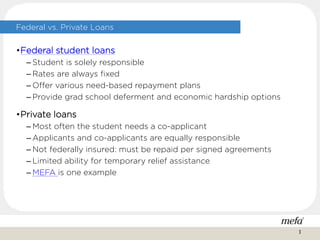

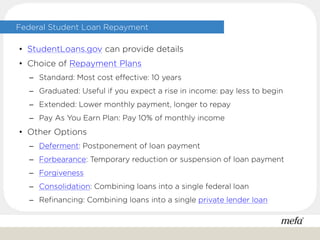

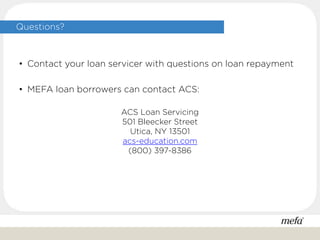

The document provides guidance on loan repayment, emphasizing the differences between federal and private loans, and the importance of understanding your loans through your lender and college financial aid office. It details various repayment options for federal loans, consequences of missed payments on credit, and how to maintain good credit. It also includes practical tips for loan payment methods and resources for borrowers facing repayment challenges.