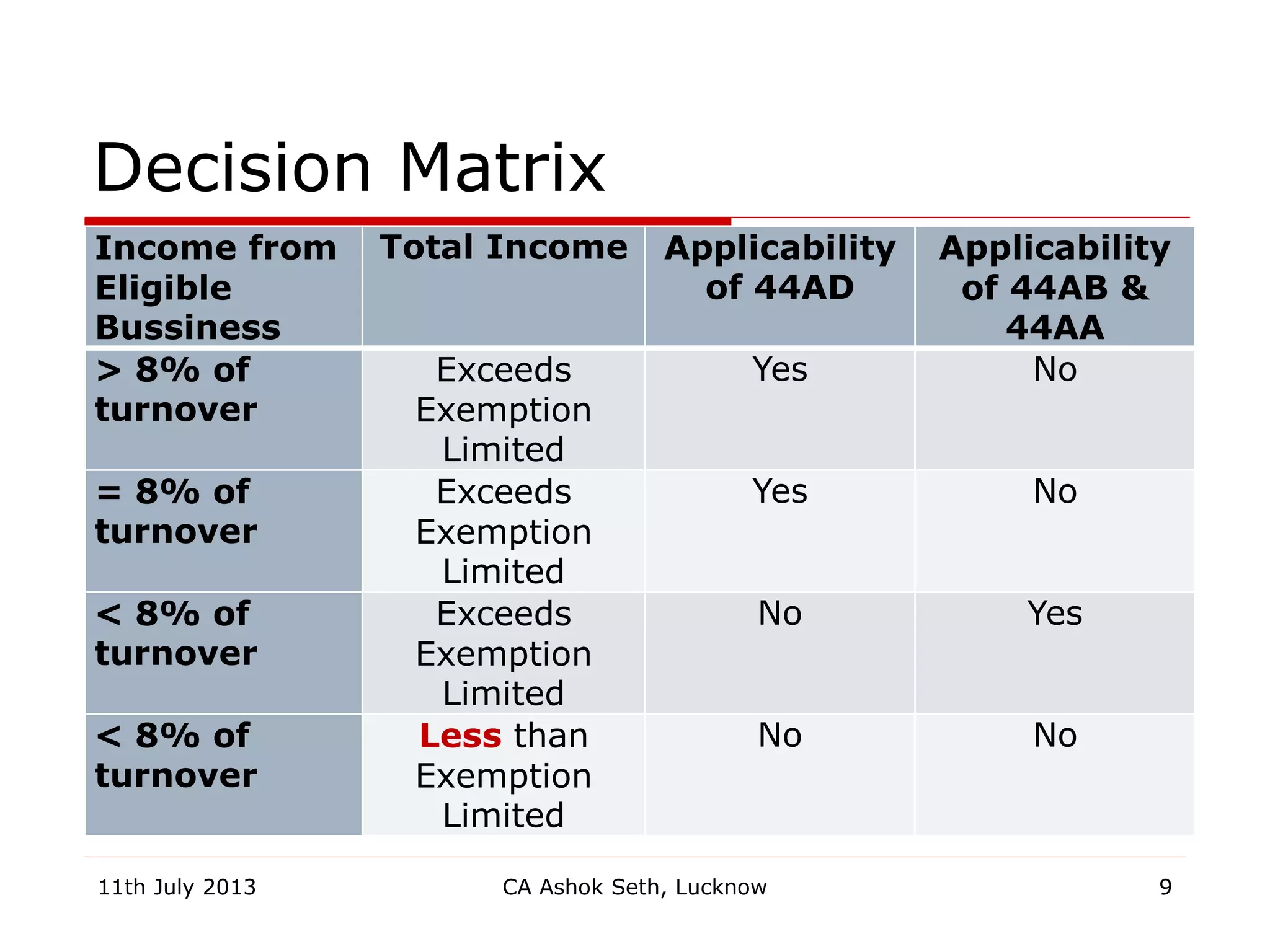

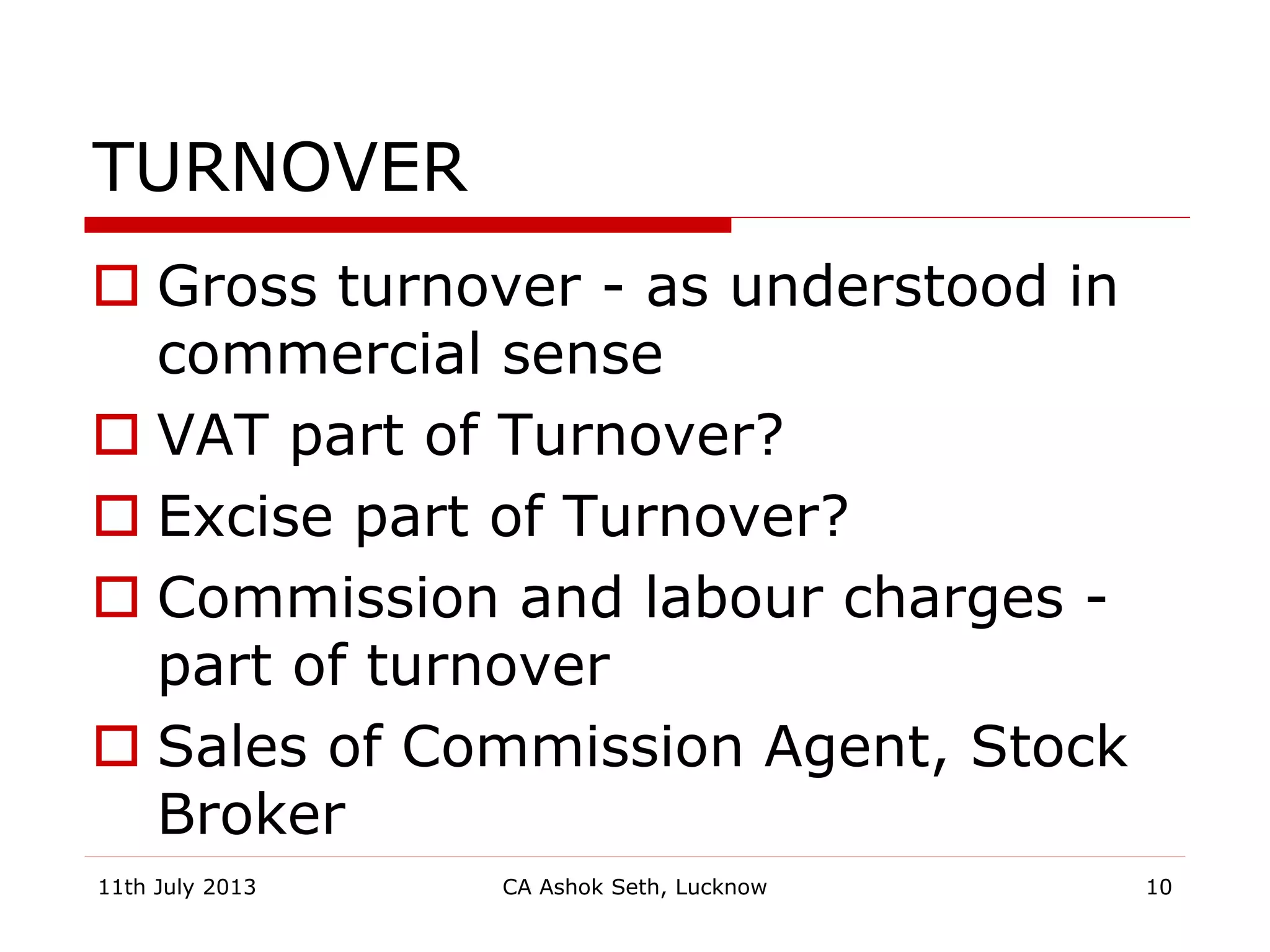

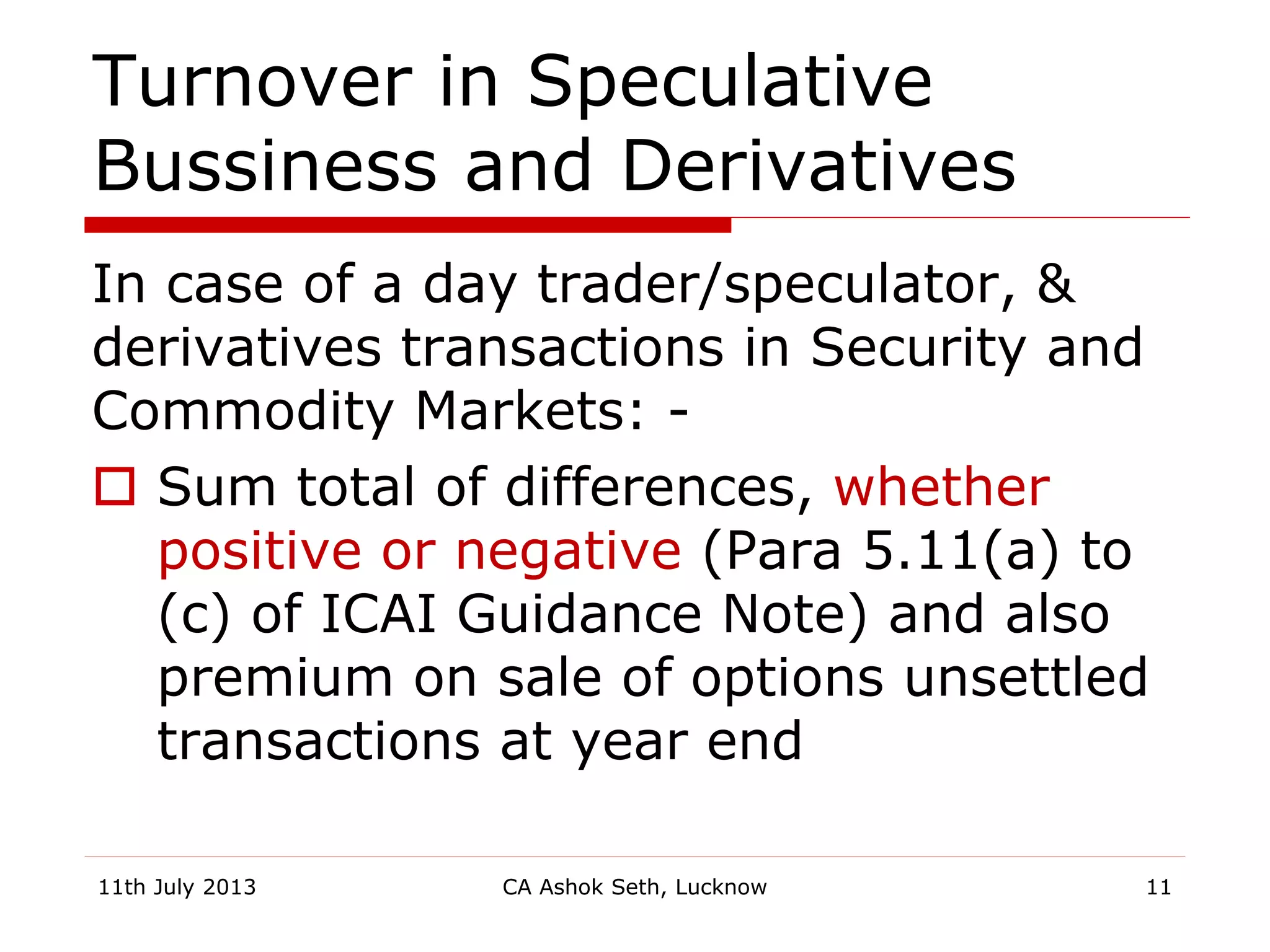

