The document discusses the requirements and procedures for tax audit under the Income Tax Act of India. It explains that tax audit is mandatory if the gross turnover or receipts of a business exceed Rs. 1 crore or gross receipts of a profession exceed Rs. 25 lakhs. It outlines the key forms used in tax audit reporting, the objectives of tax audit to assist the tax department, and the main procedures auditors must follow, including applying audit standards and techniques to verify tax compliance. The document also provides guidance on specific clauses in the tax audit report form related to the nature of business, books of accounts, inventory valuation, depreciation, and other income and expense items.

![S G C O & Co.

Chartered Accountants

42

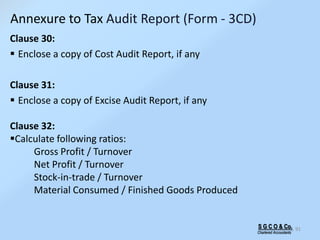

Annexure to Tax Audit Report (Form - 3CD)

Clause 7:

Is applicable to Firms & Association of Persons

Names of partners / members & their profit-sharing ratios [Sub-

Clause (a)]

Changes in the constitution, or profit-sharing, of Partnership /

Association & the particulars of change [Sub-Clause (b)]

Relevant Issues

Will change in remuneration paid to partners without change in

profit-sharing ratio would require any disclosure in tax audit

report?

When partner in representative capacity retires & admitted as

partner in individual capacity, will it amount to change in

partnership?](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-42-320.jpg)

![S G C O & Co.

Chartered Accountants

43

Clause 8:

Nature of Business / Profession (If more than one business /

profession is carried out, then nature of every business /

profession) [Sub-Clause (a)]

Particulars of change in business / profession [Sub-Clause (b)]

Relevant Issues

If assessee starts another business whose gross receipts are not

material compared to existing business, would it still amount to

change in business?

If assessee manufactures certain products & also sells certain

components which are used in manufacture of product, would he

be categorized as trader or manufacturer?

If nature of business covers vast no. of activities, is it sufficient for

TA to obtain management representations?

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-43-320.jpg)

![S G C O & Co.

Chartered Accountants

44

Annexure to Tax Audit Report (Form - 3CD)

Clause 9:

Whether books of accounts are prescribed as per S. 44AA? [Sub-

Clause (a)]

Books of Accounts maintained (In case of computerized system of

accounting, mention books of account generated by such system)

[Sub-Clause (b)]

List of books examined [Sub-Clause (c)]

Relevant Issues

Where stock records are not maintained due to high volume of

transactions, what is TA’s stand?

Would post audit print-outs of accounts prepared be sufficient

evidence of audit without audit ticks?](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-44-320.jpg)

![S G C O & Co.

Chartered Accountants

45

Annexure to Tax Audit Report (Form - 3CD)

Clause 10:

Mention profit assessable on presumptive basis which is included

in profit & loss account and relevant section under which it is

assessable

Clause 11:

Method of Accounting followed in P.Y [Sub-Clause (a)]

Any change in method of accounting in relation to last P.Y [Sub-Clause (b)]

Details of such change and its effect on profit / loss [Sub-Clause (c)]

Details of deviation in method employed from accounting standards

prescribed u/s. 145 & effect on profit / loss [Sub-Clause (d)]

Relevant Issues

Does change in accounting policy amount to change in ‘method of

accounting’?

If preceding P.Y’s accounts were not subject to tax audit, is it sufficient to

rely only upon information & explanations provided by client?](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-45-320.jpg)

![S G C O & Co.

Chartered Accountants

46

Annexure to Tax Audit Report (Form - 3CD)

Clause 12:

Method of Valuation of Closing Inventory employed in P.Y [Sub-

Clause (a)]

Details of deviation of such method of valuation from method

prescribed u/s. 145A & effect on profit / loss [Sub-Clause (b)]

What is objective behind S. 145A?

Whether there is any effect on Profit & Loss Account by adopting

‘Inclusive Method’ as per S. 145A ?

Clause 12: Relevant Issues

Where closing inventories are valued at market price (being lower than

cost), should excise duty be added to such amount for complying with S.

