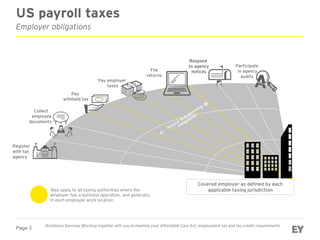

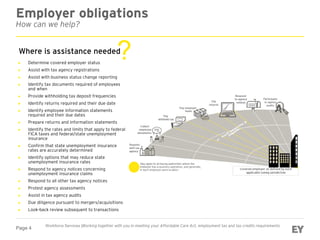

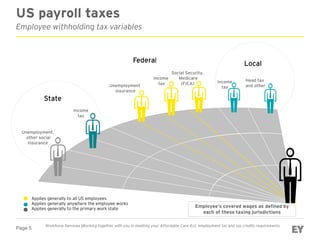

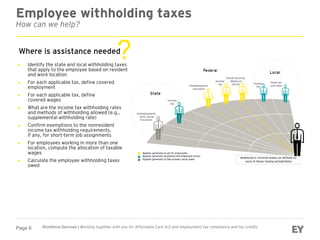

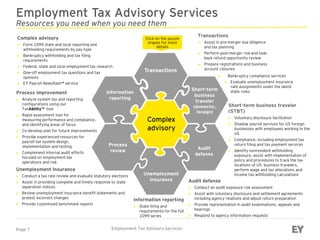

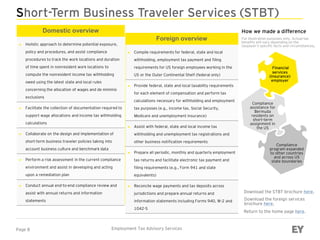

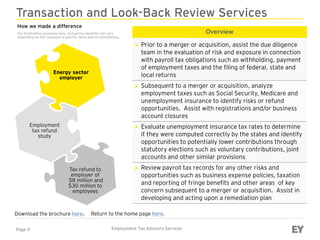

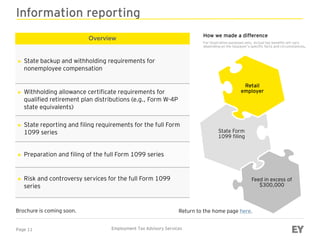

This document provides an overview of employment tax advisory services. It discusses employer and employee obligations related to payroll taxes including registering with tax agencies, paying withheld taxes, filing returns, and responding to notices. It also outlines how the services can help with determining tax status, completing registrations, identifying required documents and due dates, preparing returns, and responding to tax agency notices. The services include assistance with unemployment insurance, process improvement reviews, audit defense, complex advisories, short-term business traveler compliance, transactions, and look-back reviews.