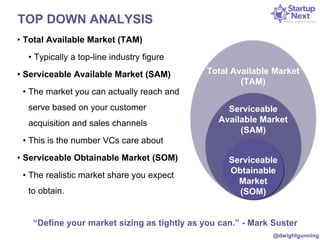

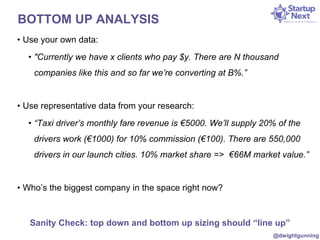

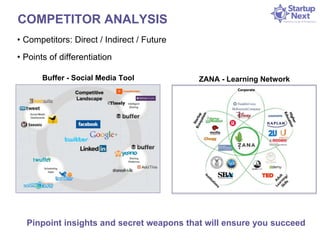

The document discusses market sizing and competitive analysis, emphasizing the importance of accurately defining market potential for investors looking to grow companies to $100 million in revenue. It outlines top-down and bottom-up market sizing approaches, encourages understanding of the competitive landscape, and stresses the need to evaluate both current competitors and broader economic factors. The insights aim to help startups present a compelling case to investors by connecting their business to market dynamics.