145A?](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-46-320.jpg)

![S G C O & Co.

Chartered Accountants

47

Clause 12A:

Give following particulars of Capital Asset converted into Stock-in-Trade-

Description of Capital Asset [Sub-Clause (a)]

Date of Acquisition [Sub-Clause (b)]

Cost of Acquisition [Sub-Clause (c)]

Amount at which asset is converted into Stock-in-Trade [Sub-Clause (d)]

Profits or gains arising on conversion of a capital asset into, stock-in-

trade are chargeable to tax as capital gains.

Verify the resolution passed by the Directors, in case the assessee it is a

company, or any other supporting document and the accounting entry

passed in books to reflect the asset into stock, instead of as a fixed

asset.

Verify the valuation report/any other supporting document based on

which the conversion is recorded in the books of accounts.

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-47-320.jpg)

![S G C O & Co.

Chartered Accountants

48

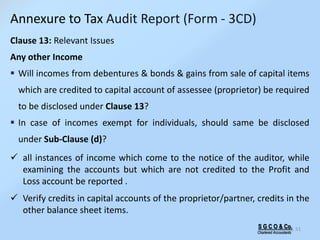

Annexure to Tax Audit Report (Form - 3CD)

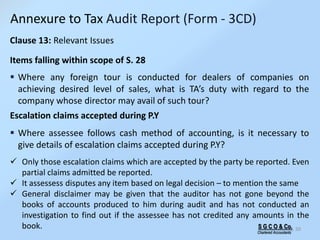

Clause 13:

Amounts not credited to Profit / Loss Account, being -

items falling within scope of S. 28 [Sub-Clause (a)]

Verify the reserves account, or any other account to identify I any item

is directly credited to the same .

pro forma credits, drawbacks, refunds of customs or excise duties

or service tax, sales tax or VAT, where same are admitted as due by

concerned authorities [Sub-Clause (b)]

Only the claims lodged and admitted by authorities be reported. If such

claims are not admitted, the same need not be reported.

escalation claims accepted during P.Y [Sub-Clause (c)]

any other items of income [Sub-Clause (d)]

capital receipt [Sub-Clause (e)]](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-48-320.jpg)

![S G C O & Co.

Chartered Accountants

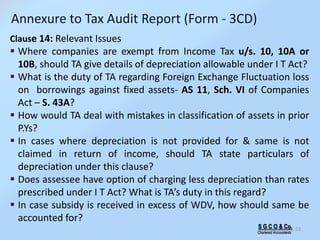

52

Clause 14:

Particulars of depreciation as per Income Tax Act, 1961 for each block of assets in

following form-

description of asset / block of assets [Sub-Clause (a)]

rate of depreciation [Sub-Clause (b)]

actual cost / WDV [Sub-Clause (c)]

Additions (alongwith date of asset being put to use) / deductions made to block

alongwith following adjustments [Sub-Clause (d)]-

• CENVAT claimed & allowed

• Change in exchange rates

• Subsidy, grant or reimbursement

Depreciation allowable [Sub-Clause (e)]

WDV at end of P.Y [Sub-Clause (f)]

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-52-320.jpg)

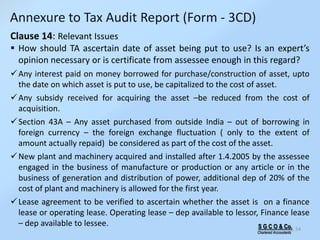

![S G C O & Co.

Chartered Accountants

55

Clause 15:

Amounts admissible u/s. 33AB, 33ABA, 33AC (wherever applicable),

35, 35ABB, 35AC, 35CCA, 35CCB, 35D, 35DD, 35DDA & 35E-

Debited to Profit / Loss Account (showing amount debited &

deduction allowable under each section) [Sub-Clause (a)]

Accounts to be scrutinized to identify the amount which is debited to

profit and loss account

Not Debited to Profit / Loss Account [Sub-Clause (b)]

Where deduction is available for consecutive years, deduction available

in subsequent years, though the amount is not debited to profit and

loss account. Deduction claimed in the first year of claim be verified.

