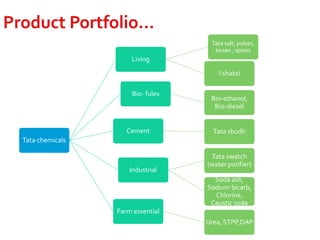

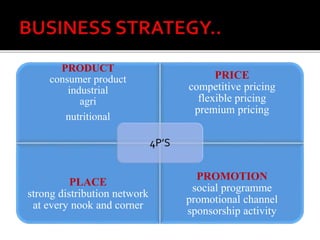

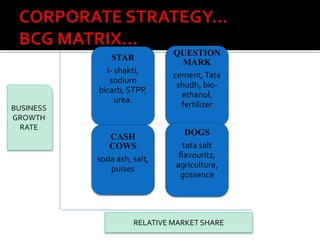

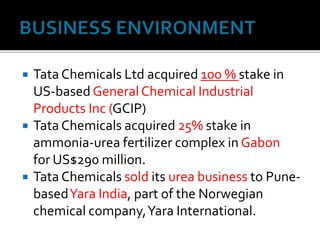

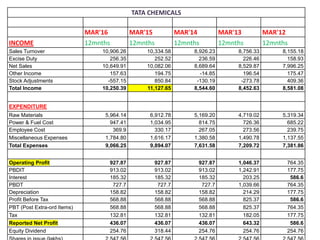

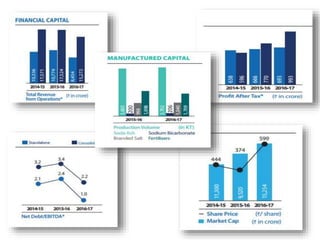

Tata Chemicals has increased R&D spending and expanded its market reach, focusing on products like Tata Salt, biofuels, and fertilizers, while leveraging competitive pricing and strong distribution networks. The company's income and profitability have shown growth in recent years, and it has strategically acquired stakes in global ventures while divesting from less profitable segments. Looking ahead, Tata Chemicals aims to boost its agri and consumer businesses significantly within four years, supported by advancements in technology and operational efficiencies.