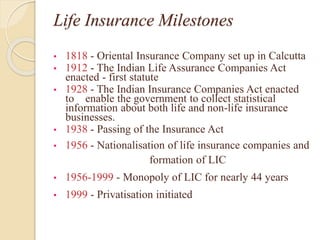

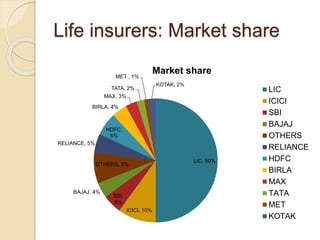

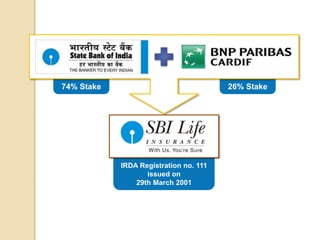

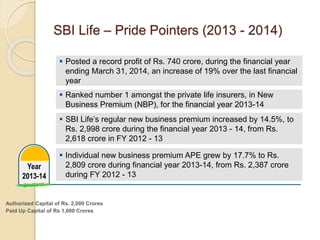

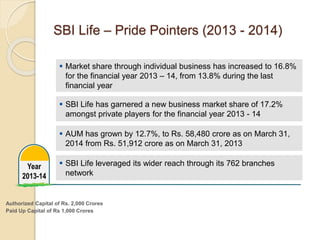

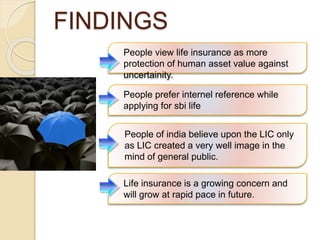

This document discusses recruitment and selection at SBI Life insurance. It provides background on the life insurance industry and SBI Life's vision, values, and achievements in 2013-2014. Recruitment involves locating and attracting individuals for job vacancies, while selection eliminates candidates who do not have the required skills. The findings note that Indians prefer LIC and internal references when applying to SBI Life. The conclusion states that insurance faces high attrition, making recruitment critical, and innovations are needed for organizations to sustain in competition.