Whether considered in DTA/DTL calculation , depreciation not available

on exp written off.

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-55-320.jpg)

![S G C O & Co.

Chartered Accountants

57

Clause 16:

Sum paid to employee as bonus or commission, where same was

payable as profits or dividend [Sub-Clause (a)]

Sums received from employees as contributions to any provident

or superannuation funds or any other fund u/s. 2(24)(x); due date

for payment & actual date of payment to concerned authorities

u/s. 36(1)(va) [Sub-Clause (b)]

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-57-320.jpg)

![S G C O & Co.

Chartered Accountants

59

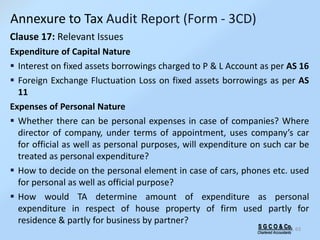

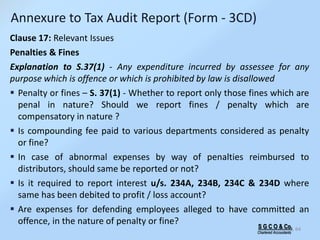

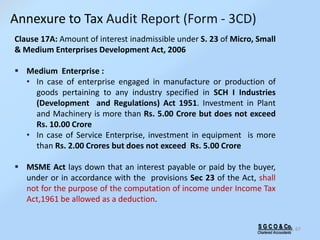

Clause 17:

Amounts debited to Profit / Loss, being-

capital expenditure [Sub-Clause (a)]

personal expenditure [Sub-Clause (b)]

expenditure on advertisement in any publication of political party [Sub-Clause (c)]

expenditure incurred at clubs [Sub-Clause (d)]-

• as entrance fees & subscription

• as cost for club services & facilities used

penalty or fine for violation of any law [Sub-Clause (e)(i)]

any other penalty or fine [Sub-Clause (e)(ii)]

expenditure incurred for an offensive purpose or that which prohibited by law

[Sub-Clause (e)(iii)]

Amount inadmissible u/s. 40(a) [Sub-Clause (f)]

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-59-320.jpg)

![S G C O & Co.

Chartered Accountants

60

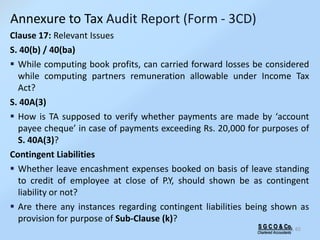

Clause 17:

Amounts debited to Profit / Loss, being-

Amounts inadmissible u/s. 40(b) / 40 (ba) & computation thereof, by way of [Sub-

Clause (g)]-

• Interest

• Salary

• Bonus

• Commission or remuneration

Whether certificate is obtained from assessee regarding payments relating to

expenditures covered u/s. 40A(3) that same were made by account payee cheque

/ draft [Sub-Clause (h A)]

Amount inadmissible u/s. 40A(3) read with r. 6DD & computation thereof [Sub-

Clause (h B)]

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-60-320.jpg)

![S G C O & Co.

Chartered Accountants

61

Clause 17:

Provision for gratuity not allowable u/s. 40A(7) [Sub-Clause (i)]

Any sum paid as employer not allowable u/s. 40A(9) [Sub-clause (j)]

Particulars of contingent liability [Sub-Clause (k)]

Deduction inadmissible as per S. 14A relating to expenditure pertaining

to Income not forming part of Total Income [Sub-Clause (l)]

Amount inadmissible under proviso to S. 36(1)(iii) [Sub-Clause (m)]

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-61-320.jpg)

![S G C O & Co.

Chartered Accountants

62

Clause 17 (l): Amount of deduction inadmissible in terms of S. 14A

S. 14A-

Disallowance of ‘expenditure incurred in relation to income which does not

form part of total income’ (S. 14A expenses)

AO empowered to determined amount inadmissible as per R. 8D only if not

satisfied with correctness of –

• assessees claim having regard to accounts of assessee, or

• assessees claim of NIL expenditures incurred u/s. 14A

[Sub-secs. (2) &(3) r.w.r 8D(1)]

Clause 17(m): Interest inadmissible under proviso to S. 36(1)(iii)

Proviso to S. 36(1)(iii) disallows ‘Interest’ paid -

in respect of capital borrowed

for acquisition of assets

for extension of existing business / profession

for any period from date of borrowing till date of put to use of asset

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-62-320.jpg)

![S G C O & Co.

