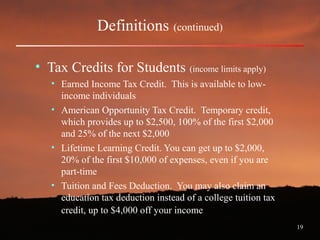

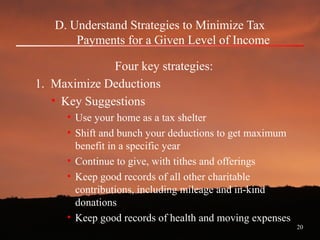

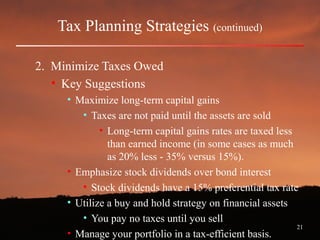

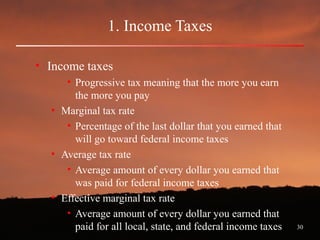

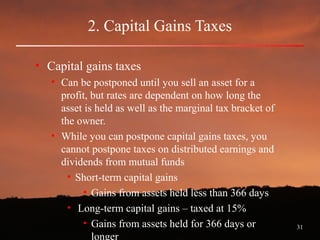

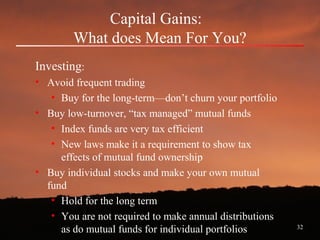

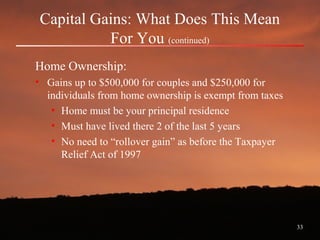

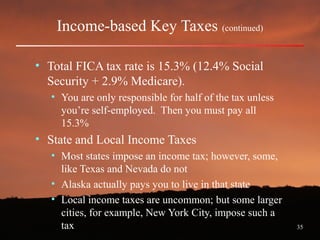

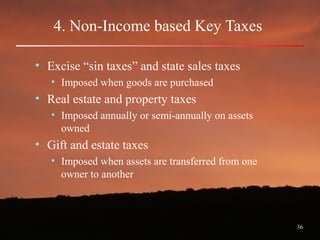

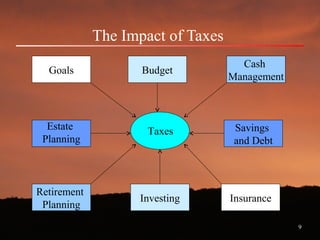

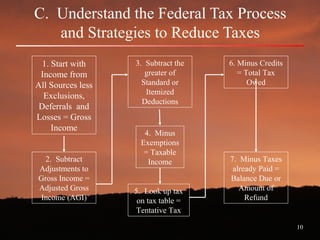

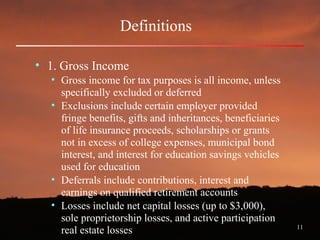

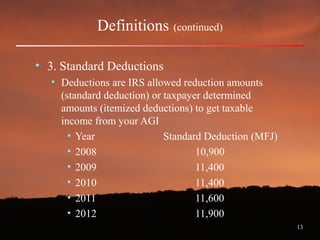

The document provides a comprehensive overview of tax planning, emphasizing its importance in achieving personal financial goals, understanding the federal tax process, and legal strategies to minimize tax liability. It includes insights from leaders regarding tax obligations and offers various strategies for deductions, credits, and tax-advantaged investments. Additionally, it discusses the major features of the tax system, including income taxes, capital gains taxes, and various local and federal tax obligations.

![17

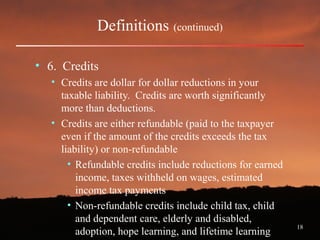

Definitions (continued)

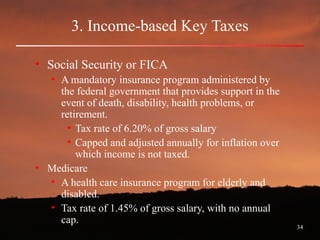

• 5. Tax Tables (married filing jointly [Schedule Y-1])

Year If Taxable But not Tax Plus this Of the

income is over over is percentage Excess

2010 0 $16,750 0 10% 0

$16,750 $68,000 1,675 15% 16,750

$68,000 $137,300 9,363 25% 68,000

$137,300 $209,250 26,688 28% 137,300

2011 $0 $17,000 $0 10% $0

17,000 69,000 1,700 15% 17,000

69,000 139,350 9,500 25% 69,000

139,350 212,300 27,088 28% 139,350

2012 0 17,400 0 10% 0

17,400 70,700 1,740 15% 17,400

70,700 142,700 9,735 25% 70,700

142,700 217,450 27,735 28% 142,700](https://image.slidesharecdn.com/taxplanning-170615074154/85/slide-17-320.jpg)