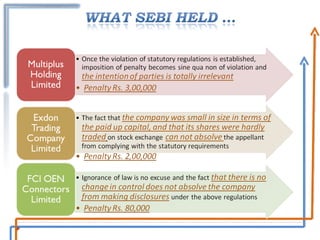

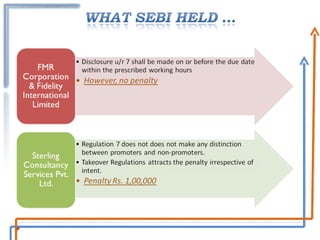

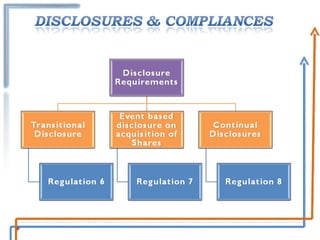

1. The document discusses various regulations under the SEBI Takeover Code regarding disclosure requirements and compliance obligations when acquiring shares or voting rights in an Indian listed company beyond certain thresholds.

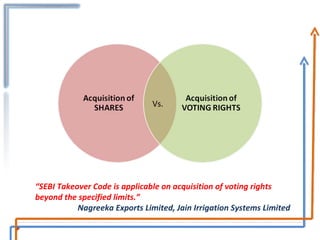

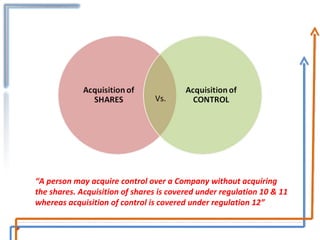

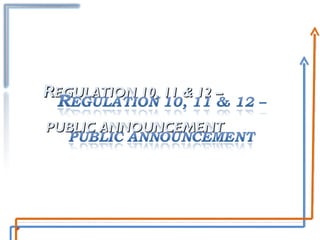

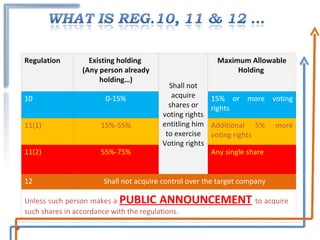

2. It compares key terms and explains regulations around continual disclosures, event-based disclosures, and the requirement to make a public announcement when acquiring shares or voting rights beyond certain levels.

