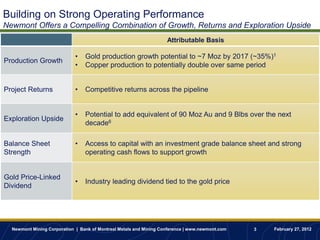

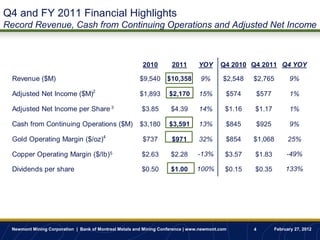

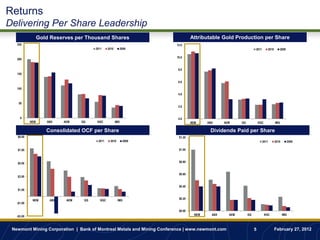

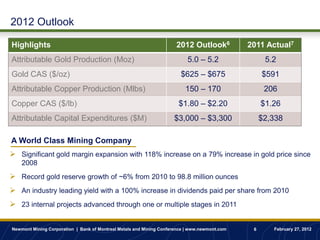

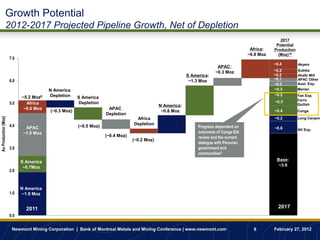

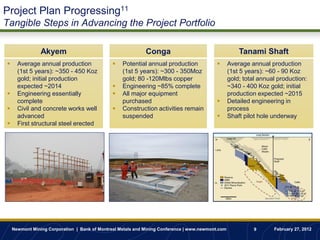

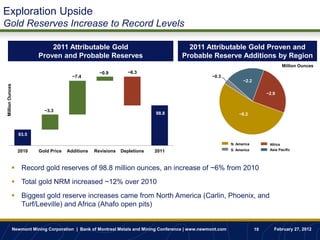

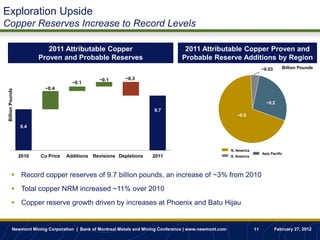

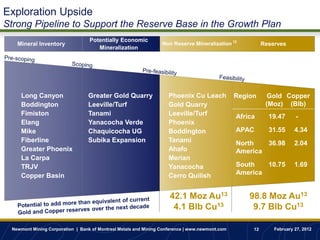

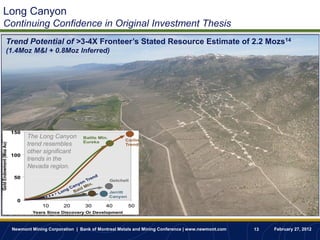

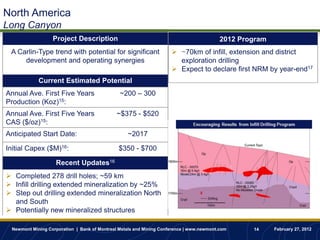

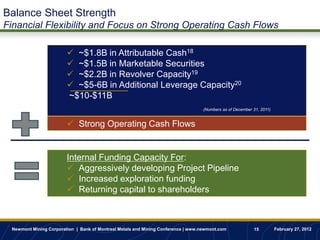

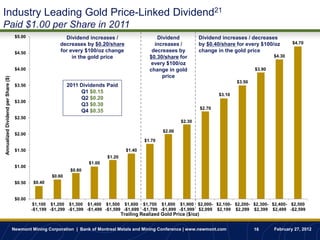

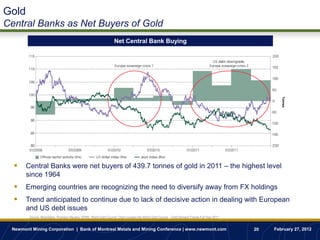

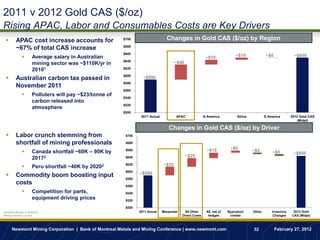

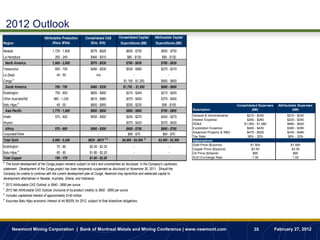

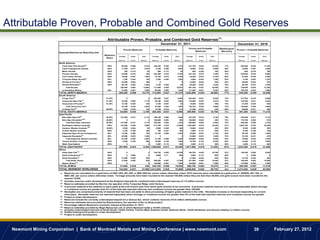

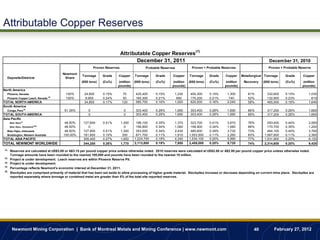

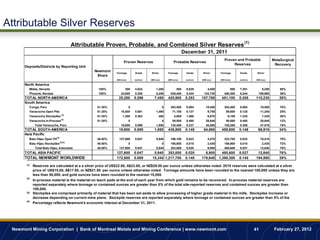

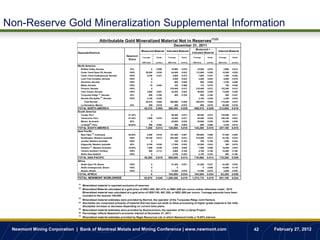

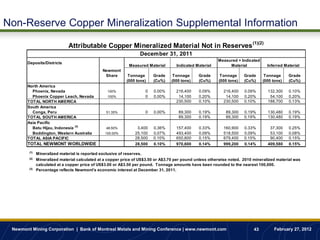

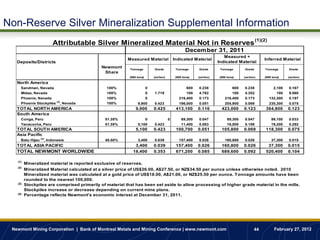

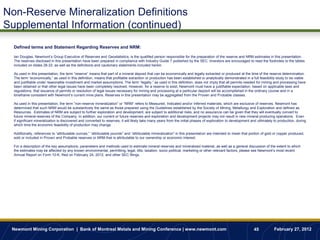

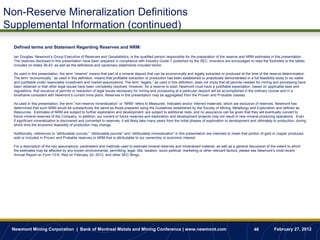

This document provides Richard O'Brien's presentation at the Bank of Montreal Metals and Mining Conference on February 27, 2012. The presentation highlights Newmont Mining Corporation's growth potential through 2017, competitive project returns, and exploration upside. It discusses Newmont's record 2011 financial results, leadership in key metrics like reserves and production per share, and outlook for 2012 of attributing gold production of 5.0-5.2 million ounces and copper production of 150-170 million pounds.