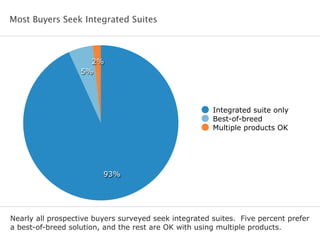

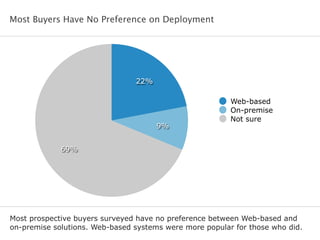

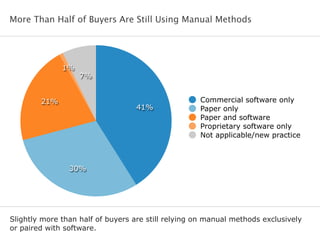

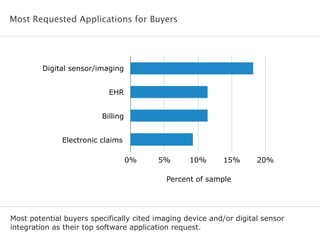

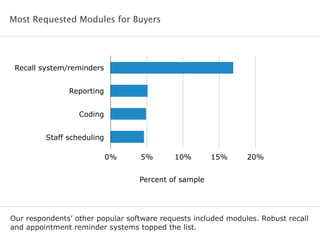

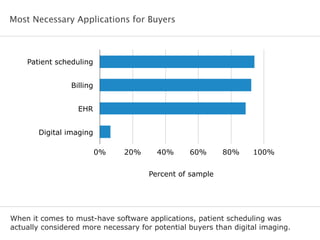

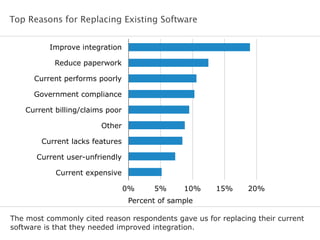

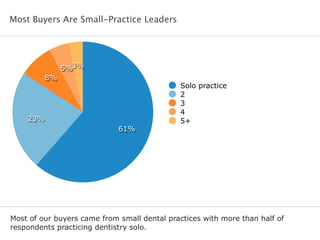

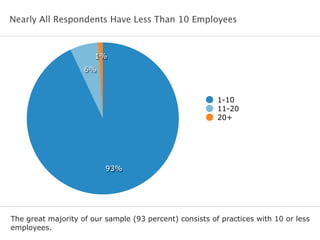

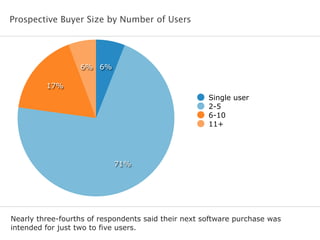

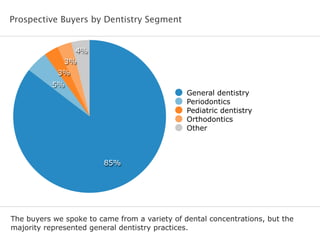

The 2014 Software Advice BuyerView report analyzes insights from 368 dental professionals seeking software solutions, revealing that 93% prefer integrated suites, with 51% still using manual methods. The top requested software application was imaging device integration, and patient scheduling is prioritized as a must-have application. Most buyers come from small practices, with over half operating solo and a focus on general dentistry.