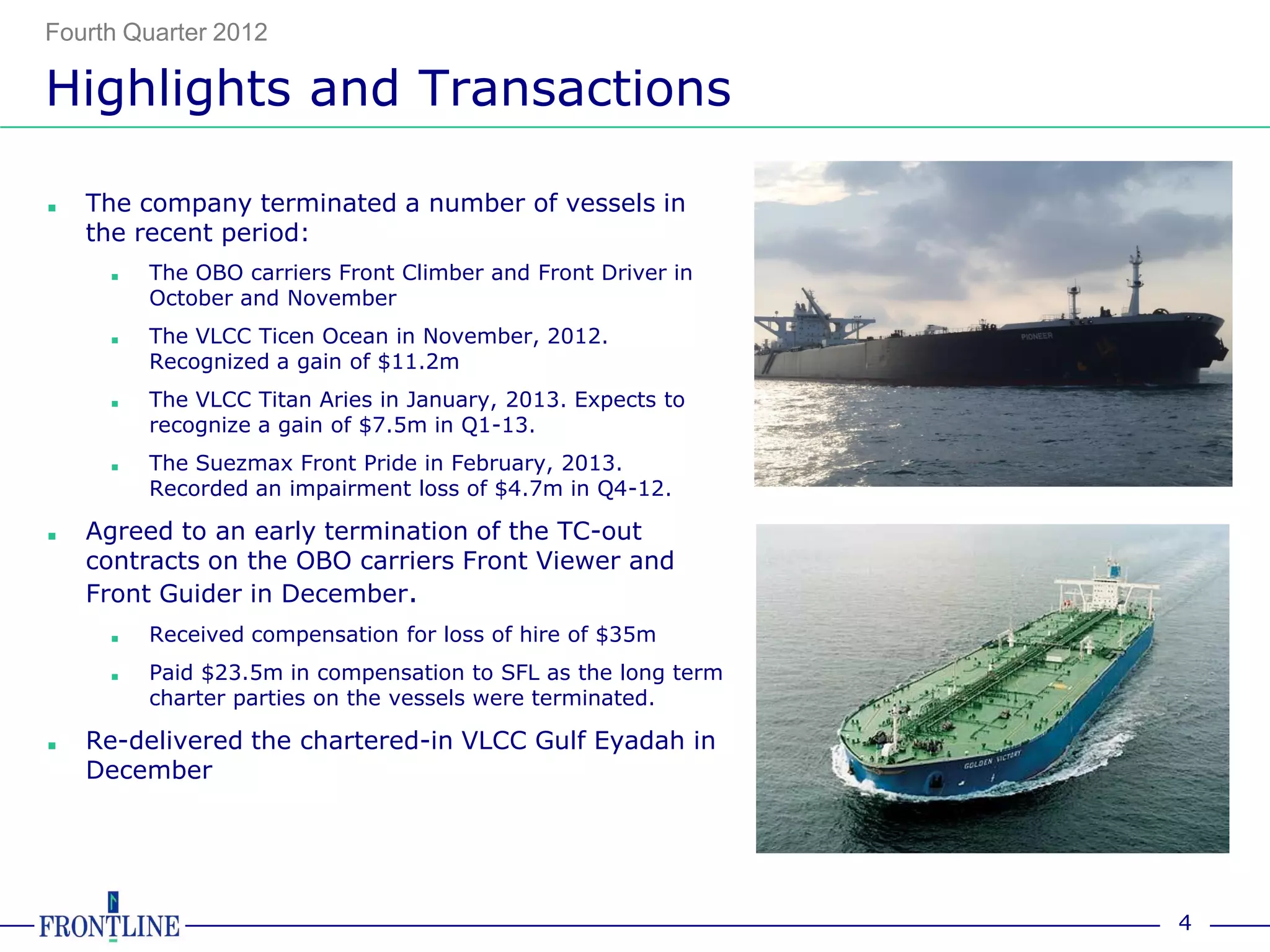

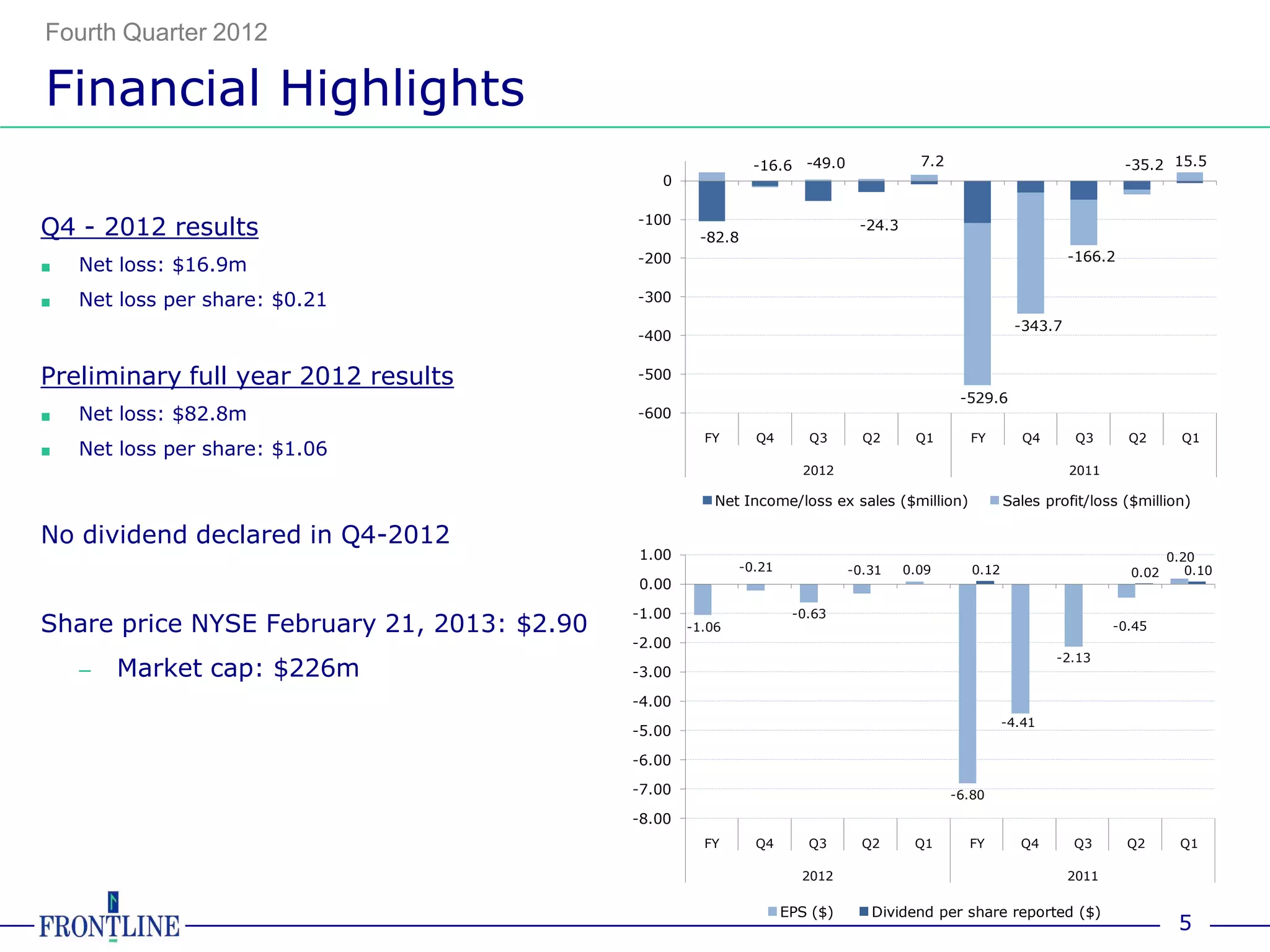

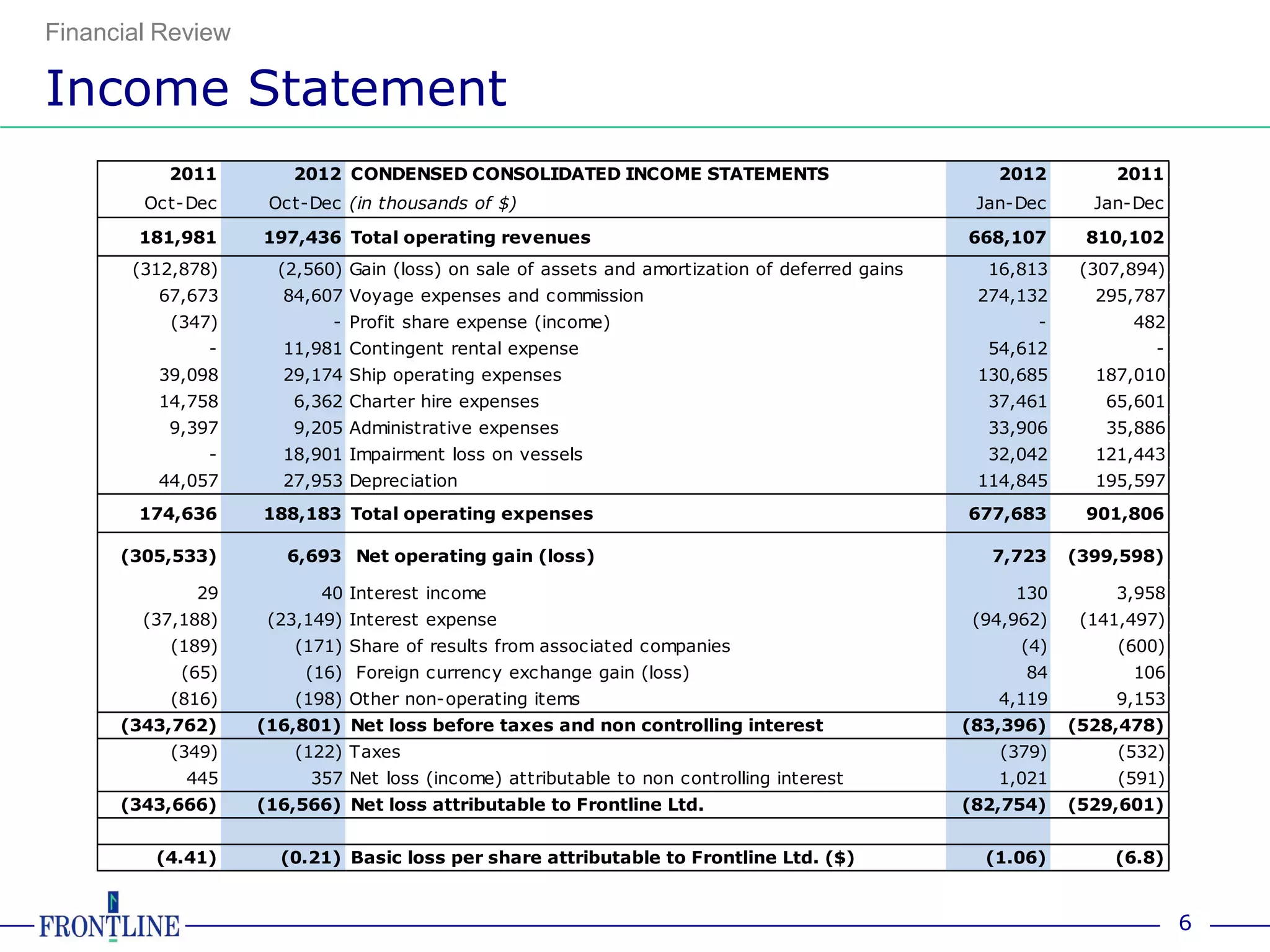