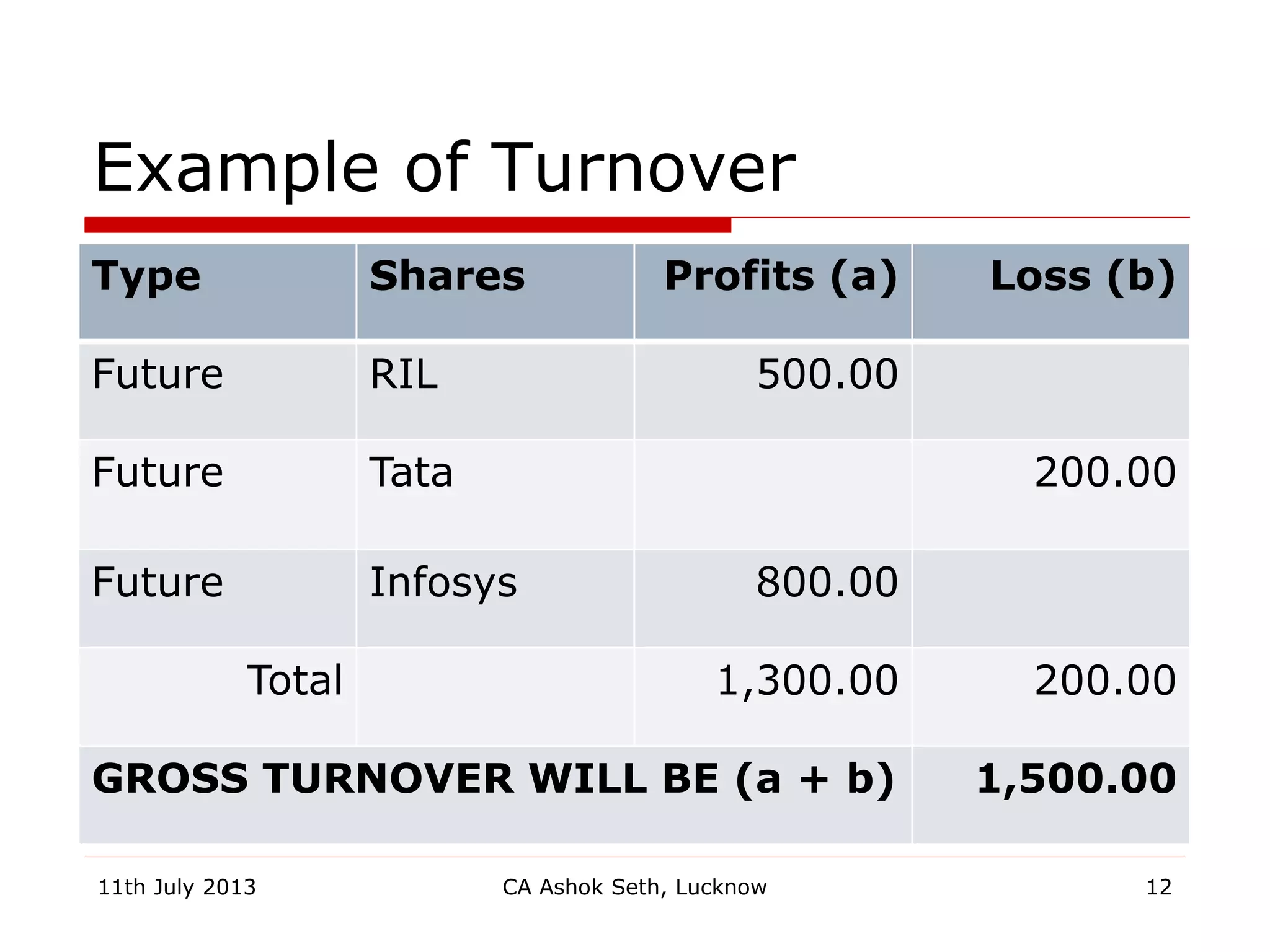

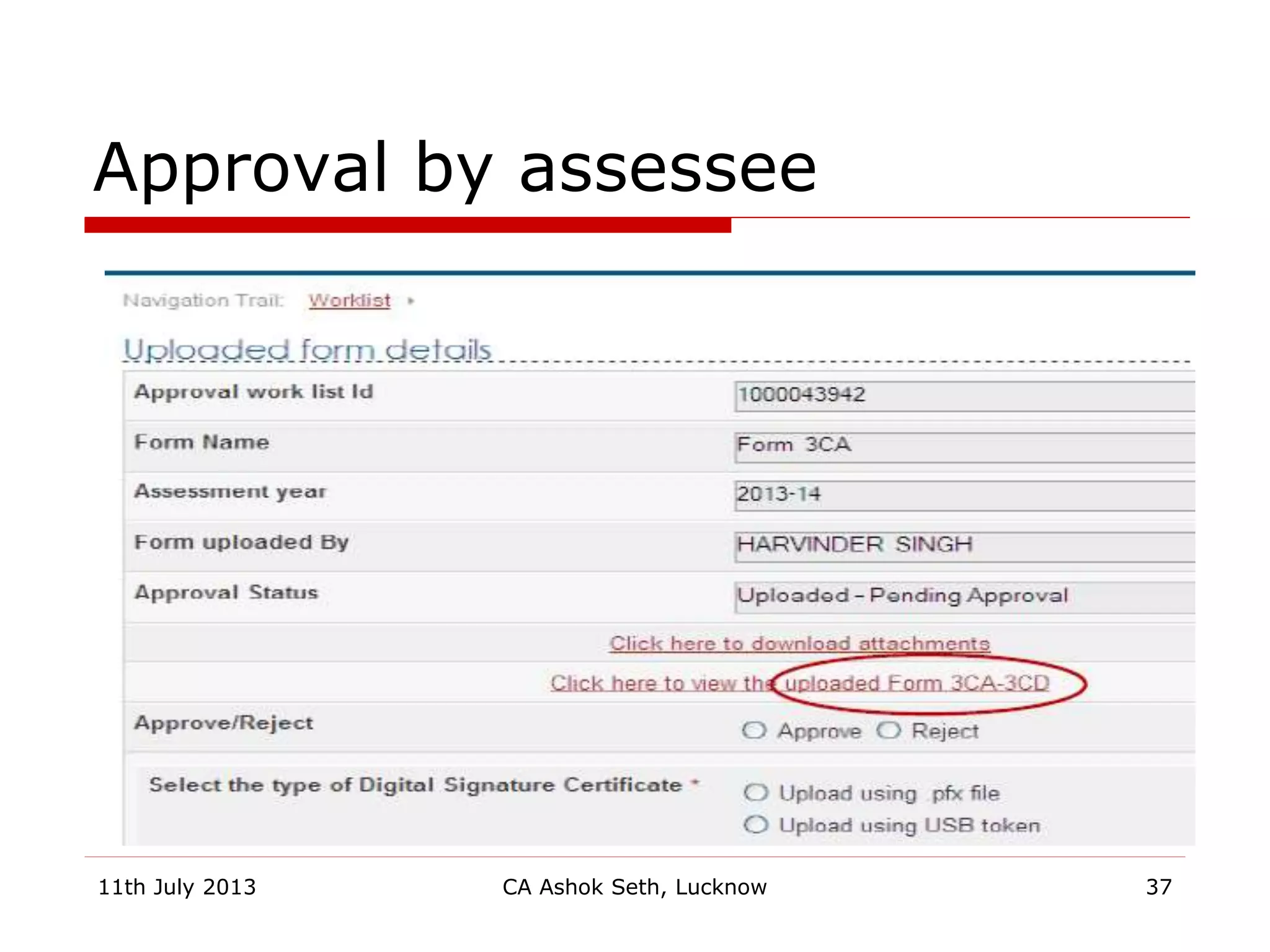

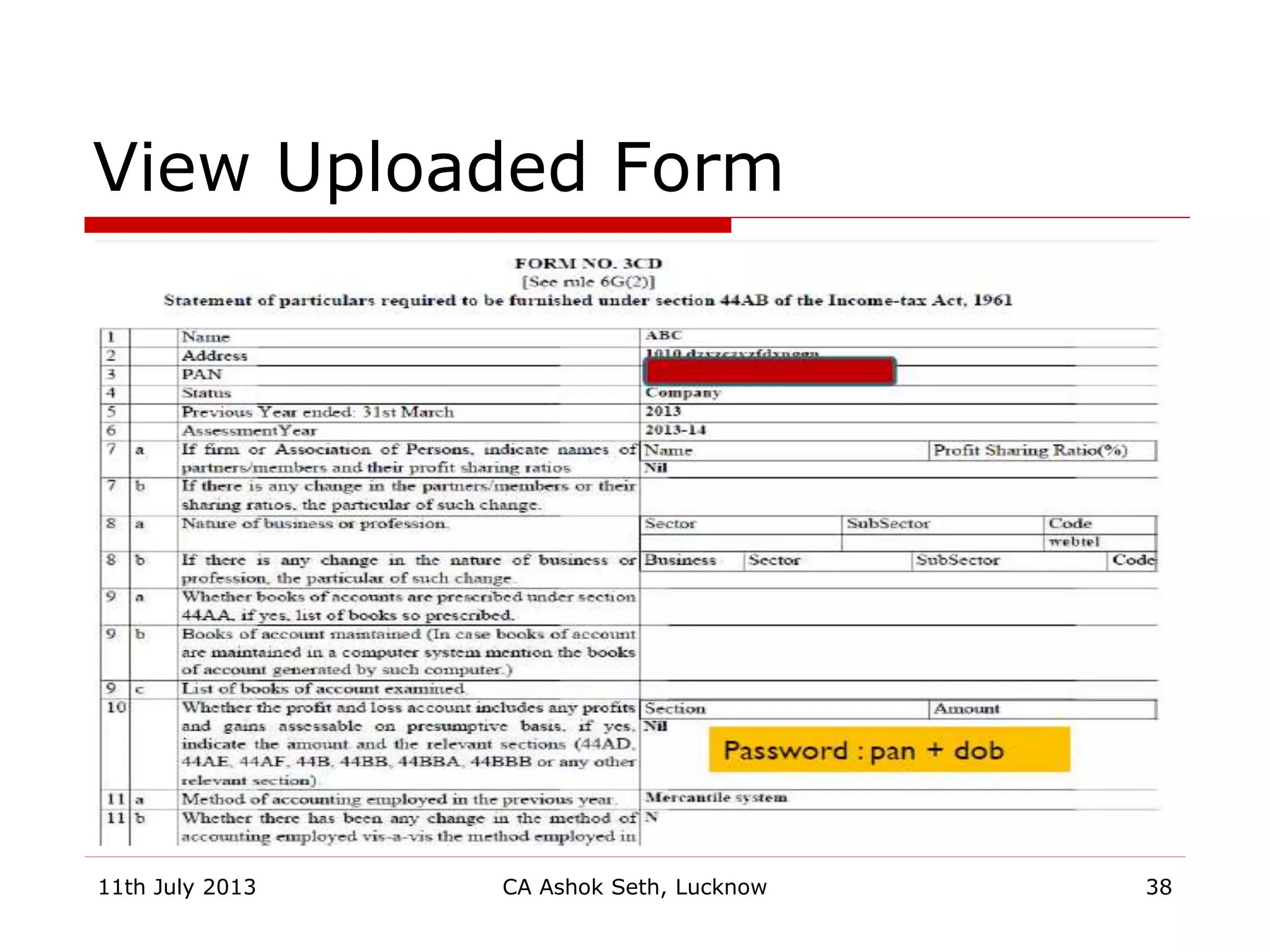

This document discusses changes and issues related to tax audits in India. It summarizes key sections of the Indian Income Tax Act related to tax audits for small businesses and individuals. Section 44AD allows eligible small businesses and individuals to pay tax at 8% of gross receipts if turnover is less than Rs. 1 crore. Section 44AB mandates tax audits if total income exceeds a threshold. The document provides guidance on determining taxable turnover for different business types and compliance requirements for tax audit reports.