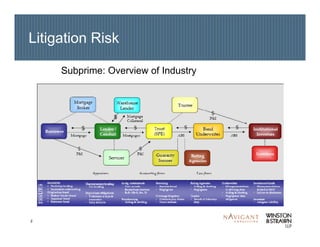

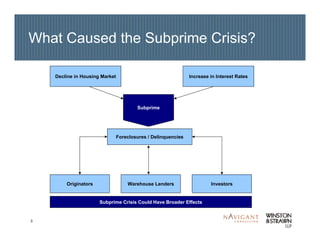

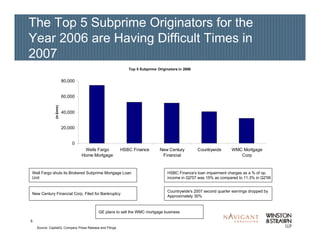

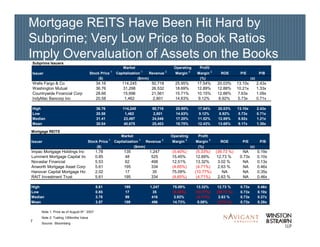

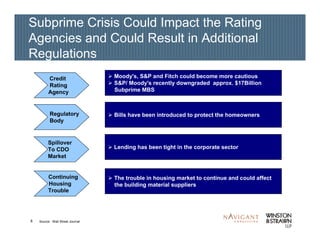

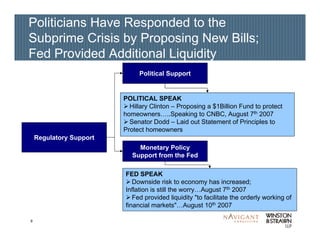

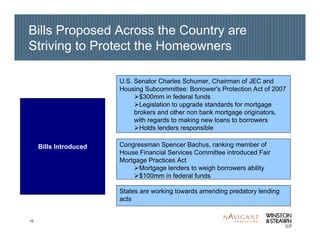

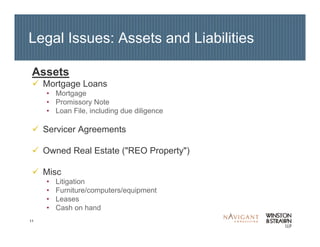

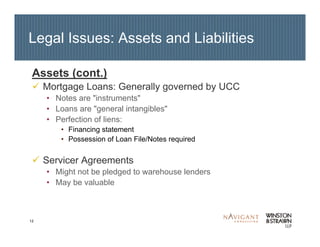

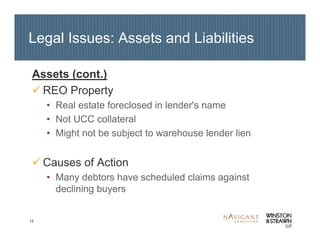

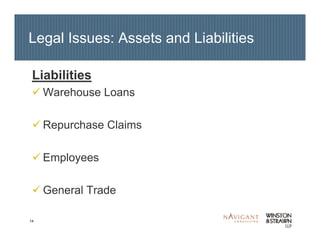

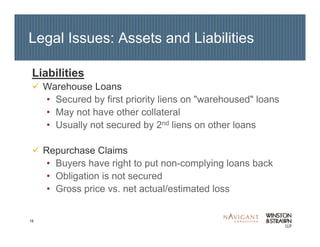

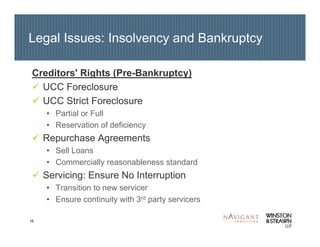

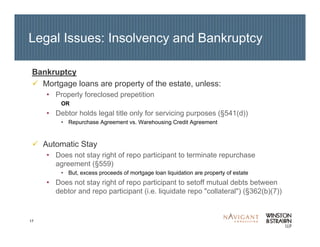

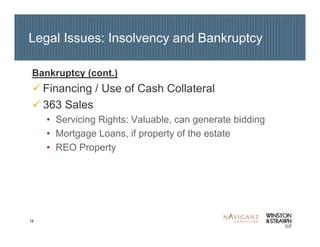

The document discusses the subprime mortgage crisis and its effects. It summarizes that the crisis was caused by rising foreclosures and delinquencies due to declining housing prices and rising interest rates. This impacted subprime originators, warehouse lenders, investors, and mortgage insurers. Proposed responses from politicians and regulators include new bills to protect homeowners and monetary policy support from the Federal Reserve. Legal issues for distressed subprime lenders could include determining asset and liability values and priorities in bankruptcy.