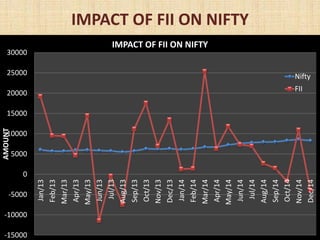

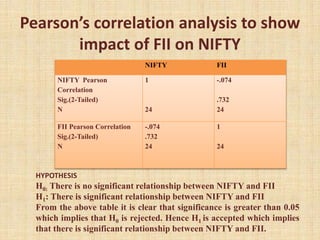

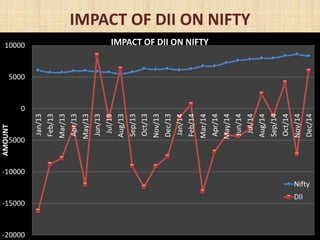

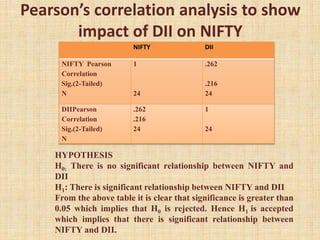

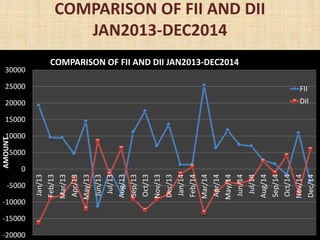

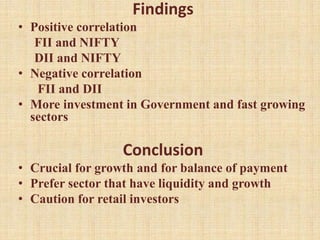

This document summarizes a study on the relationship between foreign institutional investors (FIIs), domestic institutional investors (DIIs) and the NIFTY index in India from January 2013 to December 2014. The key findings are:

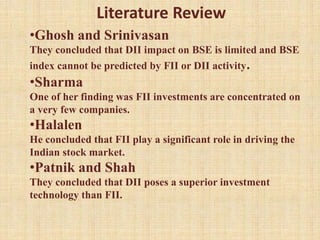

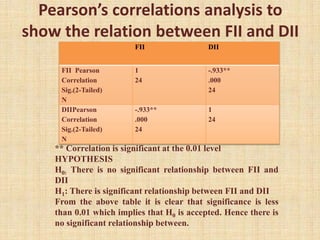

1) There is a significant positive correlation between FIIs/DIIs and the NIFTY index, but a negative correlation between FIIs and DIIs.

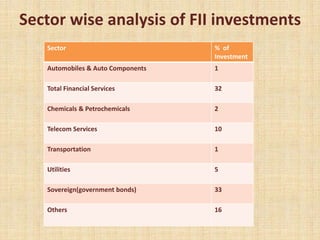

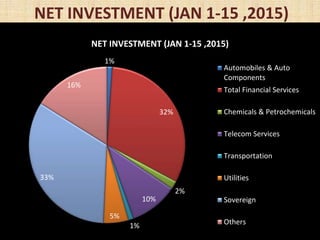

2) FIIs primarily invest in the total financial services sector (32%) and government bonds (33%), while DII investments are more spread out across different sectors.

3) FIIs and DIIs play an important role in driving the Indian stock market, but their activities sometimes have opposing impacts.