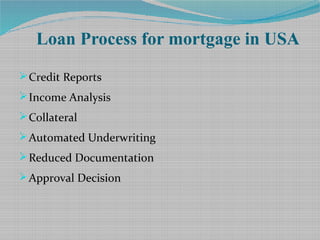

This document presents a comparative study of the mortgage markets in the USA and Bangladesh. It provides information on the characteristics of mortgages in each country, the top mortgage lenders, the loan processes, and types of mortgages. The document contains sections on mortgage characteristics, top lenders, the loan process, and types of mortgages for both the USA and Bangladesh.