This document discusses several tax issues related to startup companies, including:

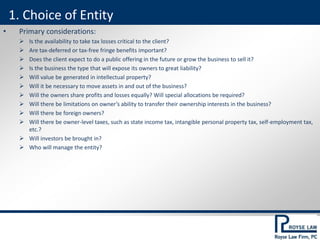

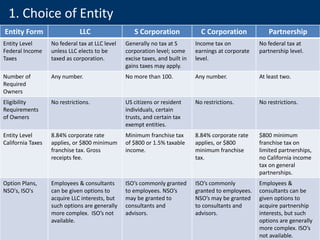

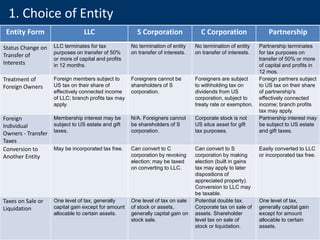

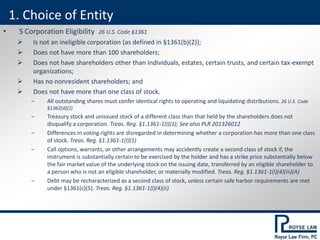

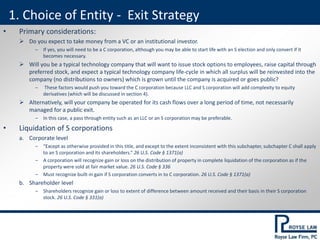

1) Choice of entity considerations such as availability of losses, fringe benefits, public offerings, liability, intellectual property, and ownership transfers.

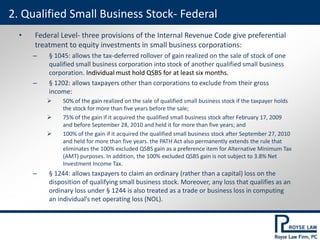

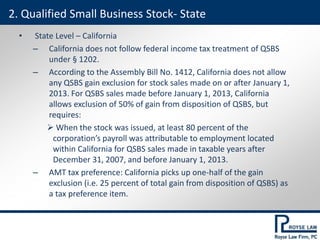

2) Qualified small business stock and relevant tax benefits at the federal and state levels.

3) Proposed §305 regulations regarding deemed distributions on convertible instruments.

4) Dynamic split models for allocating founder's equity.

5) Tax treatment of convertible debt issued as an investment.