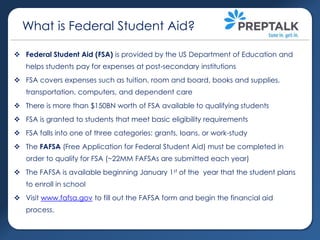

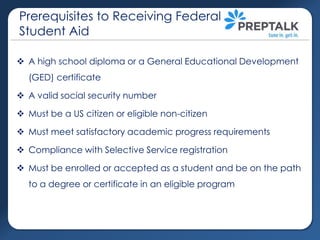

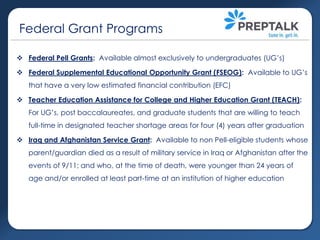

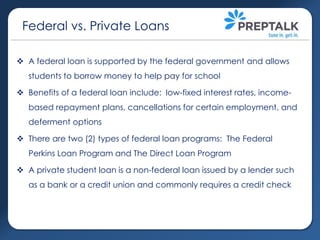

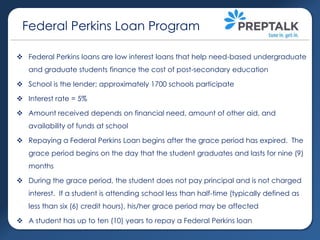

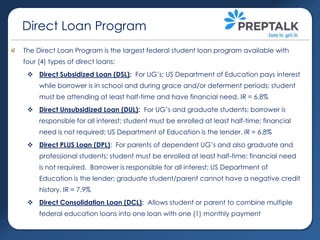

This document provides an overview of federal student aid available to students in the United States. It discusses the different types of federal student aid including grants, loans, and work-study. It outlines eligibility requirements and explains the FAFSA application process. It also describes various federal student loan programs like Direct Loans, Perkins Loans, and PLUS Loans. The document provides details on interest rates, loan limits, grace periods and repayment terms for each loan type.