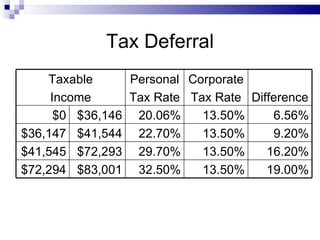

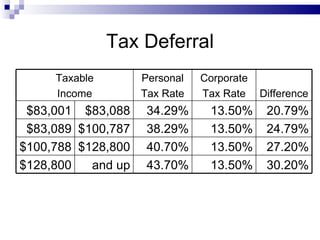

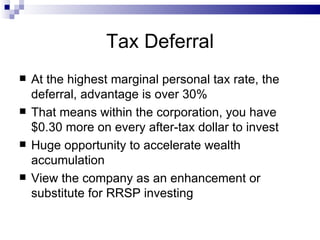

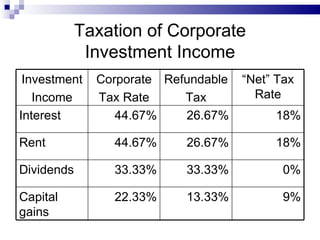

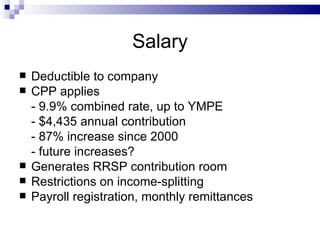

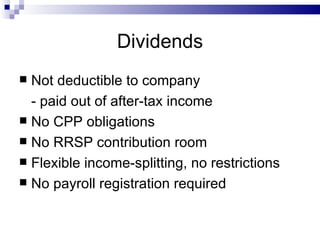

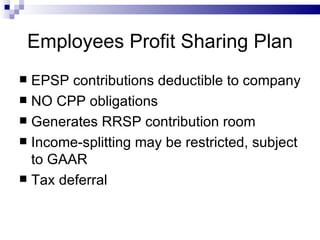

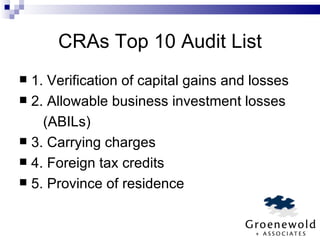

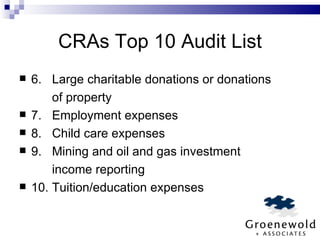

This document discusses the benefits of incorporating a professional business. Tax deferral is a key benefit, as corporate tax rates are generally lower than personal tax rates, allowing business owners to retain more income. Incorporation also enables income splitting between family members through dividend distributions or paying a spouse/children through the corporation. Limited liability protects personal assets from business debts and liabilities. The document provides tax rates and strategies for compensation, investments, transferring assets, and common CRA audit topics. It emphasizes that incorporation is best for tax deferral and planning but has costs like taxes when withdrawing corporate funds.

![Contact Information John Groenewold, CGA, CFP, TEP Groenewold + Associates 410 – 1508 West Broadway Vancouver, BC V6J 1W8 (604) 683-3488 (phone) (888) 349-8834 (fax) [email_address]](https://image.slidesharecdn.com/incorporation2011-13195141221208-phpapp02-111024225506-phpapp02/85/Incorporation-2011-27-320.jpg)