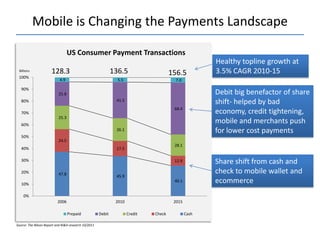

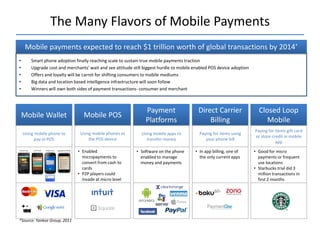

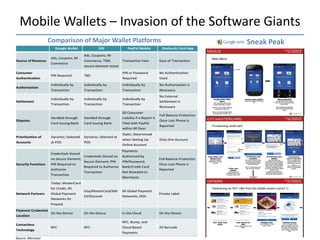

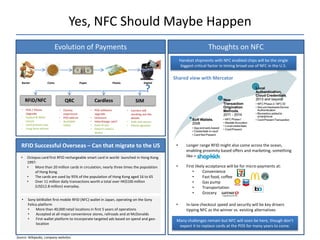

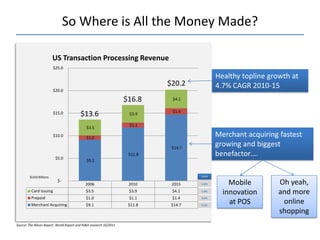

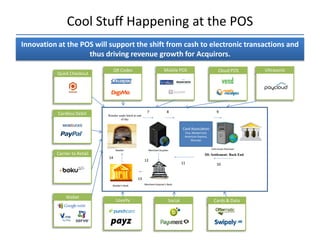

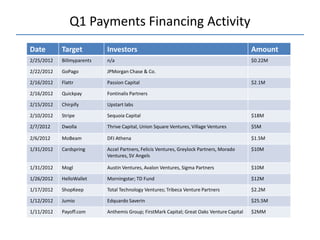

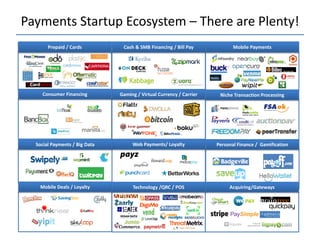

The document discusses trends in online and mobile payments. It notes that mobile payments are expected to reach $1 trillion by 2014 as smartphone adoption increases. There are many types of mobile payment methods, including mobile wallets, mobile point-of-sale, payment platforms, carrier billing, and closed-loop systems. NFC technology enables fast and secure card-present payments directly from phones but requires upgrades to handsets and point-of-sale terminals to see broad use. Overall mobile payments are growing rapidly but challenges remain around technology adoption and business models.