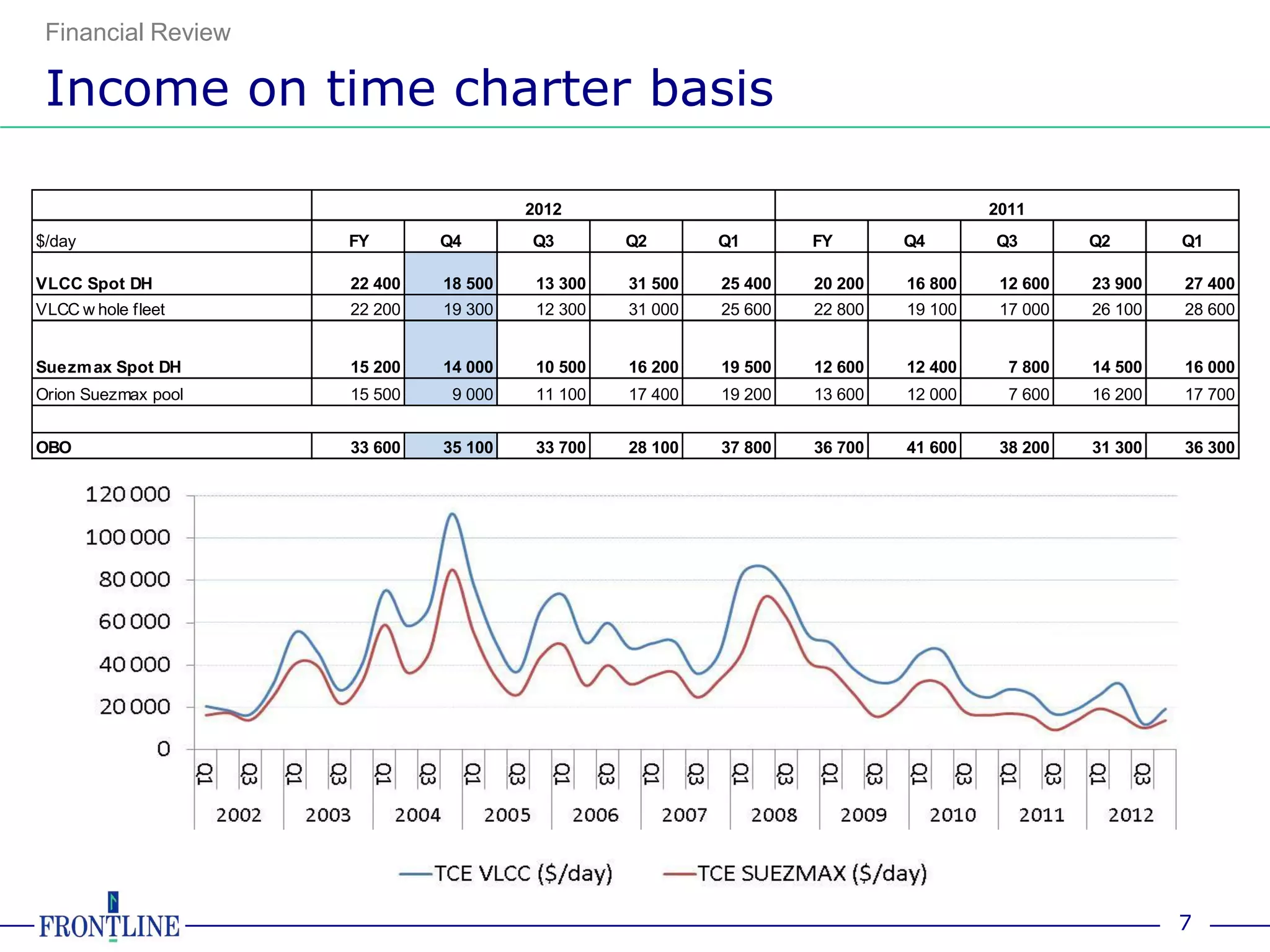

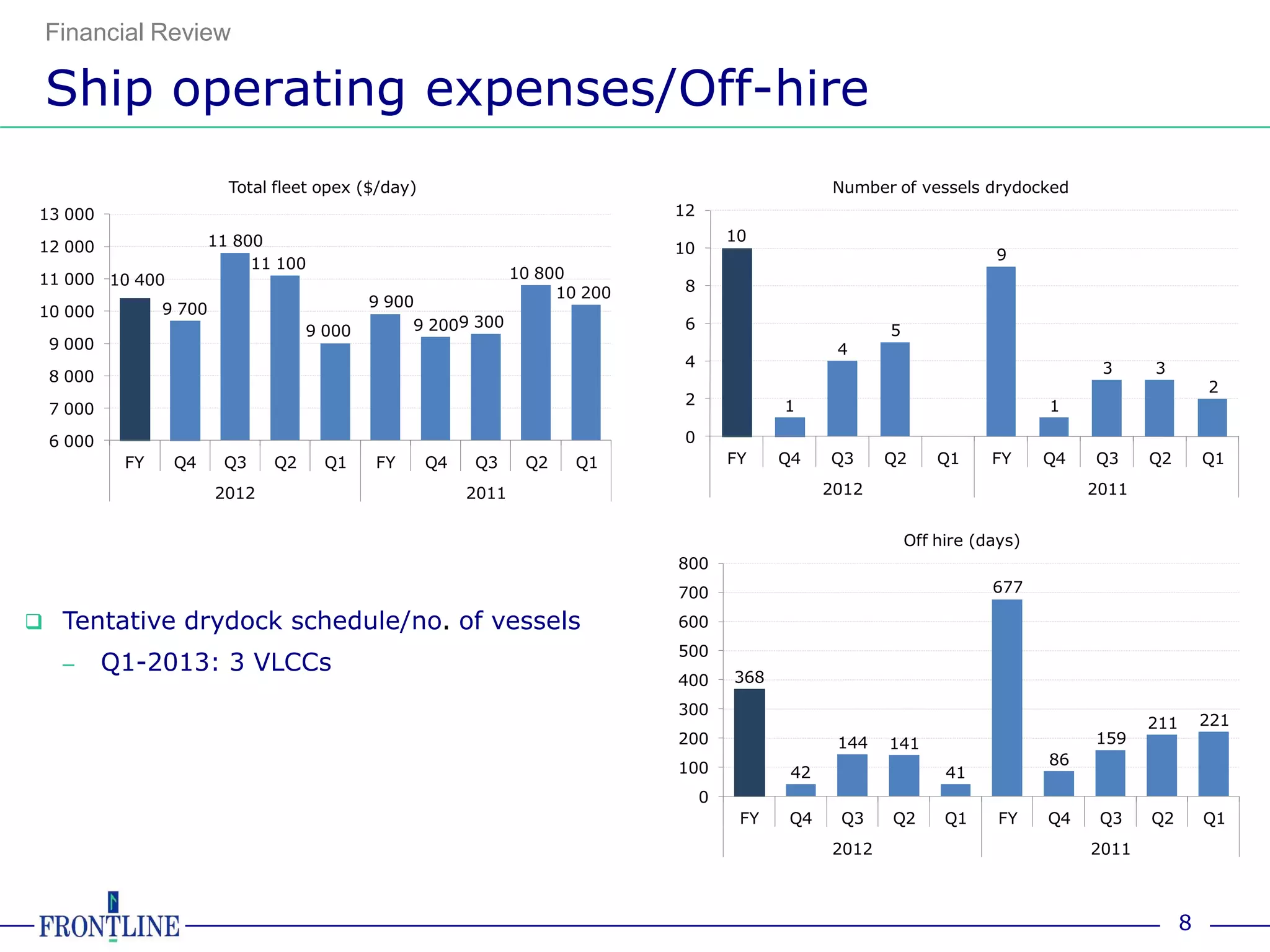

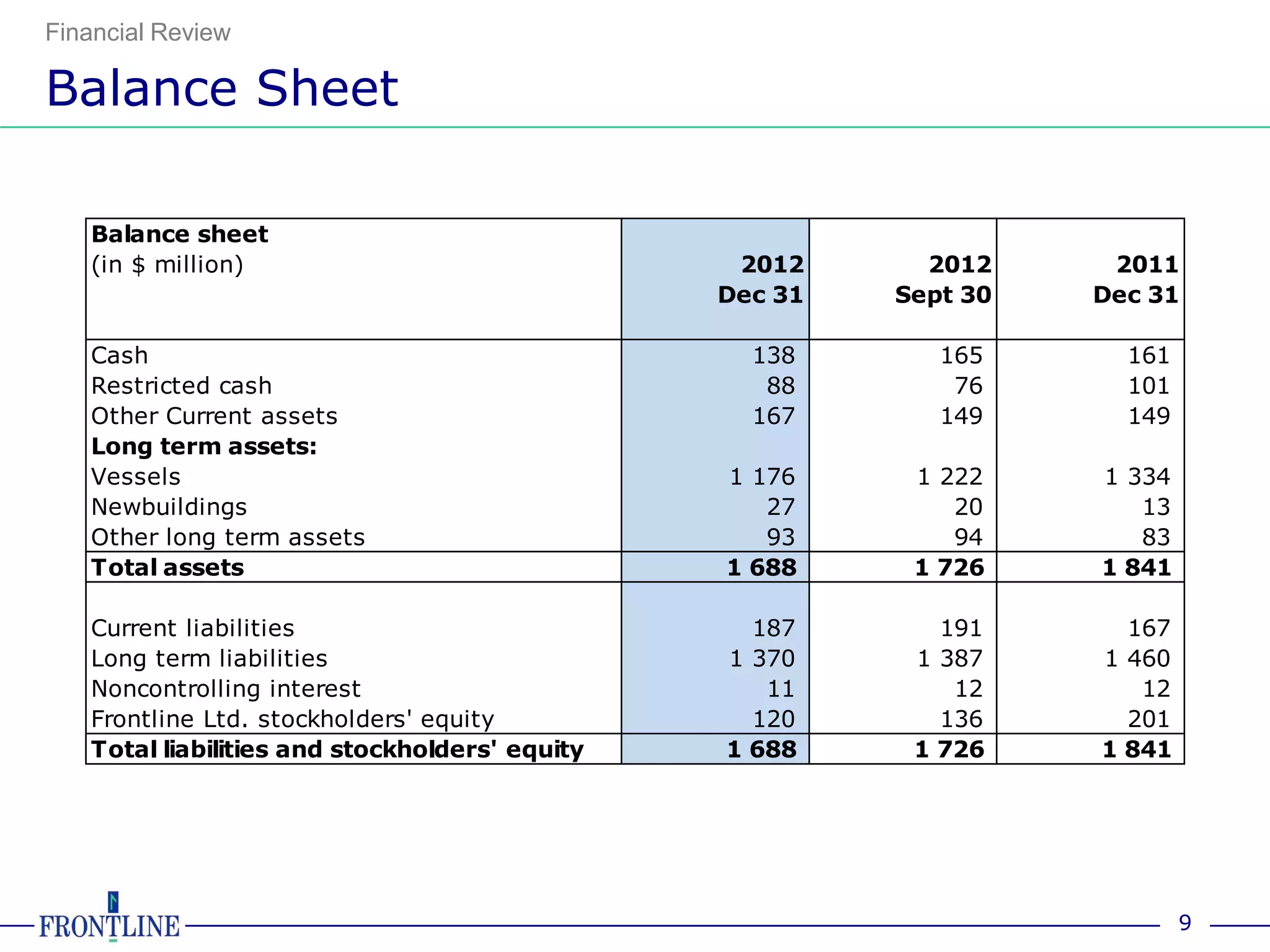

