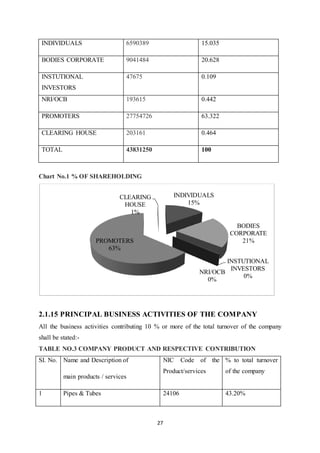

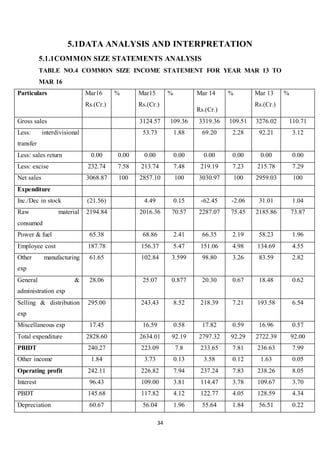

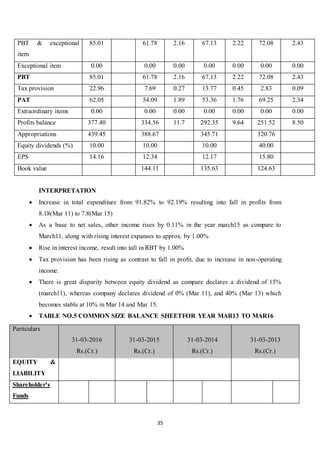

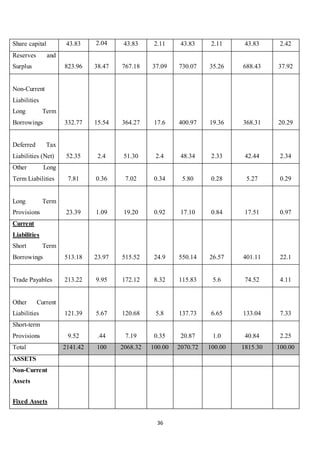

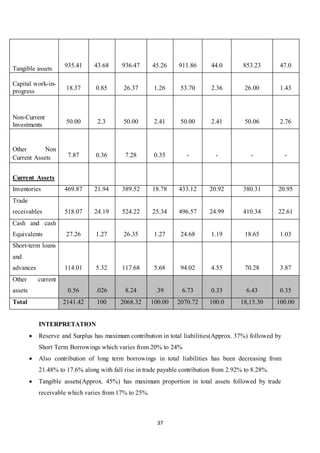

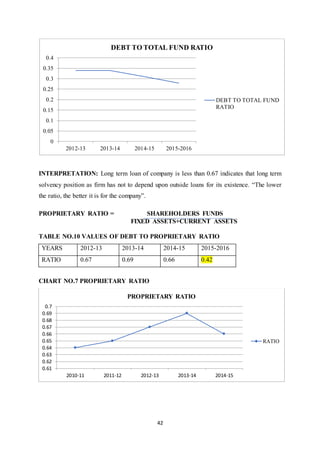

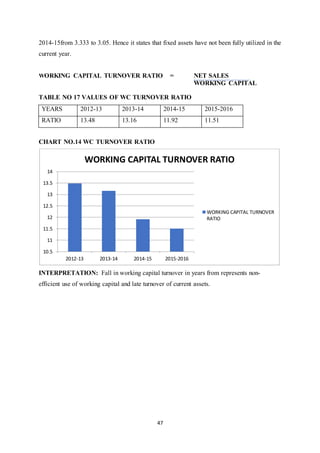

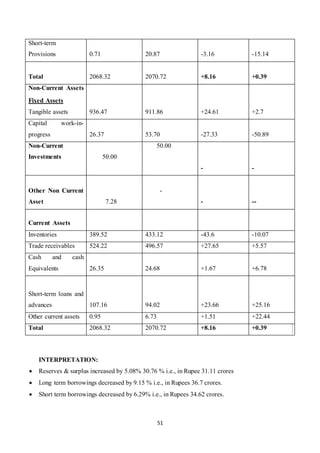

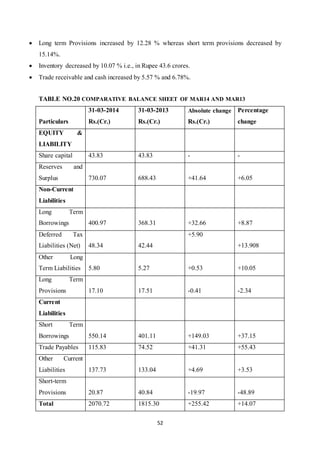

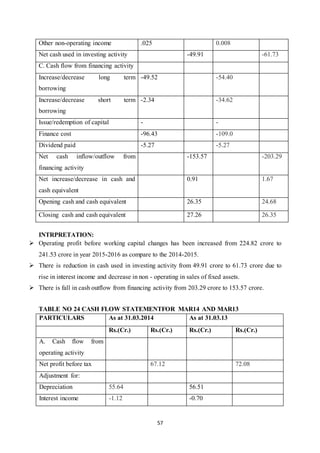

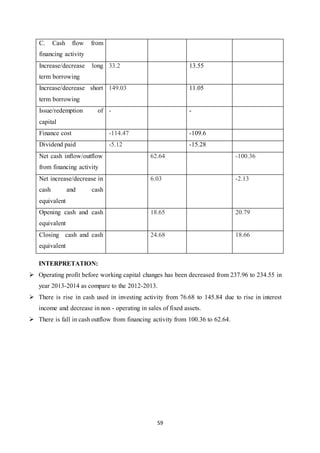

This document provides an overview of a summer training project report on the financial performance analysis of Surya Roshni Limited conducted over 45 days. It includes an acknowledgement, declaration, abstract, table of contents, and lists of tables and charts. The report analyzes the company's financial statements from 2013-2016 using various techniques like common size statements, ratio analysis, comparative statements, and cash flow analysis to evaluate the company's financial performance and position over time.