The document provides an overview of key concepts for understanding and interpreting various types of tax returns, including:

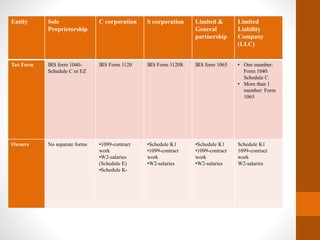

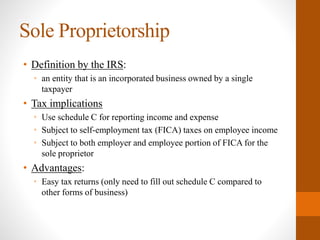

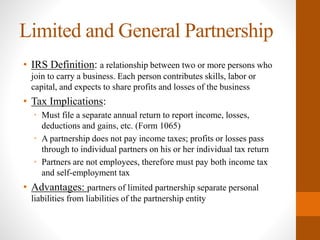

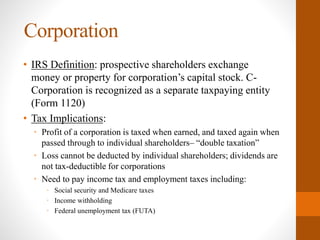

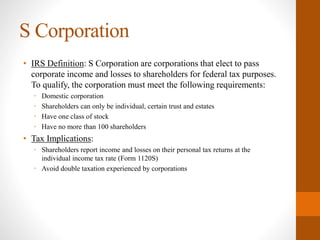

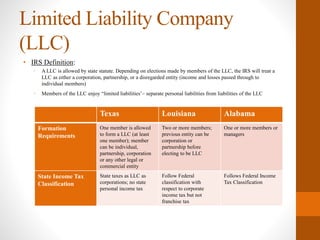

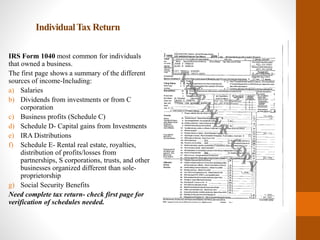

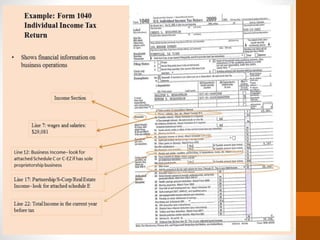

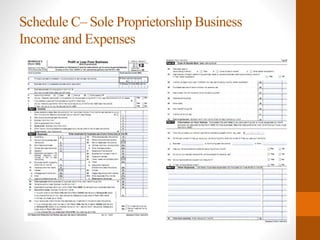

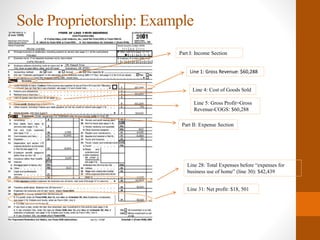

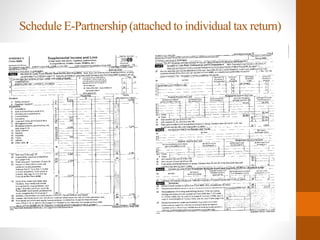

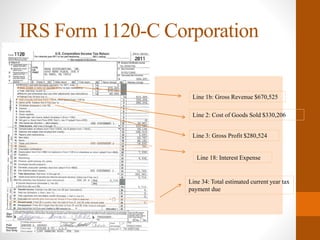

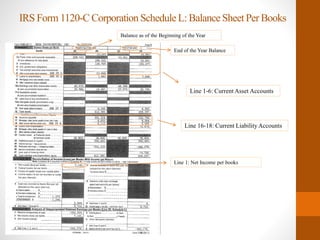

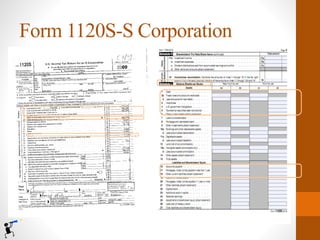

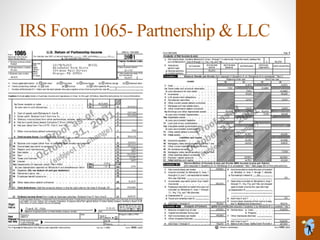

- It defines sole proprietorships, partnerships, C and S corporations, and LLCs and the different tax forms associated with each (Schedule C, Form 1065, Form 1120, Form 1120S).

- It highlights things to check when reviewing a tax return like the name, tax period, and signature.

- It explains the relationship between individual and business tax returns and how profits/losses flow through for each entity type.

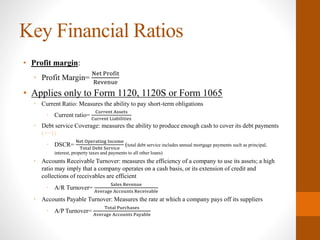

- It outlines several important financial ratios that can be calculated from the information in the tax returns like profit margin, current ratio, and accounts receivable/pay