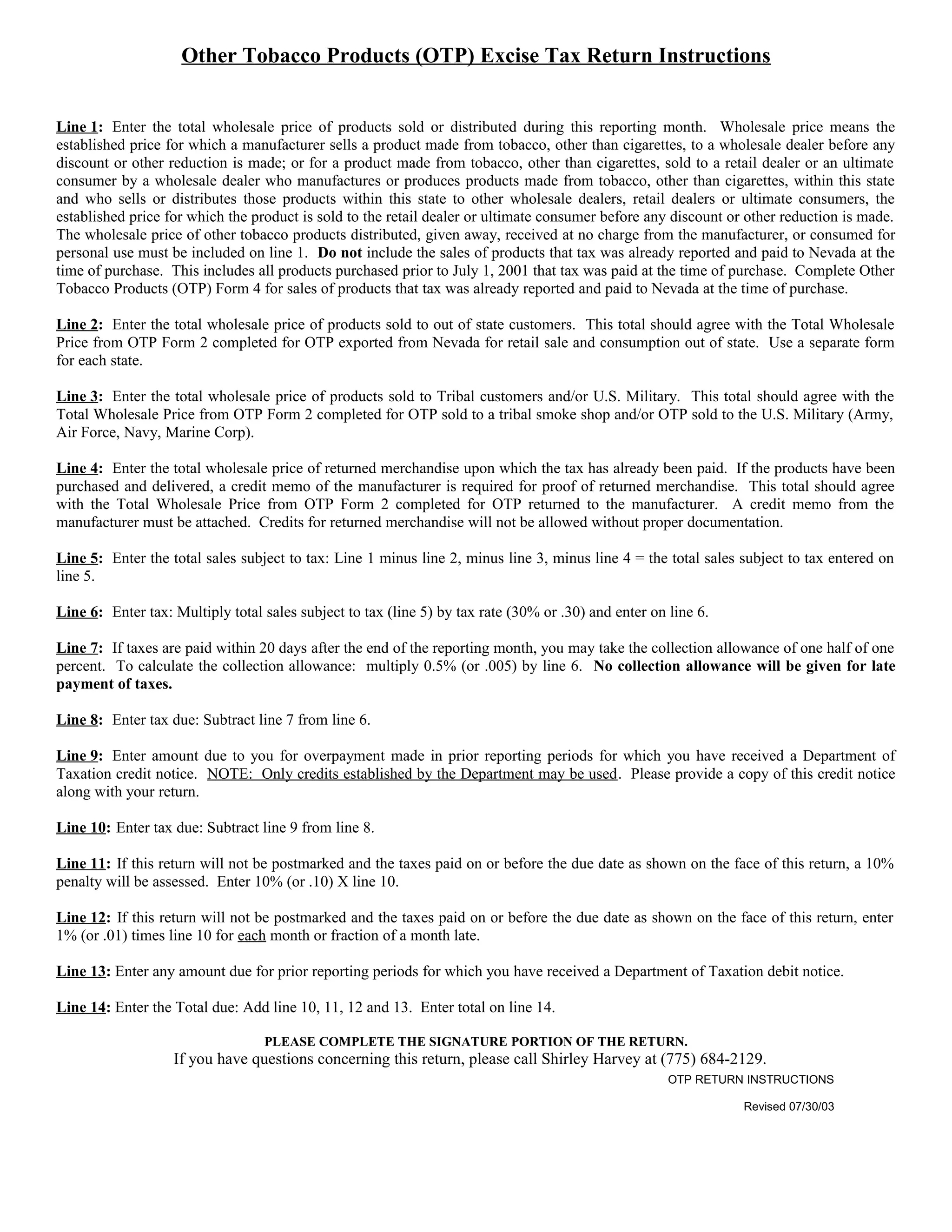

This document provides instructions for completing an Other Tobacco Products (OTP) Excise Tax Return and associated forms for Nevada. It explains how to calculate taxes owed on OTP sales. Line items on the return collect information on total sales, sales to out-of-state customers or tribes that are tax exempt, returned merchandise credits, and tax amounts due. Associated forms track tax-exempt OTP exports and credits for returned products to claim on the main return. Penalties are assessed for late filing or payment.