Chartered Accountants

71

Clause 21:

In respect of any sum referred to in Clauses (a), (b), (c), (d), (e) or (f) of S.

43B, liability for which-

Pre-existed on first day of P.Y but was not allowed in assessment of

preceding P.Y & was-

• Paid during P.Y

• Not paid during P.Y [Sub-Clause (i A)]

Was incurred in P.Y & was-

• Paid on or before due date for furnishing returns of P.Y u/s. 139 (1)

• Not paid on or before due date [Sub-Clause (i B)]

State whether sales tax, customs duty, excise duty or any other indirect

tax, levy, cess, impost etc. is passed through profit / loss account

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-71-320.jpg)

![S G C O & Co.

Chartered Accountants

73

Clause 22:

Amount of CENVAT Credit utilized during P.Y. & treatment in profit /

loss account & treatment of CENVAT Credit outstanding [Sub-

Clause (a)]

Particulars of prior period Income / Expenditure credited / debited

to Profit / Loss Account [Sub-Clause (b)]

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-73-320.jpg)

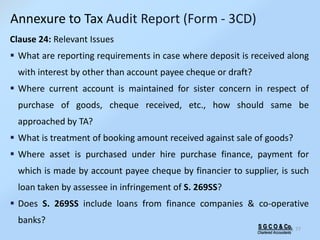

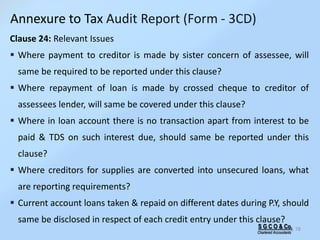

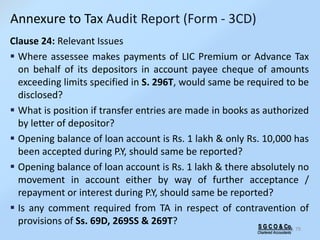

![Clause 23:

Amount borrowed on hundi (including interest thereon) repaid

other than through account payee cheque (section 69D)

Clause 24:

Particulars of each loan / deposit exceeding limits specified u/s.

269SS taken or accepted during P.Y-

Name, address & PAN of lender / depositor

Amount of loan / deposit

Whether loan / deposit was squared up during P.Y

Maximum amount outstanding at any time in P.Y

Whether loan / deposit was taken / accepted otherwise than by

account payee cheque or account payee bank draft [Sub-Clause

(a)]

75S G C O & Co.

Chartered Accountants

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-75-320.jpg)

![S G C O & Co.

Chartered Accountants

76

Clause 24:

Particulars of loan / deposit repaid exceeding limits specified u/s. 269T

during P.Y-

Name, address & PAN of payee

Amount of repayment

Maximum amount outstanding at any time during P.Y

Whether repayment was made otherwise than by account payee

cheque or account payee bank draft [Sub-Clause (b)]

Whether certificate has been obtained from assessee regarding taking or

accepting, or repayment of same through account payee cheque / draft

[Sub-Clause (c)]

Such particulars are not necessary in case of government companies,

banking companies or corporations established under Central, State or

Provincial Act

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-76-320.jpg)

![S G C O & Co.

Chartered Accountants

80

Clause 25:

Details of brought forward loss or depreciation allowance, in following manner

[Sub-Clause (a)]-

Where change in shareholding of company has taken place in P.Y due to which

losses incurred in preceding P.Ys cannot be carried forward as per S. 79 [Sub-

Clause (b)]

Applicable only to closely held companies

Brought forward loss can be set off during the year only if 51% of the voting power

is beneficially held on the last day of the year by the same set of shareholders who

beneficially held 51% of voting power on the last day of the year, in which loss

occurred

Exceptions provided in the section

Carry forward and set off Unabsorbed Depreciation is not hit by change in

shareholding

Verify shareholders register to ascertain any change in the shareholding.

