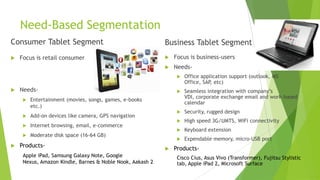

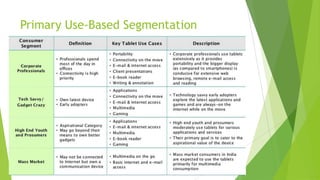

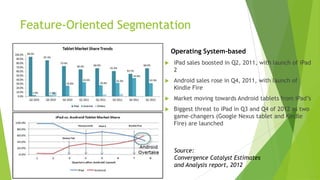

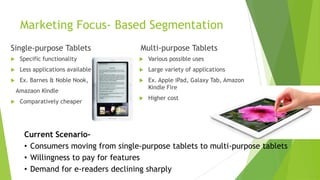

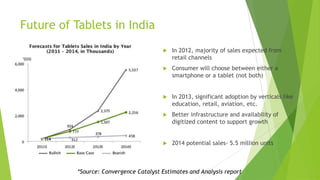

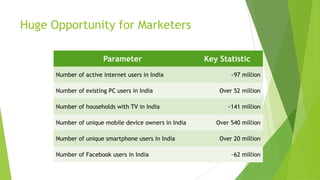

The document summarizes India's tablet market segmentation. It discusses the significant growth in tablet sales over the last year. It then covers the history and major players in the tablet market. Various segmentation strategies for tablets are presented, including demographic segmentation based on consumer vs business users, need-based segmentation, operating system-based segmentation, and feature-oriented segmentation. Price-based segmentation and geographic segmentation are also summarized. Current market share data for major brands in India is provided. The conclusion discusses the huge opportunity for marketers in India given the large number of potential customers as internet and technology adoption increases.