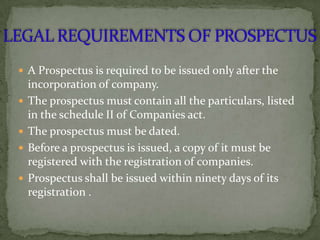

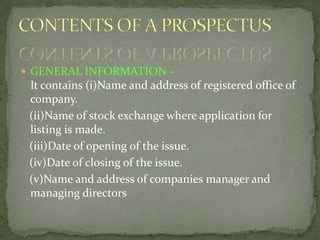

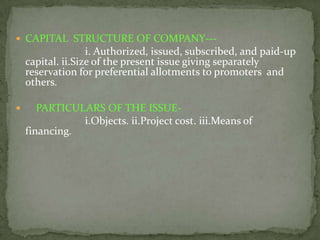

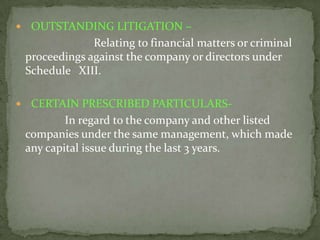

A company prospectus provides information to the public and investors about securities being offered, including details on the company's capital structure, financial performance, and risks. It must be registered and contain specific required information. A company must also file a statement in lieu of a prospectus before allotting shares if it has not issued a full prospectus.