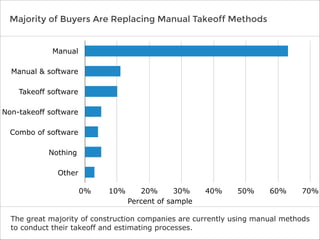

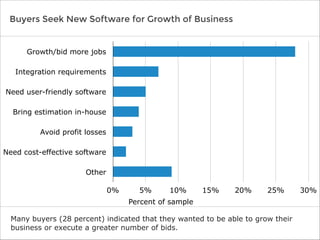

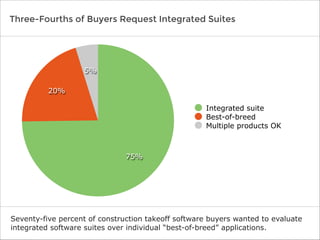

A report on small-business buyers of takeoff software reveals that 63% still rely on manual methods, while only 10% currently use dedicated software. The primary motivation for purchasing new software is to accommodate business growth and increase bidding capacity. A strong preference for integrated software suites is noted, with 75% of buyers favoring these over standalone applications.