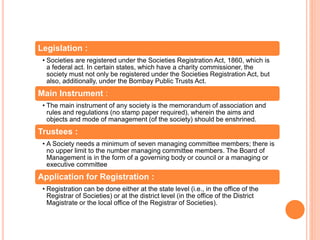

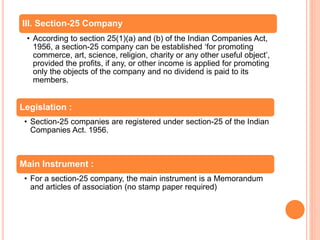

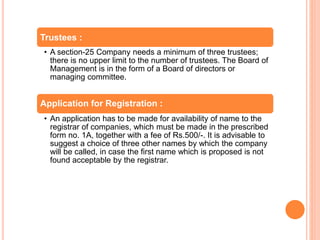

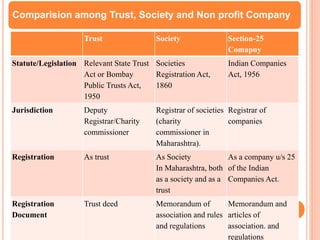

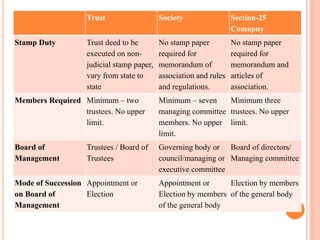

NGO Registration Methods in India outlines three common methods for registering non-profit organizations: trusts, societies, and non-profit companies under Section 25. Trusts are governed by state Trust Acts and require a trust deed. Societies register under the Societies Registration Act of 1860 with a memorandum and rules. Section 25 companies register with the Registrar of Companies and require a memorandum and articles of association. Both societies and Section 25 companies have minimum member requirements while trusts require minimum trustees but have no upper limits.