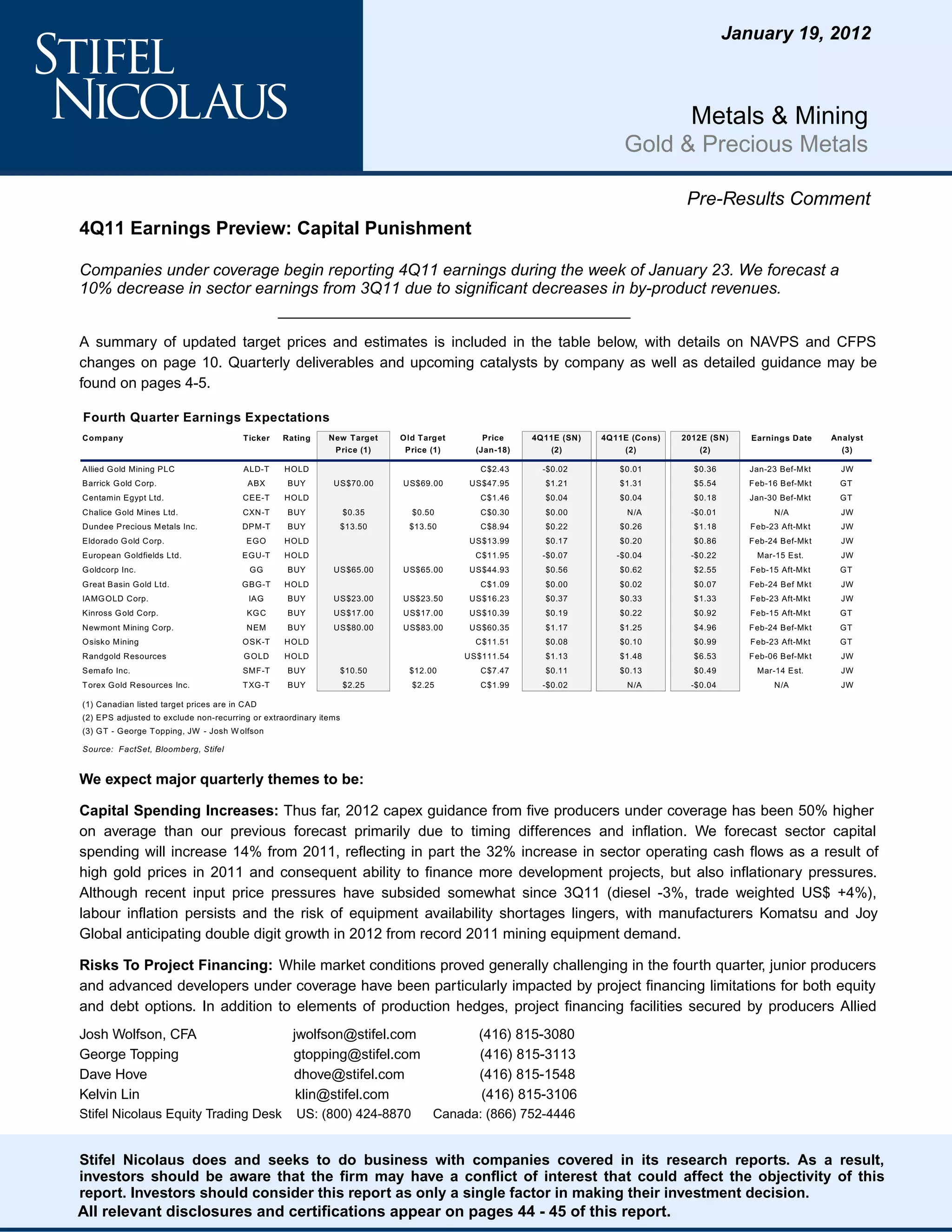

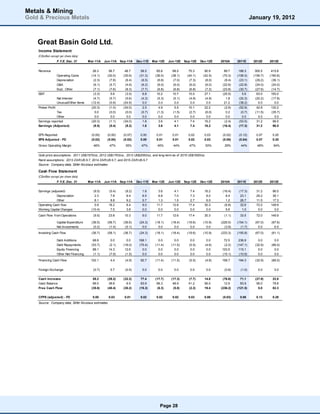

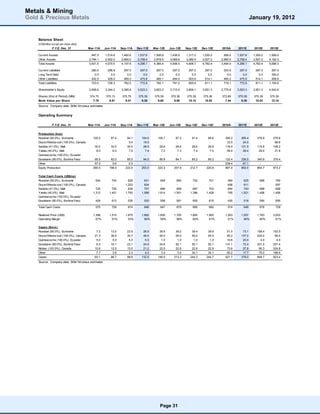

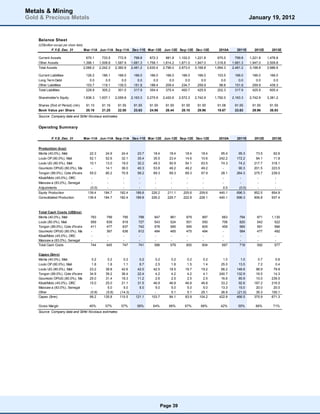

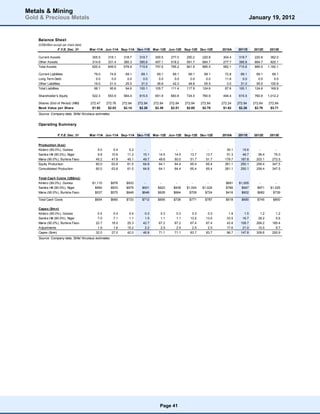

The document provides an earnings preview for gold and precious metals companies reporting 4th quarter 2011 earnings during the week of January 23rd. It is forecasted that sector earnings will decrease 10% from 3Q11 due to decreases in by-product revenues. A table provides target prices, estimates, and earnings dates for covered companies. Key quarterly themes discussed are expected increases in capital spending, risks to project financing, potential for industry consolidation, and rising operating costs.