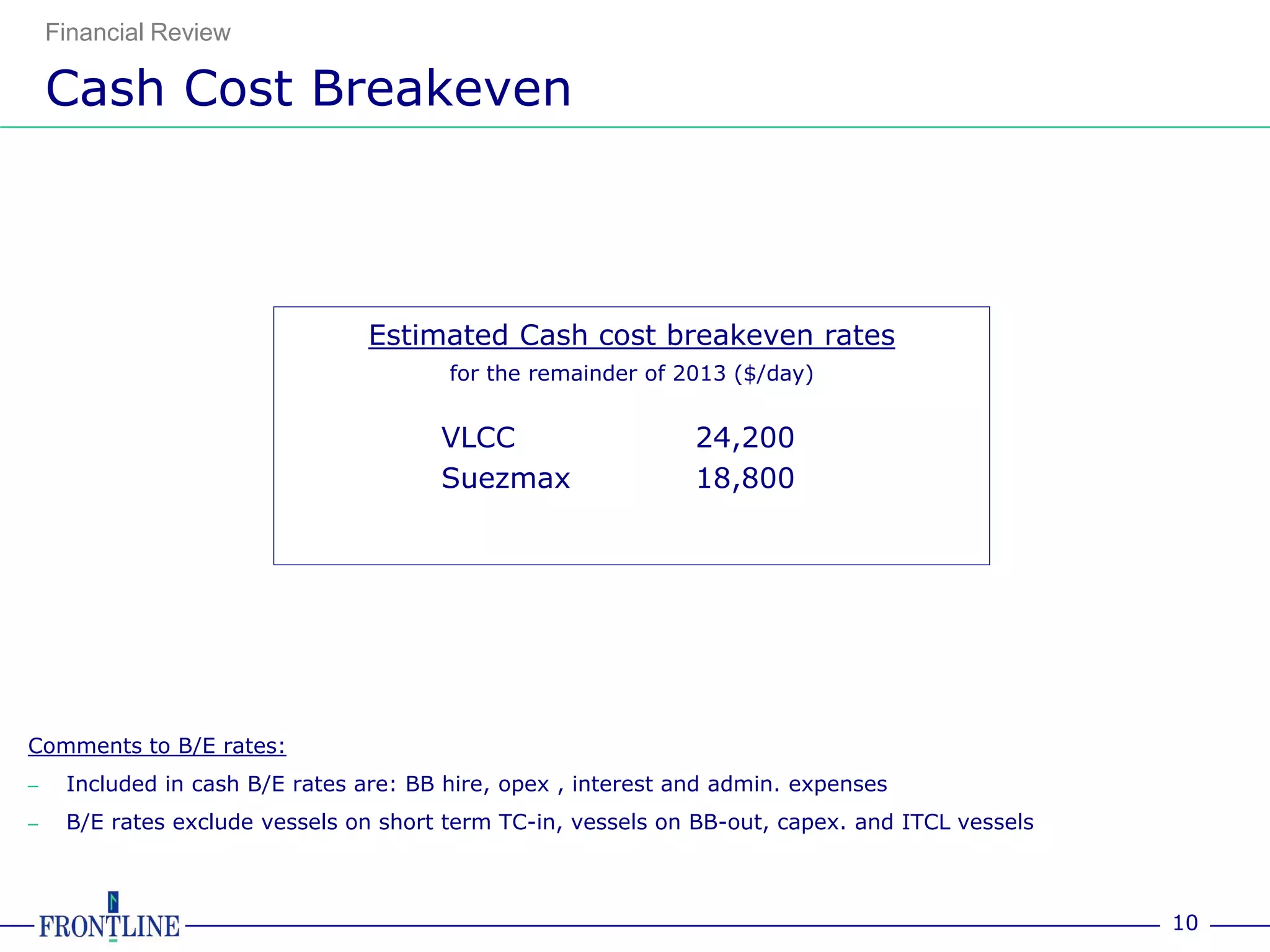

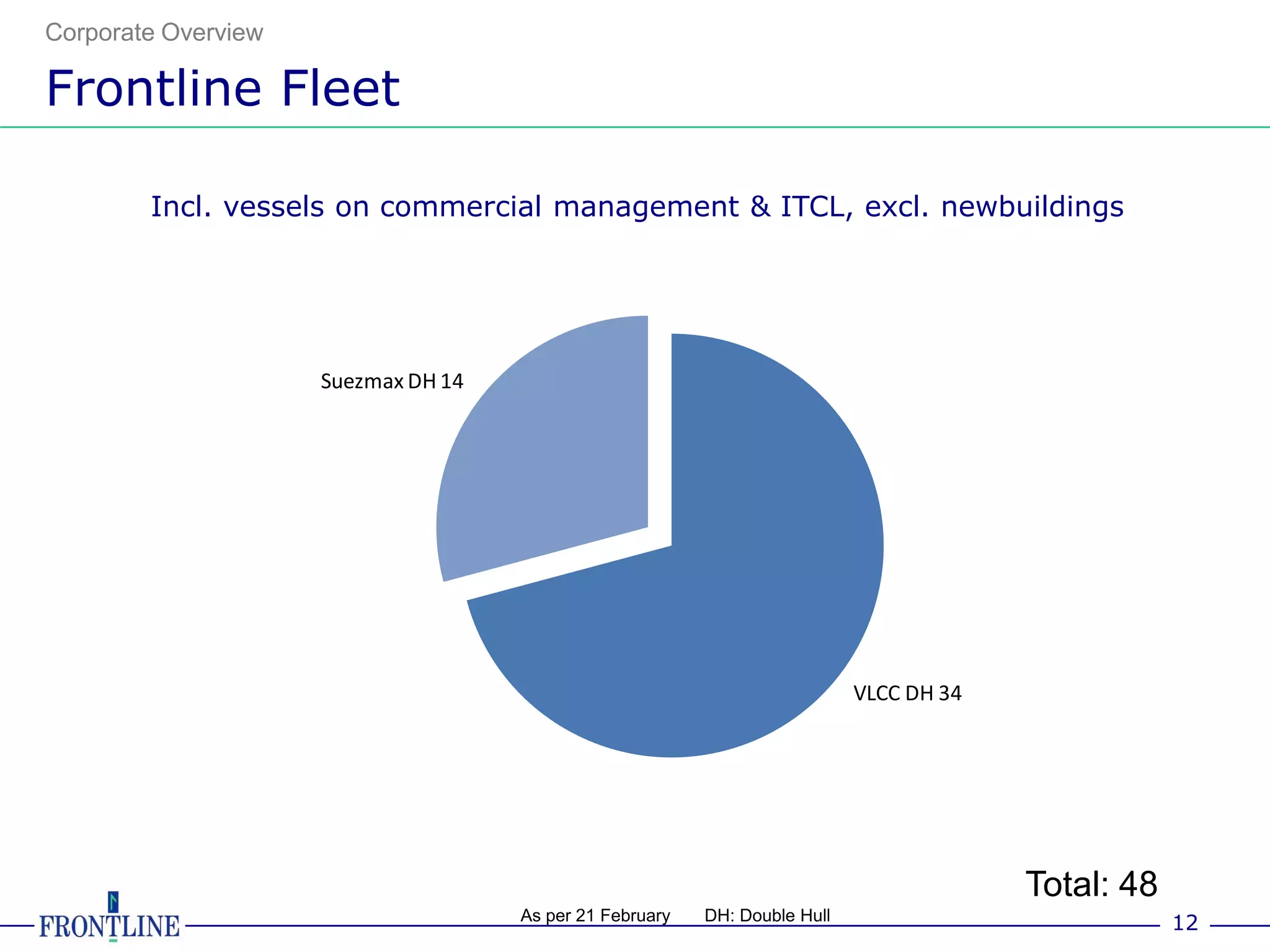

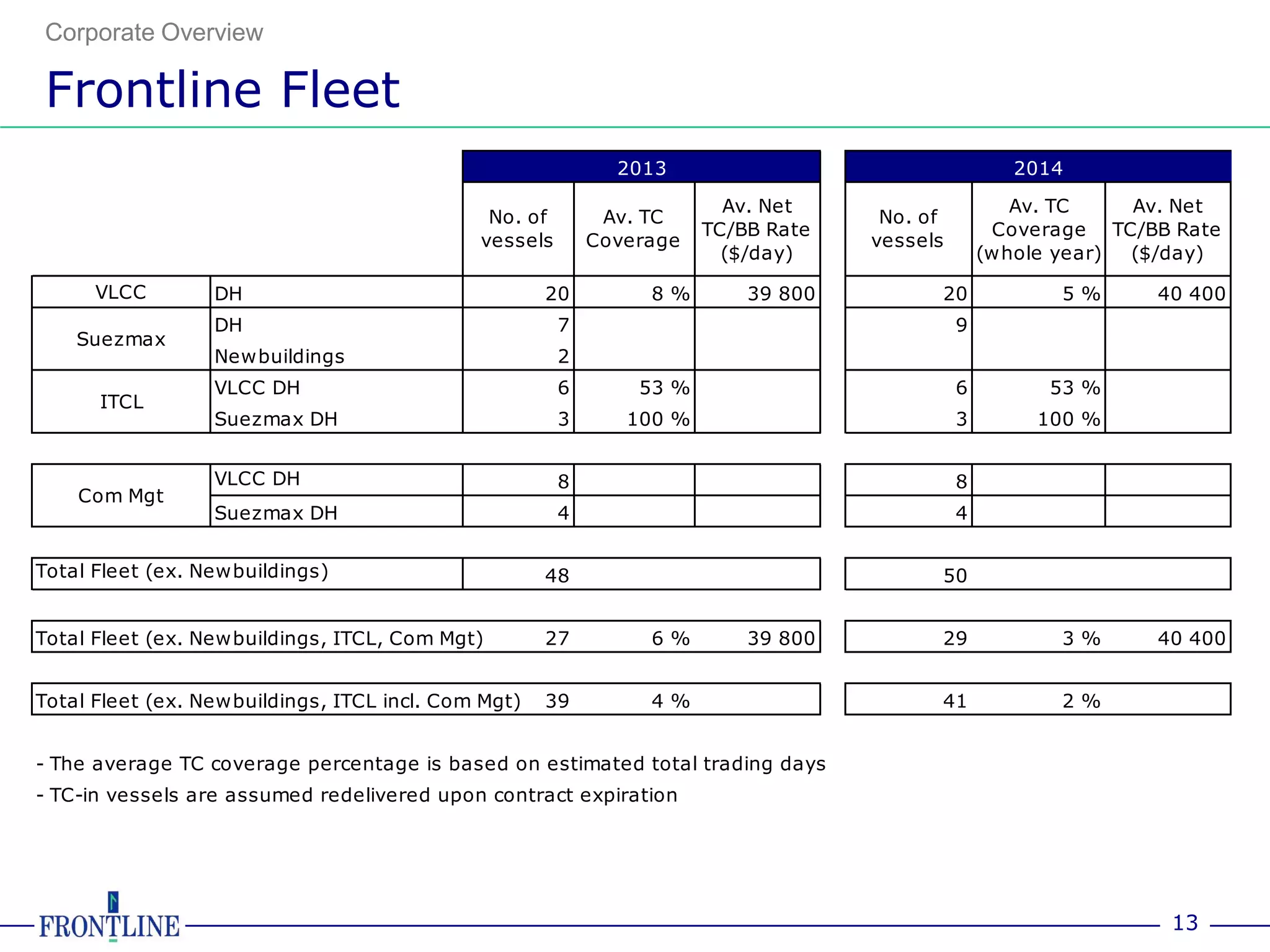

