department, a new request will need to be submitted. An authorized representative of the originating company and an authorized representative of the recipient company must sign the Request and Certification for Intercompany Liquor Transfer. The following documents must be included with request in order to obtain approval: 1. Copy of non-restricted gaming license from both affiliates 2. Copy of retail liquor license from both affiliates 3. Evidence of affiliation between the locations transferring liquor (Document from Secretary of State or notarized statement from company official) 4. Legible copies of invoices of original purchase of liquor from Nevada licensed wholesaler 5. An affidavit from each Nevada licensed wholesaler attesting to their marketing area Request and Certification for Intercompany Liquor Transfer form and all pertinent documents listed above, must be received by the Department of Taxation 30 days prior to the date of transfer. The approved transfer request, signed by the Department of Taxation, must accompany the liquor during transfer. Copies of the approved request must be maintained by both the originated company and the recipient company. Send completed form and pertinent documents to: Nevada Department of Taxation 1550 E. College Pkwy, Suite 115 Carson City, NV 89706