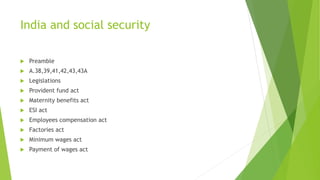

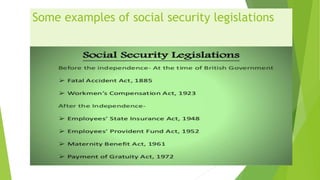

Social security provides protection to workers against various risks like unemployment, sickness, disability, old age and death. It aims to ensure a basic standard of living for citizens. The concept originated in Germany in 1883 and was further developed and implemented in countries like the US and India. The International Labour Organization has influenced social security measures globally through conventions and recommendations. In India, the Constitution directs the state to secure social security for citizens and various laws provide benefits like provident funds, employment injury compensation, and health insurance.