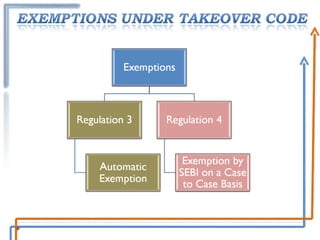

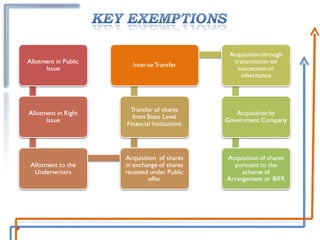

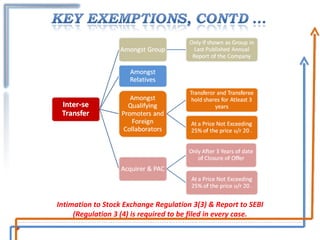

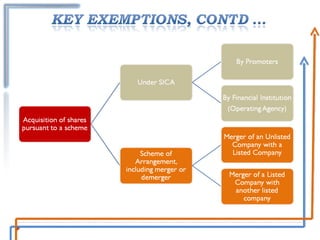

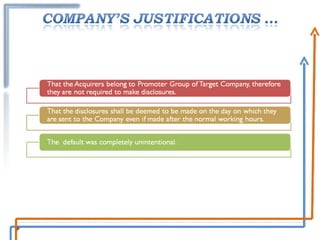

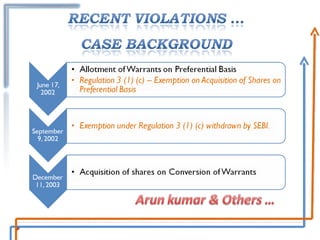

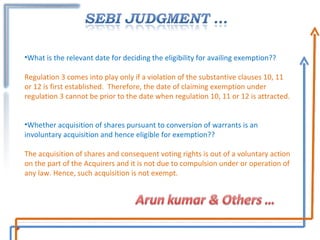

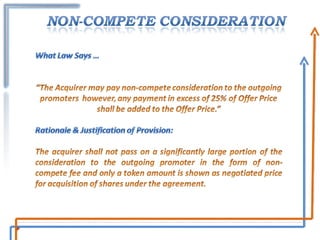

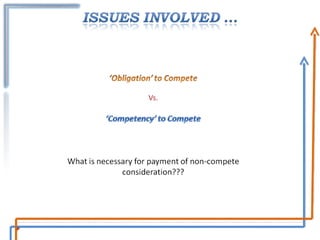

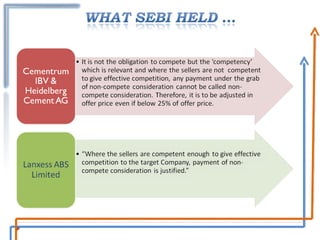

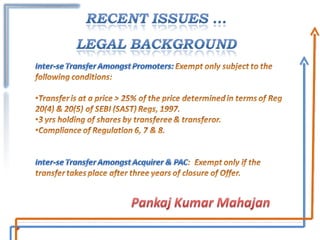

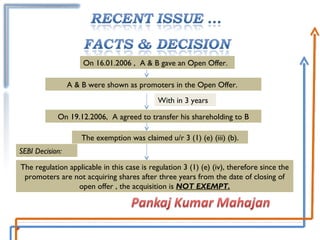

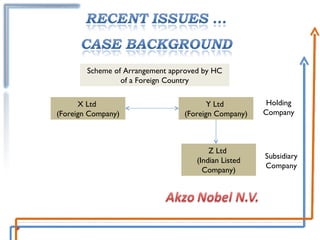

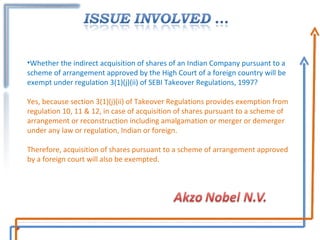

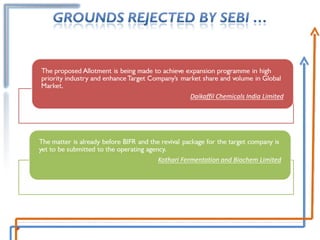

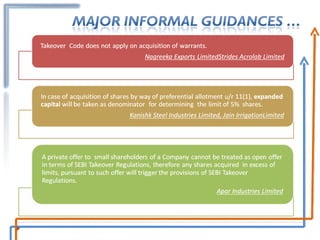

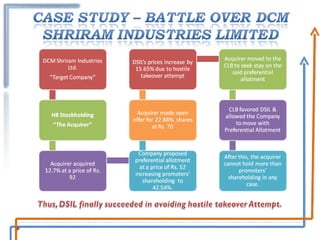

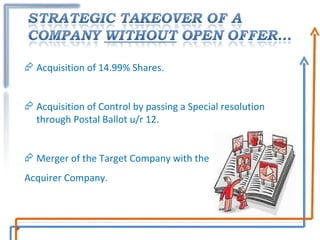

3. It addresses issues around claiming exemptions under the Takeover Code regulations, applicability of regulations to indirect acquisitions such as those through a scheme of arrangement, and factors to consider for investment decisions that may invoke the Takeover Code.

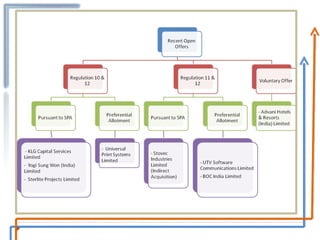

![Acquisition of more than 5%, 10%, 14%, 54% & 74% [ Regulation 7] Persons, who are holding between 15% - 55%, acquisition/ sale aggregating more than 2 % or more voting rights [Regulation 7(1A)] Person holding more than 5% shares [Regulation 6]](https://image.slidesharecdn.com/sastrecentapplicationinterpretation140308-120222055624-phpapp01/85/SEBI-Takeover-Code-5-320.jpg)

![Acquisition more than 15% or more voting rights [ Regulation 10] Persons, who are holding between 15% - 55%, acquisition more than 5% or more voting rights in a financial year.[Regulation 11(1)] Persons, who are holding more than 55% , acquisition of single share or voting right [Regulation 11(2)]](https://image.slidesharecdn.com/sastrecentapplicationinterpretation140308-120222055624-phpapp01/85/SEBI-Takeover-Code-6-320.jpg)