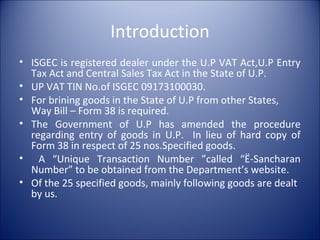

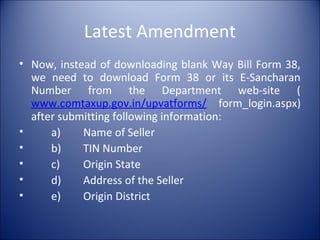

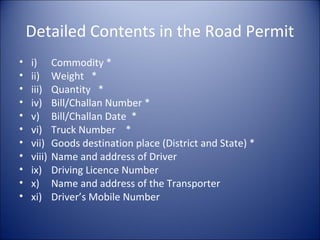

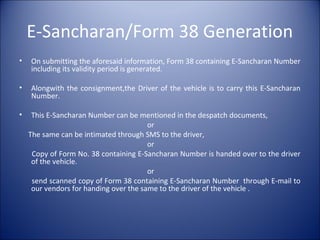

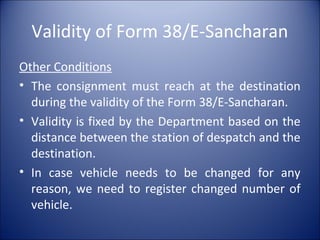

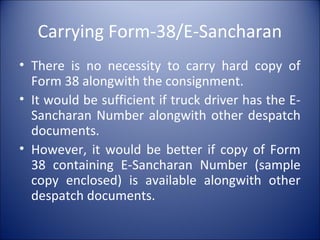

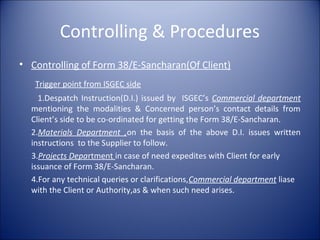

This document provides guidance on obtaining and using road permits, called e-Sancharan numbers, for transporting goods within the state of Uttar Pradesh, India. It outlines the process for vendors to generate e-Sancharan numbers online using commodity information, then issues them to drivers for valid transportation of goods during the permit period. It also discusses procedures for ISGEC to coordinate with clients to obtain permits for billable and non-billable items, and how to request permits directly from taxation authorities if clients deny issuing them. Any questions about the process should be submitted in writing by July 20th.