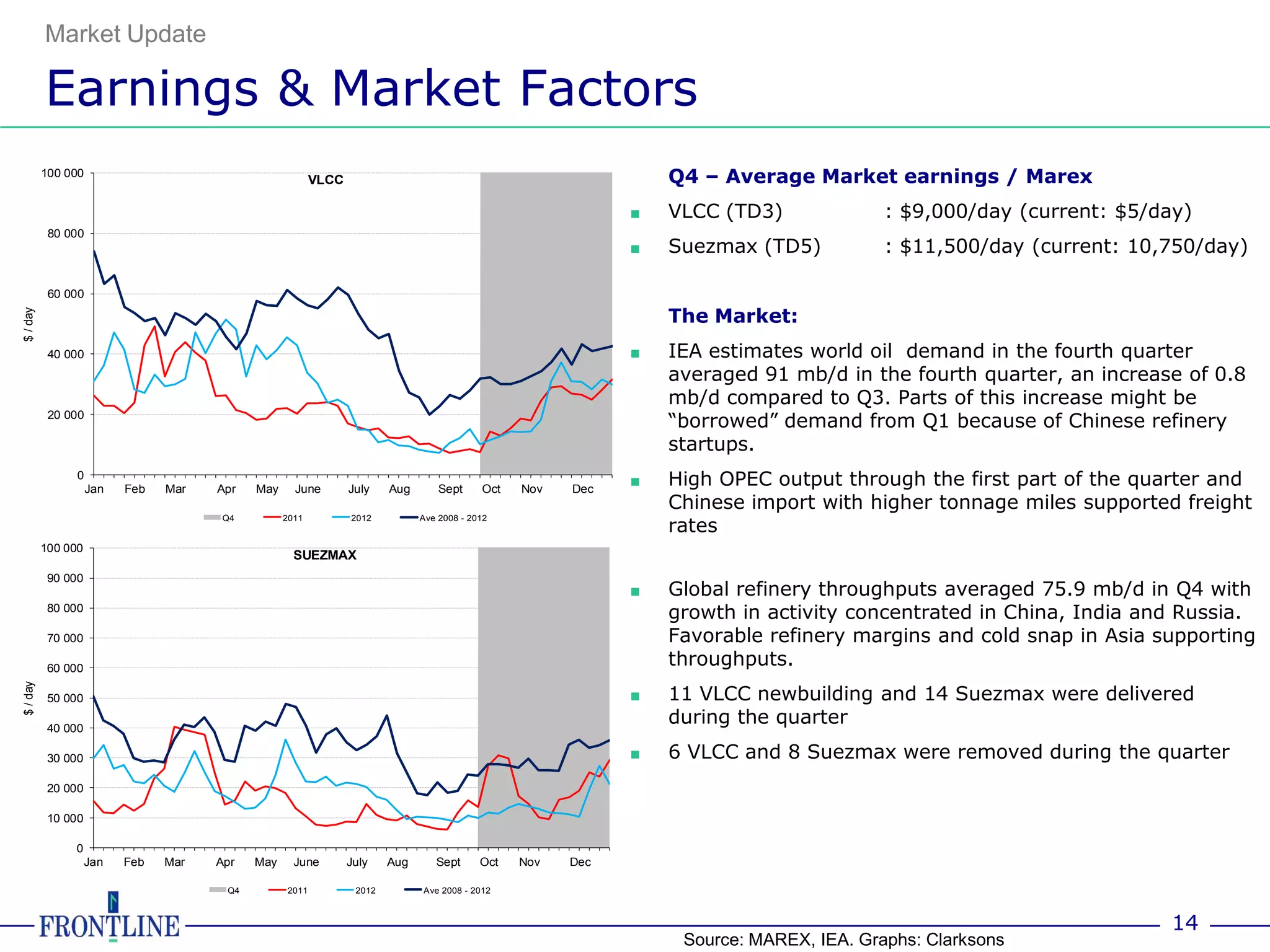

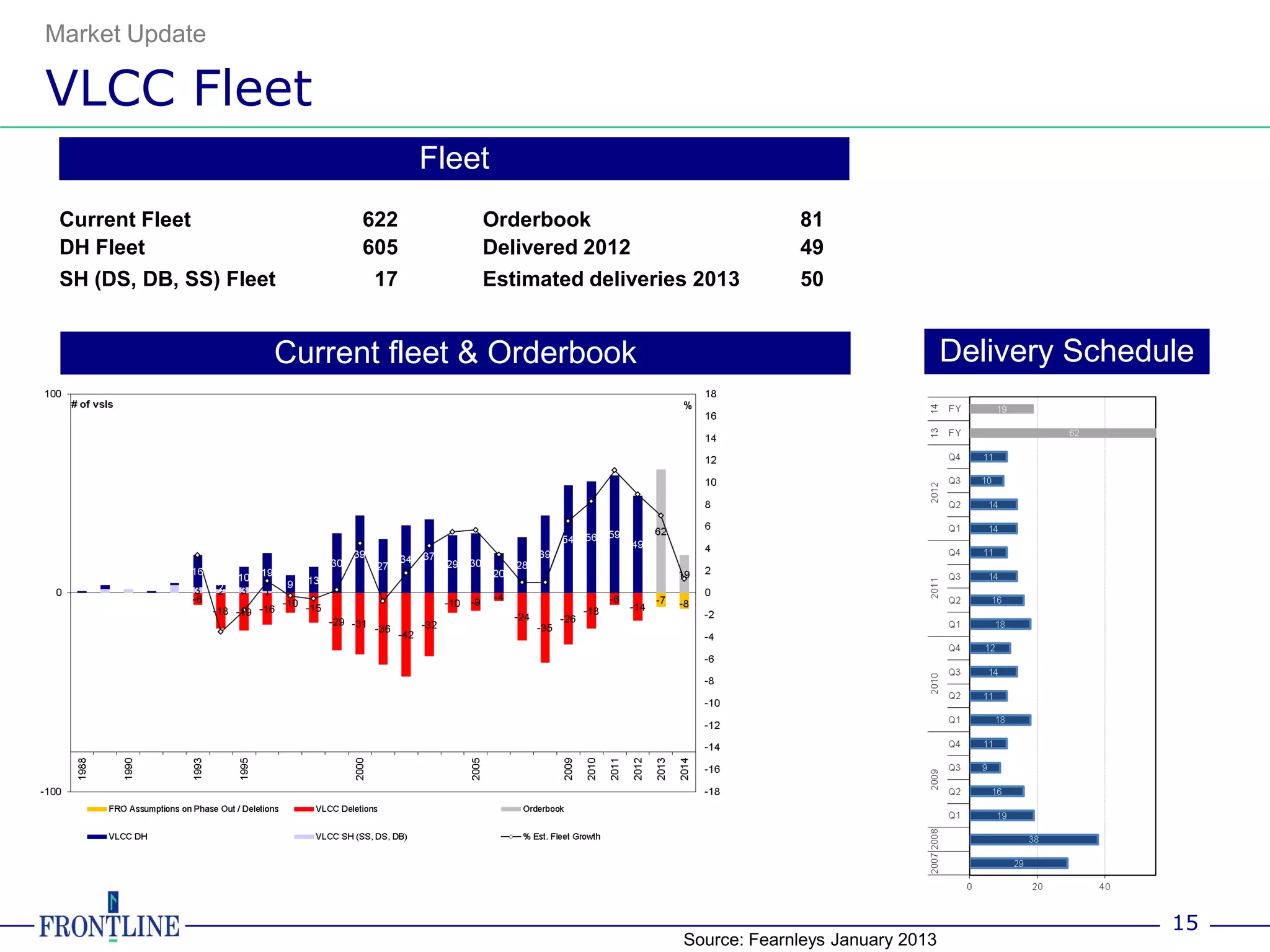

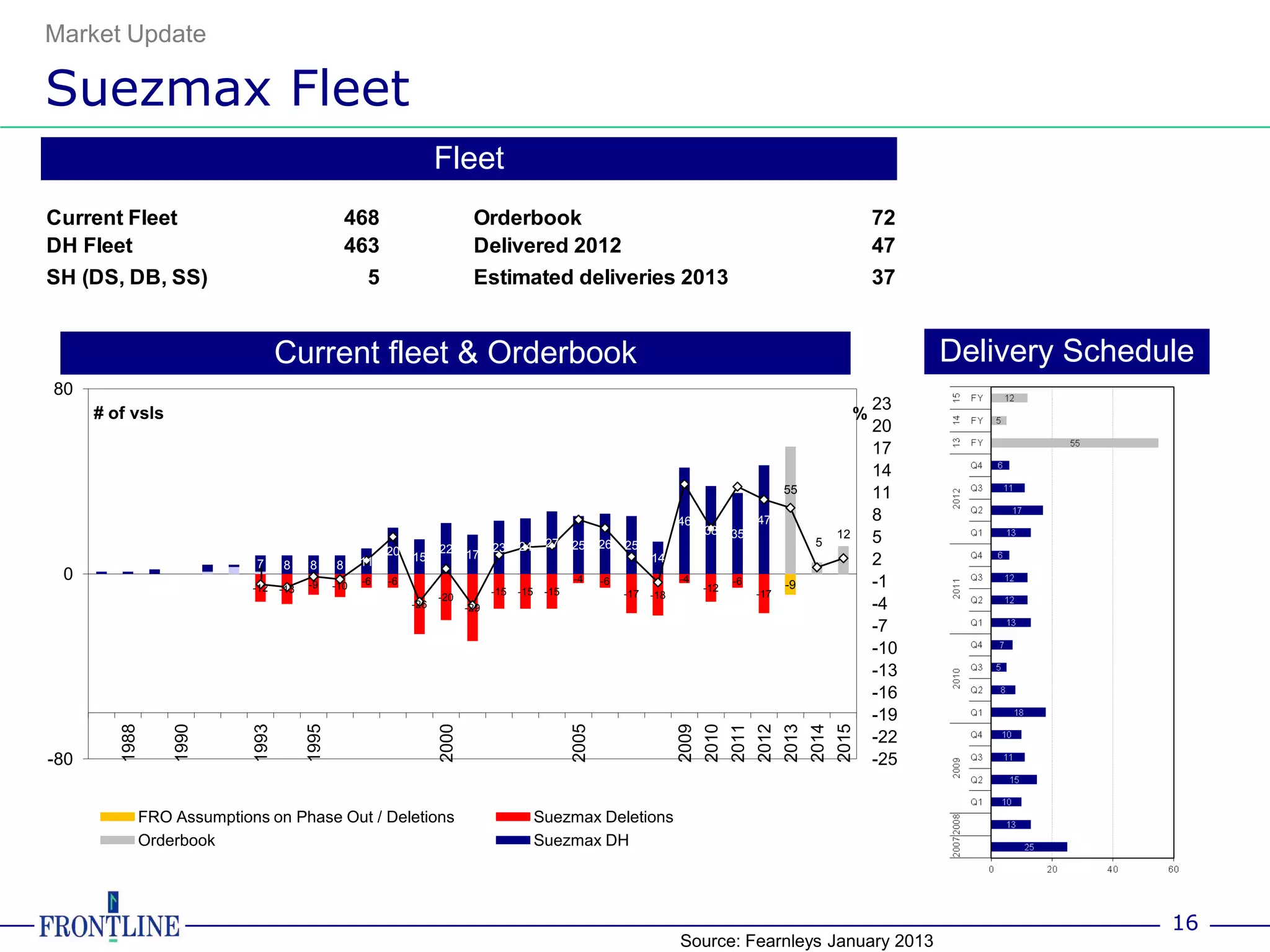

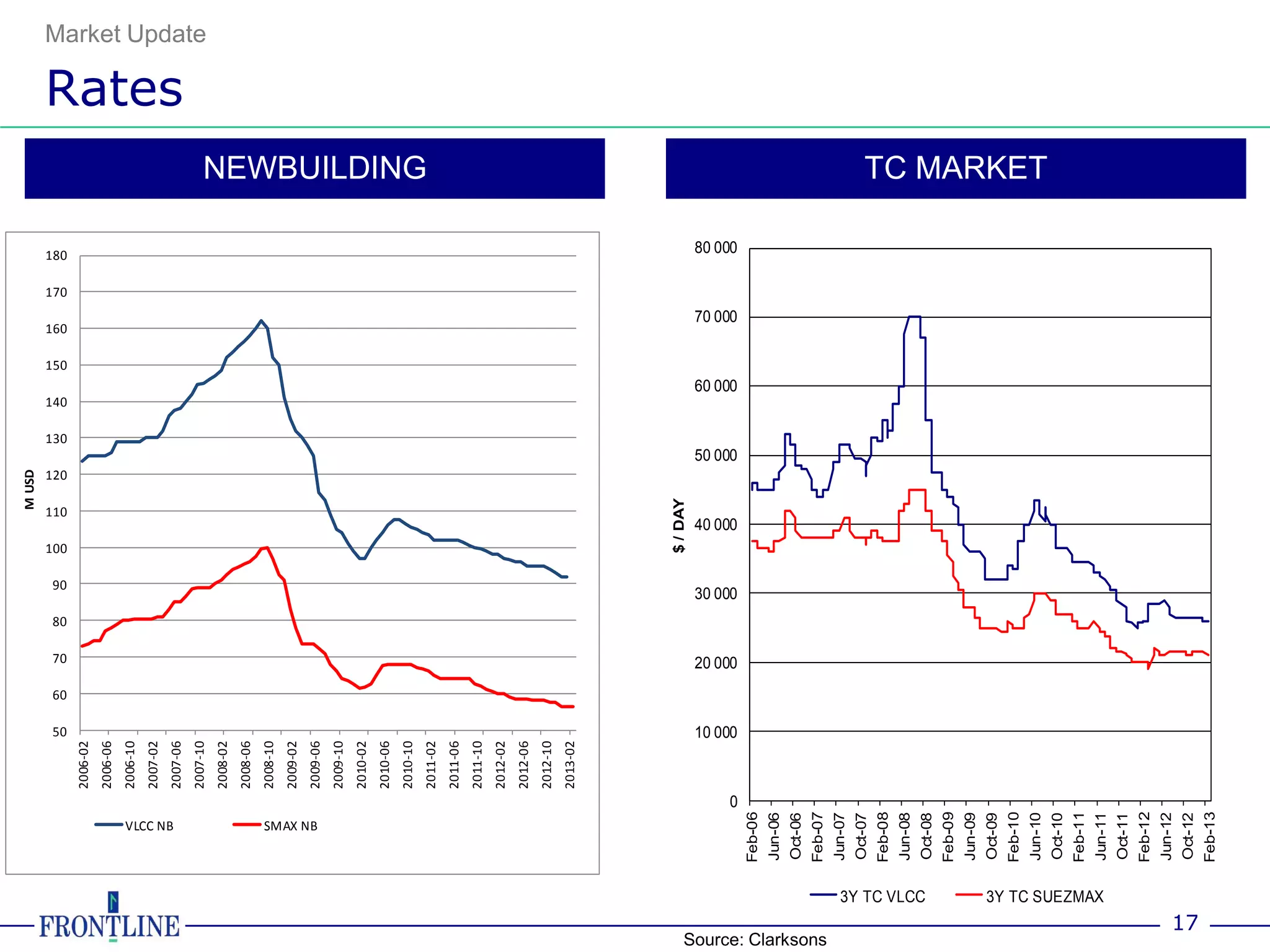

The document provides Frontline's Q4 2012 results and outlook. It discusses several transactions in Q4 including terminating some vessels and early termination of TC contracts on two OBO carriers. It reported a net loss of $16.9 million for Q4 2012 and $82.8 million for full year 2012. Frontline also provides an overview of its fleet size and average time charter rates and coverage for 2013-2014. The company estimates its cash cost breakeven rates for VLCCs and Suezmax tankers for the remainder of 2013.