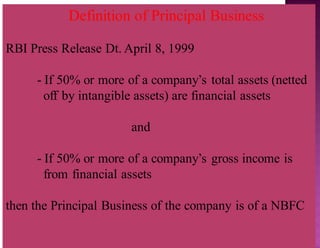

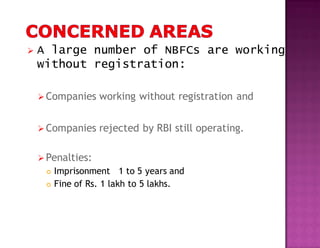

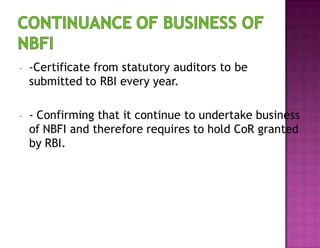

1. The document discusses the regulatory framework for non-banking financial companies (NBFCs) in India including definitions, registration requirements, prudential norms, and recommendations of the Usha Thorat Committee.

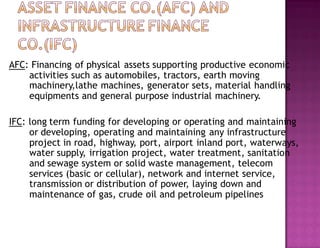

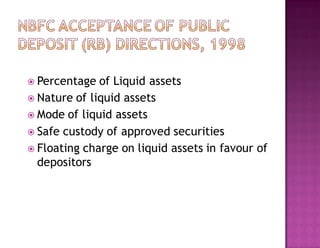

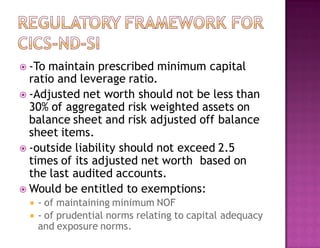

2. It provides details on the classification of NBFCs based on their business and public deposit acceptance, capital adequacy requirements, prudential norms on income recognition and provisioning.

3. The USHA THORAT Committee recommended increasing the minimum asset size for registering new NBFCs and subjecting large NBFCs to corporate governance norms similar to listed companies.