Serial No Assessment

Year

Nature of

Loss /

Allowance

(in Rs.)

Amount as

returned (in

Rs.)

Amount as

assessed (give

reference to

relevant order)

Remarks

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-80-320.jpg)

![S G C O & Co.

Chartered Accountants

82

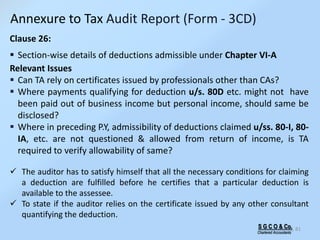

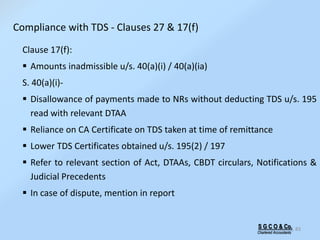

Clause 27:

Whether assessee has complied with Chapter XVII-B regarding-

– Deduction of TDS, &

– Payment thereof to Govt [Sub-Clause (a)]

Disclose following, if not complied with -

(i) Tax Deductible & not deducted at all

(ii) Shortfall on account of lesser deduction

(iii) Tax deducted late

(iv) Tax deducted but not paid to Govt before last day of P.Y or due date for

TDS deducted in March month of P.Y

Compliance with TDS - Clauses 27 & 17(f)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-82-320.jpg)

![S G C O & Co.

Chartered Accountants

84

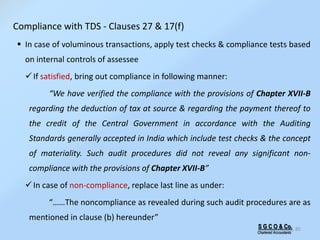

S. 40(a)(ia)-

Disallowance of following expenses without deducting TDS / Payment to

Govt. within stipulated time-

– Payments to Contractors & Sub-contractors [S. 194-C]

– Interest [S. 193 / 194A]

– Commission / Brokerage [S. 194H]

– Rent [S. 194-I]

– Royalties [S. 194J]

– Fees for Professional / Technical Services [S. 194J]

Compliance with TDS - Clauses 27 & 17(f)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-84-320.jpg)

![S G C O & Co.

Chartered Accountants

87

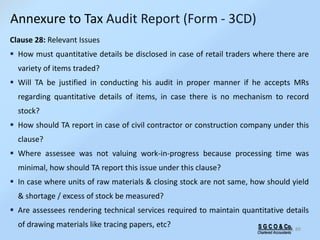

Clause 28:

In case of trading concern, quantitative details of principal goods traded-

Opening Stock

Purchases during P.Y

Sales during P.Y

Closing Stock

Short / Excess [Sub-Clause (a)]

In case of manufacturing concern, quantitative details of raw materials, finished goods &

/ or by-products-

Opening Stock

Purchases during P.Y

Consumption / Production during P.Y

Closing Stock

Short / Excess

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-87-320.jpg)

![S G C O & Co.

Chartered Accountants

88

Clause 28:

Yield of finished products *

Percentage of yield *[Sub-Clause (b)]

*Information may be given to the extent available; applies to raw

materials only

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-88-320.jpg)

![S G C O & Co.

Chartered Accountants

90

Clause 29:

In case of domestic company , details of tax on distributed profits

u/s. 115-O in following form-

Total amount of distributed profits [Sub-Clause (a)]

Total tax paid thereon [Sub-Clause (b)]

Dates of payment with amounts [Sub-Clause (c)]

Relevant Issues

Where tax audit is completed after dividend is declared but before

dividend distribution tax is paid, will it be sufficient compliance to

report on dividend declared in preceding P.Y but paid in current

P.Y?

Annexure to Tax Audit Report (Form - 3CD)](https://image.slidesharecdn.com/taxauditpresentation-ay2013-14-130921083356-phpapp01/85/Tax-audit-presentation-AY-2013-14-90-320.jpg)