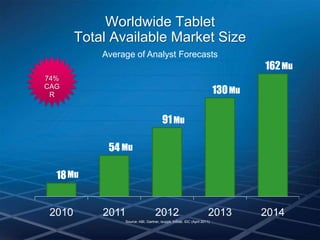

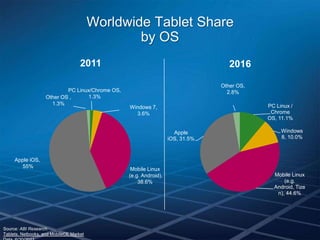

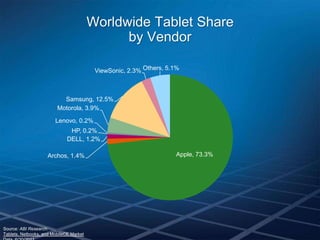

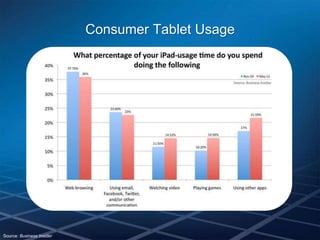

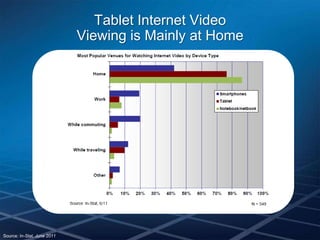

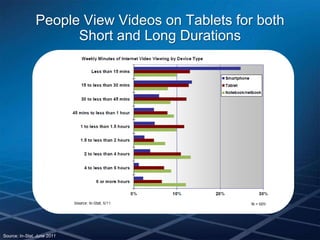

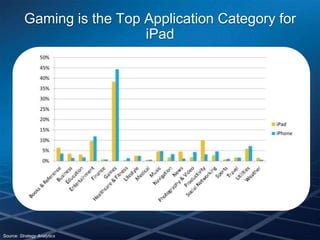

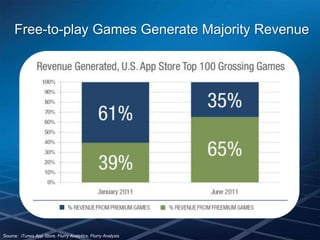

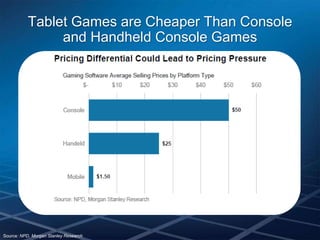

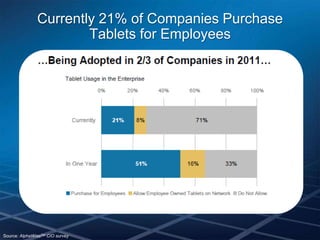

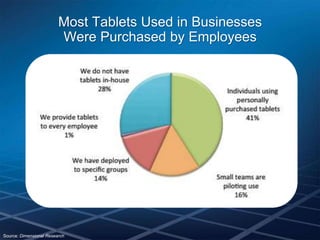

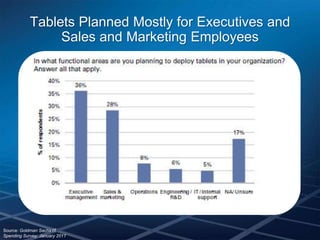

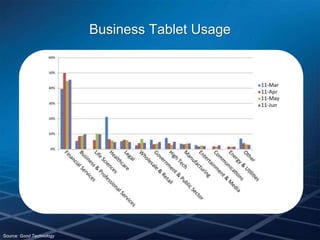

This document summarizes the tablet market from 2010 to 2016. It finds that the tablet market is growing rapidly, with worldwide shipments expected to increase from 18 million in 2010 to over 130 million in 2012. The market is dominated by Apple's iOS, though Android is gaining share. Tablet usage is mainly for media consumption like video and games at home. The business tablet market is also growing as companies provide tablets to employees. The document outlines several technology and market opportunities for tablets in various industries.