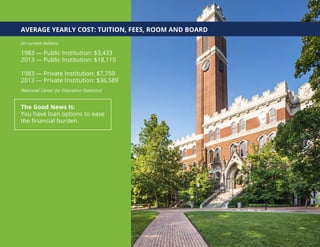

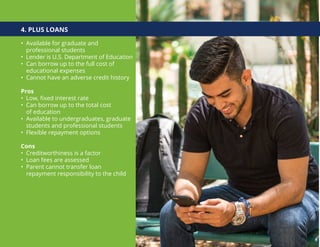

The document discusses the rising costs of higher education and the various student loan options available to help finance a degree. It outlines 6 major types of loans: Direct Subsidized and Unsubsidized Loans from the federal government, Perkins Loans, PLUS Loans for parents and graduate students, state-specific loans, and private student loans. The loans differ in their eligibility requirements, interest rates, and borrowing limits. The document stresses starting the financial planning and aid application process as early as possible to secure the necessary funding.