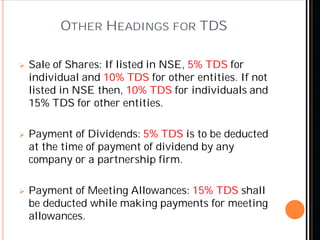

Nepal requires tax deduction at source (TDS) on certain types of payments, including contracts, rent, interest, commissions, and royalties. The payer must deduct TDS and pay it to the government within 25 days of the month it was deducted. Failure to file monthly TDS returns or pay the deducted amount on time results in fines and interest. Specifically, TDS of 10% is required for rent payments, 1.5% for contract payments over NPR 50,000, and 5-10% for various other types of payments like dividends, sale of shares, and meeting allowances depending on the recipient.